New Study Offers Guide to Recovery in MA Retail, Accommodation and Tourism, and Restaurant Sectors

Estimated 3,600 establishments – 22.5 percent of all restaurants in the Commonwealth – not expected to survive COVID-19 impact on state economy

BOSTON – A new guide to economic recovery in the retail and hospitality industries published by Pioneer Institute calls for the federal and state governments to consider consumption-based refundable tax credits for brick and mortar businesses; the federal government to conduct a detailed study of the costs and benefits of suspending employer-side payroll taxes; businesses to pay special attention to developing and marketing their cleanliness, hygiene and contactless procedures; and third-party customer review sites to include comments about the implementation of COVID safety measures to provide options and reassurance to safety-minded consumers.

“A 2011 Congressional Budget Office study found that reducing employer payroll taxes has a larger effect on GDP than reducing either employee payroll taxes or individual income taxes,” said Pioneer Executive Director Jim Stergios. “The federal government should do an in-depth review to determine whether that’s appropriate in this case.”

“As we emerge from the COVID-19 economic crisis,” said Pioneer Director of Government Transparency Mary Connaughton, “tax policy must balance incentivizing consumption related to the industries hardest hit with stabilizing government revenues in the long-term.”

In addition to these recommendations that will benefit all of these industries, Rebekah Paxton, Andrew Mikula and Greg Sullivan, authors of “Public Policy Guide for Economic Recovery from COVID-19 in the Retail and Hospitality Sectors” make specific proposals for each.

Retail

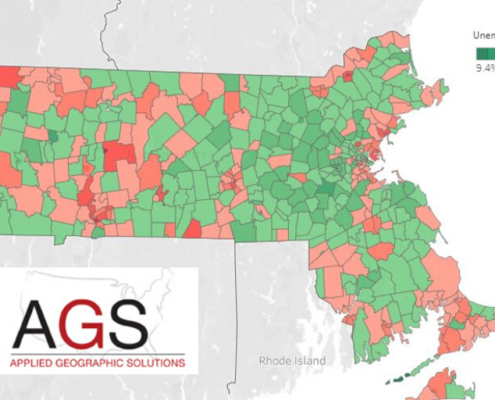

The retail sector was struggling before the pandemic hit. Statewide retail sales are now projected to fall by 10.5 percent, or about $2.8 billion, in 2020.

COVID-19 created a distinction between essential and non-essential businesses. Food and beverage retailers, which include essential businesses like grocery stores, saw sales rise 14.5 percent from May 2019 and May 2020. But sales of clothing and accessories dropped by more than 63 percent, and electronics sales fell nearly 30 percent.

The authors urge state policy makers to give retailers the right to expand delivery options through by-right delivery, and to explore whether an extended state sales tax holiday would stimulate long-term economic growth. They also call for the elimination or a significant reduction in permitting requirements for outdoor product sales on business property.

The authors urge business owners to implement systems that clearly communicate to consumers how to pick up online orders and to retailers when to pick up their orders. To boost cash flow, it will be important to advertise and hold clearance sales of out-of-season inventory.

Accommodation and Tourism

Massachusetts accommodations and tourism sales are projected to fall by nearly 45 percent in 2020, a reduction of nearly $11 billion. From February to May of this year alone, state employment in the sector dropped by 70 percent.

Maine recently adopted a policy that allows out-of-state visitors who provide proof of a negative COVID-19 test to forgo the state’s 14-day quarantine requirement. To assuage consumer fears, the authors urge accommodations and tourism business owners in Massachusetts to develop metrics to monitor guest health metrics prior to arrival.

State leaders should also weigh the cost of suspending or reducing the Commonwealth’s room occupancy and/or car rental tax against their ability to stimulate demand, although in these cases the marginal reduction in cost may not be enough to overcome coronavirus fears. Demand for car rentals has also previously been found to be relatively inelastic.

Restaurants

Between 2015 and 2019, 54 percent of all spending on food was outside the home. But according to the Massachusetts Restaurant Association (MRA), 3,600 establishments, or 22.5 percent of all the Commonwealth’s restaurants, will not survive COVID-19’s impact on the state economy.

U.S. restaurant industry sales were down by more than half between February and April of this year, and bars, taverns and fine dining establishments laid off 90 percent of their employees between March and April alone.

The authors urge the Commonwealth to

- shift control over the number and distribution of liquor licenses to the local level

- allow restaurants to sell fresh produce, meats and other whole foods by right to provide easier access to consumers during the pandemic

- investigate the possibility of providing immunity from COVID-related liability to restaurants that demonstrate compliance with testing, PPE, and all other public health guidelines

Local governments are urged to allow restaurants to do alcohol takeout with fewer restrictions; to make permitting for food trucks owned by restaurants a priority; and to allow sidewalk seating, by-right food delivery, curbside pick-up, and drive-through service.

The authors urge restaurant owners to target advertising to reach consumers in their homes via events like “cook-alongs” with meal kits from the restaurant. Owners should also expand seating into parking lots and sidewalks as allowed.

Several Western Massachusetts restaurants have banded together to sweeten the deal on their gift card program, offering gift cards valid at several establishments and bonus vouchers for larger purchases. This approach allows the gift cards to retain their value even if some of the restaurants go out of business, which, sadly, is quite possible in the present business climate.

About the Co-Authors

Andrew Mikula is the Lovett & Ruth Peters Economic Opportunity Fellow at Pioneer Institute. Mr. Mikula was previously a Roger Perry Government Transparency Intern at Pioneer Institute and studied economics at Bates College.

Rebekah Paxton is a Research Analyst at Pioneer Institute. She first joined Pioneer in 2017 as a Roger Perry intern, writing about various transparency issues within the Commonwealth, including fiscal policy and higher education. Since then, she has worked on various research projects under PioneerPublic and PioneerOpportunity, in areas of state finance, public policy, and labor relations. She recently earned an M.A. in Political Science and a B.A. in Political Science and Economics, from Boston University, where she graduated summa cum laude.

Gregory Sullivan is Pioneer’s Research Director. Prior to joining Pioneer, Sullivan served two five-year terms as Inspector General of the Commonwealth of Massachusetts, and held several positions within that office previously. Sullivan was a 17-year member of the Massachusetts House of Representatives, serving on the committees of Ways and Means, Human Services, and Post-Audit and Oversight. Greg holds a bachelor’s degree from Harvard College, a master’s degree in public administration from The Kennedy School of Public Administration at Harvard, and a master’s degree from the Sloan School at M.I.T., with a concentration in finance.

About Pioneer

Mission: Pioneer Institute develops and communicates dynamic ideas that advance prosperity and a vibrant civic life in Massachusetts and beyond.

Vision: Success for Pioneer is when the citizens of our state and nation prosper and our society thrives because we enjoy world-class options in education, healthcare, transportation and economic opportunity, and when our government is limited, accountable and transparent.

Values: Pioneer believes that America is at its best when our citizenry is well-educated, committed to liberty, personal responsibility, and free enterprise, and both willing and able to test their beliefs based on facts and the free exchange of ideas.

Media Coverage

Boston Business Journal: Pioneer Institute report suggests longer sales tax holiday to help retailers

Get Our COVID-19 News, Tips & Resources!

Related Posts