Hubwonk360 Video: If we tax them, will they leave?

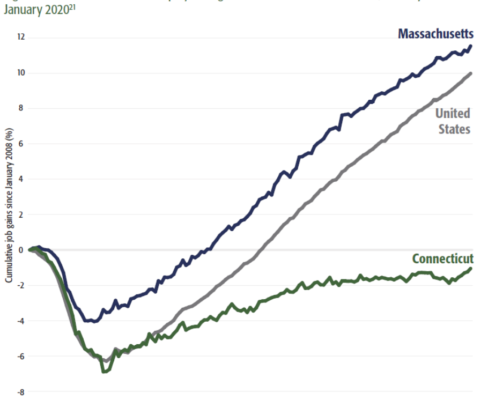

Massachusetts is again considering a constitutional amendment that could dramatically increase the income tax on retirees and small businesses. Pioneer Institute has published dozens of research papers on the economic implications of the proposed tax hike, and recently compiled them in a book, Back to Taxachusetts? How the proposed tax amendment would upend one of the nation’s best economies. In this brief, six-minute video, Pioneer Executive Director Jim Stergios and Director of Government Transparency, Mary Z. Connaughton, walk through:

- Who this proposal would affect

- Why it would likely drive out retirees, homeowners, and small business owners, and

- How that exodus would devastate the Bay State’s economy

Get Updates on Our Economic Opportunity Research

Related Posts: