Celebrating Leadership: Watch Pioneer’s video tribute to Stephen D. Fantone, former Board Chair

/in Featured, News /by Editorial StaffMany of you know that Pioneer Institute has recently announced a leadership transition regarding its Board of Directors. Stephen D. Fantone, who has served as Board Chair since 2012, has stepped down and passed the torch to Adam Portnoy, who will guide the Institute as it embarks on a new strategic plan, Pioneer2024. As we look forward to our future, we also reflect on our successes, and acknowledge the deep commitment and stewardship that Stephen has shown this organization for almost a decade as Chair and, for many years prior to that, as a Board member and supporter. Stephen will continue to be involved with Pioneer in a new capacity – stay tuned for more information!

We are proud to present a video tribute, below, in which we share with our community Stephen’s reflections on his involvement with Pioneer, along with heartfelt appreciation from an array of Pioneer Board directors and staff members. We hope you enjoy it!

Click on the image below to watch the video:

From all of us at Pioneer, and on behalf of our many supporters, thank you, Stephen, for your extraordinary commitment to this organization!

Learn about membership and giving opportunities with Pioneer!

Recent posts

Public Statement on the MA Legislature’s Blanket Pension Giveaway

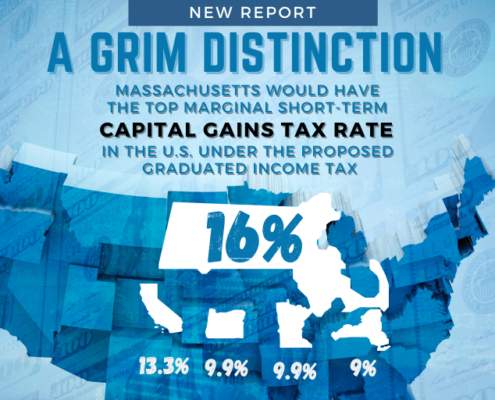

Study Says Massachusetts Surtax Proposal Could Reduce Taxable Income in the State by Over $2 Billion

This Is No Time for a Tax Increase

Study: Massachusetts Should Retain Additional Healthcare System Flexibility Granted During Pandemic

Study Finds Deep Flaws in Advocates’ Claims that the Massachusetts Tax Code is Regressive

Open Letter: Extend the Term of the MBTA’s Fiscal and Management Control Board

Study Calls for Better Reporting on Impact of COVID-19 in Eldercare Facilities

Study Says Interstate Tax Competition, Relocation Subsidies Exacerbate Telecommuting Trends

7 Reasons to Reject the Graduated Tax and Instead Focus on Growing Jobs

Study Warns Massachusetts Tax Proposal Would Deter Investment, Stifling the “Innovation Economy”

Study Shows the Adverse Effects of Graduated Income Tax Proposal on Small Businesses

Poll Finds Mixed Views About Schools’ Pandemic Performance

Study: Systemic Failure in IDEA Implementation for Private School Students with Disabilities in Additional States

Study: Graduated Income Tax Proposal Fails to Protect Taxpayers from Bracket Creep

New Analysis: ICER Framework Ignores Patient Preferences, Innovation & Societal Benefits in Evaluating Cost-Effectiveness of New Cancer Treatments

Pioneer Institute, The Immigrant Learning Center Co-Produce New Weekly Podcast

New Study Warns Graduated Income Tax Will Harm Many Massachusetts Retirees