Study: Legislature Likely to Reduce Spending on Education and Transportation from Other Revenue Sources, Replace Cuts with Surtax Money

Lawmakers tipped their hand when they overwhelmingly rejected amendment to require new revenue be in addition to current spending

BOSTON, MA – Revenue from a ballot initiative to amend the state Constitution and raise income taxes on households and businesses by adopting a graduated income tax structure would supposedly provide resources for transportation and public education, but a new study published by Pioneer Institute finds that, were the tax amendment to pass, the money would be fungible and much of it likely spent on general budget measures.

The proposed constitutional amendment, which is scheduled to appear on the statewide ballot in November, would add a surtax of 4 percent on households and businesses reporting earnings exceeding $1 million in any one year. The proposed surtax would primarily fall on retirees and pass-through businesses reporting income on individual tax returns, especially those selling an asset, a home or a business.

“If the initiative is adopted, legislators could circumvent its stated intent yet still be in compliance with it,” said Greg Sullivan, author of “Why the Legislature would likely use the proposed tax amendment as a blank check.” “They can simply reduce spending on education and transportation from other revenue sources and replace it with surtax money.”

In January, a group of 55 taxpayers filed a lawsuit, Christopher R. Anderson et al v. Maura Healey, requesting that the Massachusetts Supreme Judicial Court (SJC) declare the summary of the proposed amendment that is scheduled to appear on the November ballot unfair, misleading and inaccurate because it doesn’t inform voters that legislators can simply use surtax revenue to replace cuts to revenues from other sources.

In 2018, the SJC ruled that a nearly identical proposed amendment was unconstitutional because it violated the state Constitution’s ban on citizen-initiated ballot questions that combine unrelated subject matters—in that case, a new graduated income tax and two disparate subjects of spending. No such ban applies here because the ballot question was initiated by the Legislature.

At oral argument in the 2018 case, even the attorney for the Massachusetts Attorney General’s office, who was arguing for the constitutionality of the proposed amendment, said “The Legislature would retain ultimate discretion over spending choices for the additional reason that money is fungible. Because the proposed amendment does not require otherwise, the Legislature could choose to reduce funding in specified budget categories from other sources and replace it with the new surtax revenue.”

But the best indication that legislators would likely use surtax revenues to backfill cuts to education and transportation comes from the Legislature itself. While debating the proposed amendment in a 2019 constitutional convention, an amendment to the language was proposed that would have insured that revenue generated by the proposal would add to, not substitute for, revenue already being spent in those areas. The amendment was rejected by a vote of 6-33 in the Senate and 34-123 in the House.

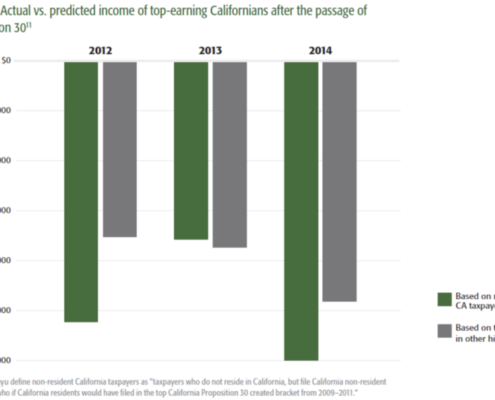

Without a commitment to dedicate all new revenues to education and transportation, Massachusetts residents may consider the state’s diversion of funds from the 1998 Tobacco Settlement to other purposes. But even more directly to point is the experience with such taxes, for example in California. It, too, confirms the likelihood of a diversion of funds to other purposes with any tax revenues from the tax amendment, were it to pass, backfilling current spending levels.

In 2012, Golden State voters approved Proposition 30, a constitutional amendment that hiked the income tax on high-earning individuals to provide additional funding for education. But instead of increasing support for education, about 60 percent of the revenue was substituted for line items that had currently been funded from the general fund. The move freed up nearly $42 billion in discretionary funds between 2013 and 2021.

The rest of the money was used to meet minimum education funding requirements set in an earlier initiative petition. Proposition 30 didn’t increase education funding beyond that pre-existing minimum level.

“The plaintiffs in Anderson v. Healey have good reason to demand a more accurate description of the graduated income tax amendment,” said Pioneer Institute Executive Director Jim Stergios. “The Attorney General and the Secretary of State have a duty to provide Massachusetts voters with a clear and honest summary of what they will be voting on when they enter the ballot box come November.”

About the Author

Gregory Sullivan is Pioneer’s Research Director. Prior to joining Pioneer, Sullivan served two five-year terms as Inspector General of the Commonwealth of Massachusetts and was a 17-year member of the Massachusetts House of Representatives. Greg holds degrees from Harvard College, The Kennedy School of Public Administration, and the Sloan School at MIT.

Pioneer’s mission is to develop and communicate dynamic ideas that advance prosperity and a vibrant civic life in Massachusetts and beyond. Pioneer’s vision of success is a state and nation where our people can prosper and our society thrive because we enjoy world-class options in education, healthcare, transportation and economic opportunity, and where our government is limited, accountable and transparent. Pioneer values an America where our citizenry is well-educated and willing to test our beliefs based on facts and the free exchange of ideas, and committed to liberty, personal responsibility, and free enterprise.

Get Updates on Our Economic Opportunity Research

Related Content