MBTAAnalysis: A look inside the MBTA

0 Comments

/

The MBTA shuttles over a million passengers a day around Greater…

https://pioneerinstitute.org/wp-content/uploads/CloseupClock-1.jpg

739

1244

Mary Connaughton

https://pioneerinstitute.org/wp-content/uploads/logo_440x96.png

Mary Connaughton2017-02-20 12:34:192017-02-21 09:47:58The Clock is Ticking…….

https://pioneerinstitute.org/wp-content/uploads/CloseupClock-1.jpg

739

1244

Mary Connaughton

https://pioneerinstitute.org/wp-content/uploads/logo_440x96.png

Mary Connaughton2017-02-20 12:34:192017-02-21 09:47:58The Clock is Ticking…….

Poll: MA Voters Oppose Legislative Proposals to Change Tax Rebate Law

A strong majority of registered Massachusetts voters oppose a plan recently announced by state legislative leaders that would change the way tax rebates are distributed in Massachusetts under a state law approved by voters in 1986, according to a new poll sponsored by Pioneer Institute and the Massachusetts High Technology Council.

Study: Immigrant Entrepreneurs Benefit N.E. Economy, Despite Facing Obstacles to Growth

BOSTON – Immigrants in Massachusetts and New England are more likely to be self-employed, but the businesses they own tend to be in different industries than those owned by the U.S. born, according to a new study published by Pioneer Institute.

Opinion: Drug patents aren’t a ‘necessary evil.’ They save lives.

Drug patents are one of the most important public policy innovations in all of human history, and a boon to patients awaiting cures. Inventions only come when inventors are rewarded, not punished. Patents are not a “necessary evil.”

Study: High List Prices and Deep Discounts for Prescription Drugs Hurt Poor and Sick Patients

A new Pioneer Institute study illustrates how the current system of drug pricing and discounts leads to patients with challenging diseases being charged huge out-of-pocket sums to keep other premiums low, effectively imposing financial penalties on the sick to protect the healthy and wealthy.

Poll Finds Charter Schools Widely and Broadly Popular in Massachusetts

More than six years after the failure of a statewide ballot initiative that would have increased the number of charter public schools in Massachusetts, a poll shows that 62 percent either strongly or somewhat favor them, with only 16 percent opposed.

Public Statement on the House’s Proposed Tax Reform and Budget

Pioneer Institute applauds key tax reform provisions advanced by the Speaker and House leadership, including a reduced short-term capital gains tax rate and implementation of a single sales factor apportionment. But leadership must do more to bolster the state’s economic competitiveness and slow out-migration of wealth and business owners that endangers the commonwealth’s economic future.

New Book Highlights the Negative Impacts of Controversial QALY Value Assessment Framework on Patient Access & Affordability

Pioneer Institute has released a new compilation of research regarding the impact of the Quality Adjusted Life Year (QALY) methodology on the ability of patients, including some of the most vulnerable patient communities, to access treatments. The Pioneer book, Rationing Medicine: Threats from European Cost-Effectiveness Models to America's Seniors and other Vulnerable Populations, is authored by Dr. Bill Smith, Senior Fellow and Director of the Life Sciences Initiative at Pioneer Institute, and compiles research and data about the discriminatory nature of the QALY for aging adults, those living with disabilities or rare diseases, and more.

Study: Massachusetts Should Join 45 States and Allow Prescribers to Dispense Medications

A Pioneer Institute study shows that middlemen—commercial pharmacies and pharmacy benefit managers—add substantial costs over wholesale prices. Allowing prescribers to dispense routine drugs would save consumers money without compromising safety.

As COVID-19 Emergencies Ease, Some Progress on Telehealth Rules

A new report from Reason Foundation, Cicero Institute and Pioneer Institute rates every state’s telehealth policy for patient access and ease of providing virtual care. The report highlights telehealth policy best practices for states.

Pioneer Institute Mourns the Passing of Tom Birmingham

We at Pioneer Institute mourn the loss of Tom Birmingham even as we are thankful for having had the opportunity to get to know this kind and brilliant man when in office and later, when he spent several years as Pioneer’s distinguished senior fellow in education.

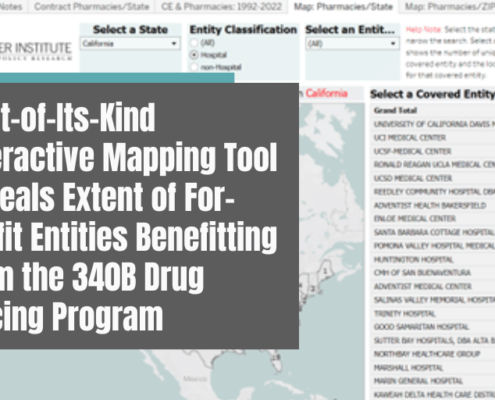

First-of-Its-Kind Interactive Mapping Tool Reveals Extent of For-Profit Entities Benefitting from the 340B Drug Pricing Program

Today, Pioneer Institute released a first-of-its-kind, 50-state mapping tool and database highlighting the troubling way in which hospitals and covered entities leverage unlimited pharmacy contracts under the 340B Drug Pricing Program.

Pioneer Commends MA Governor-elect Healey’s Step Toward Greater Transparency

Pioneer Institute commends Governor-elect Maura Healey for choosing not to claim a public records exemption for the governor’s office. Governor-elect Healey also pledged to support legislation that would curb exemptions claimed by the legislative and judiciary branches of state government.

Study Urges Massachusetts to Embrace Innovative School Models

A new policy brief from Pioneer Institute urges Massachusetts policymakers to encourage the proliferation and progress of non-traditional models that offer families creative, flexible, personalized and low-cost private education options.

Report: Immigrant Entrepreneurs Provide Economic Benefits, but Face Significant Obstacles

Immigrants have started a quarter of all businesses in Massachusetts despite making up just 17 percent of the state workforce, and those establishments appear to be more innovative than those founded by native-born Americans. Despite these contributions, shrinking federal visa caps and red tape are among the factors making it more difficult for immigrants to come to the U.S., according to “Immigrant Entrepreneurs and the Barriers They Face: An Academic Literature Review,” published by Pioneer Institute.

Poll Finds Strong Majority of Massachusetts Residents Support Restoring U.S. History MCAS Graduation Requirement

Sixty-two percent of Massachusetts residents support restoring passage of a U.S. history test as a public high school graduation requirement, according to a poll of Massachusetts residents’ attitudes toward education policy commissioned by Pioneer Institute and conducted by the Emerson College Polling Center.

Survey Finds Spotty Compliance Among Hospitals with Federal Price Transparency Law

A 2019 federal law requires hospitals to make prices for 300 shoppable services available online in a “consumer-friendly format,” but a Pioneer Institute survey of 19 hospitals finds that information on discounted cash prices—the price most likely to be charged to consumers paying out of pocket—was unavailable at seven of those hospitals.

Pioneer Institute Statement on Question 1

Yesterday, voters came closer than many expected to rejecting the largest tax increase in Massachusetts history, even though opponents were dramatically outspent by the unions that bankrolled the amendment to the state Constitution.

Study: Legislators Must Answer Key Questions Before Setting Policy for App-Based Rideshare/Delivery Workers

After Massachusetts’ Supreme Judicial Court declared an initiative that was to appear on the November ballot unconstitutional, the issue of how to classify app-based rideshare/delivery workers is back in the hands of the state Legislature. A new study published by Pioneer Institute distills from the research literature eight questions legislators must answer before determining how to address this fast-growing industry.

Two Stars in a Glowing Voc-Tech Education System

“A Tale of Two City Schools: Worcester Tech and Putnam Academy Become Models for Recovery” is a new white paper by Pioneer Institute that analyzes how Worcester Tech and Putnam Academy — schools with high numbers of low-income and special needs students — leapt from the bottom of Massachusetts voc-tech rankings to become leaders among local schools.

Toolkit Highlights Keys to Massachusetts’s Vocational-Technical School Success

Alternating weeks of academic and vocational education, school autonomy, and close ties with local businesses have been key to the success of Massachusetts's vocational-technical high schools, according to a report published today by Pioneer Institute.

Pioneer Institute Expects That Massachusetts Taxpayers Will Be Refunded $3.2B Due To State Revenue Cap

Pioneer Institute projects that the state will refund approximately $3.2 billion to taxpayers due to a state law sponsored by Citizens for Limited Taxation and voted on by taxpayers in 1986 that caps the amount of revenue the state can collect in any given year.

Survey of Business Sentiment: MA Income Tax Hike Would Lead to Employer Exodus

Nearly three quarters (73 percent) of Massachusetts business leaders think business associates will leave the state if a constitutional amendment appearing on the November ballot to hike taxes is successful, according to a survey conducted by Pioneer Institute.

Study Finds Pension Obligation Bonds Could Worsen T Retirement Fund’s Financial Woes

A new study published by Pioneer Institute finds that issuing pension obligation bonds (POBs) to refinance $360 million of the MBTA Retirement Fund’s (MBTARF’s) $1.3 billion unfunded pension liability would only compound the T’s already serious financial risks.

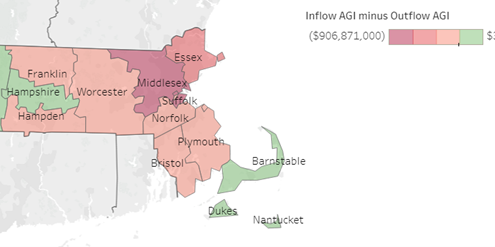

As States Compete for Talent and Families, Massachusetts Experienced a Six-Fold Increase in Lost Wealth Compared to a Decade Earlier

With competition for businesses and talent heating up across the country, in 2020 Massachusetts shed taxpayers and wealth at a clip six times faster than even just a decade ago. Between 2010 to 2020, Massachusetts’ net loss of adjusted gross Income (AGI) to other states due to migration grew from $422 million to $2.6 billion, according to recently released IRS data now available on Pioneer Institute’s Massachusetts IRS Data Discovery website. Over 71 percent of the loss was to Florida and New Hampshire, both no income tax states.

Book Finds Massachusetts Voc-Tech Schools Are National Model, Calls for Expansion

Massachusetts vocational-technical schools -- boasting minuscule dropout rates, strong academic performance, and graduates prepared for careers or higher education -- should be expanded to meet growing demand, according to a new book published by Pioneer Institute.

METCO Works Well, Small Tweaks Could Make It Even Better, Study Says

The Metropolitan Council for Educational Opportunity, or METCO program, has successfully educated thousands of students for 56 years, but several minor changes could make it even better, according to a new study published by Pioneer Institute.

Book Reveals How Tax Hike Amendment Would Damage Commonwealth’s Economic Competitiveness

If adopted, a constitutional amendment to hike state taxes that will appear on the ballot in November could erase the hard-earned progress Massachusetts has achieved toward economic competitiveness over the last 25 years and may not result in any additional education and transportation funding, according to a new book from Pioneer Institute, entitled Back to Taxachusetts?: How the proposed tax amendment would upend one of the nation’s best economies, which is a distillation of two dozen academic studies.

Pioneer Institute Statement on the Latest State Audit of the Boston Public Schools

The third review of the Boston Public Schools (BPS) in fewer than 20 years makes clear: Things are getting worse. Graduation rates are down, achievement gaps are up, an unacceptably large percentage of students attend schools ranked in the lowest 10 percent statewide. In a cruel twist, more than three in five students still are not taught material on which they are tested. There remains no clear strategy for improvement.

Study Documents The Design Challenges, Contracting Issues, And Delays Facing New MBTA Fare Collection System

This new study unearths previously unseen communications between the MBTA and its contractors, showing that the MBTA’s efforts to modernize its fare collection system, including allowing payments with credit cards and bringing “tap and go” technology to Commuter Rail and ferry lines, was riddled with technological challenges and difficulties overseeing contractors as early as 2019, culminating in a 3-year delay to the project’s full implementation.

Study Finds Continued Growth in Education Tax-Credit Scholarship Programs

Education tax credits grew increasingly popular in 2021, with four more states enacting programs. There are now 28 tax-credit scholarship (TCS) programs in 23 states, and they serve more than 325,000 students, according to a new study published by Pioneer Institute.