The Largest Groups Driving Massachusetts’s Migration

In-migration can bring incredible benefits to a local economy while out-migration can have serious consequences for it. After all, tax filer migration at large enough a scale can mean billions of dollars in income are either entering or leaving a state. In recent years many taxpayers have chosen to leave Massachusetts, taking a significant bounty of income and taxable dollars with them.

Income Range:

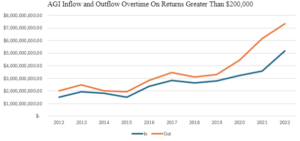

Leading this growing charge out of Massachusetts are the wealthiest residents. MassIRSDataDiscovery reports that from 2012 to 2022, gross yearly tax filer migration out of Massachusetts amongst those with over $200,000 of income grew from 3,575 to 11,810 – or 230 percent. In comparison, during the same time period, gross yearly tax filer migration under $200,000 only grew from 70,170 to 91,338 – or 30 percent. This out-migration of wealthy residents caused $7.35 billion of adjusted gross income (AGI) to leave Massachusetts in 2022 – over half of all AGI lost due to outward migration.

Luckily for Massachusetts, the state also has attracted many wealthy residents, with gross taxpayer inflow migration over $200,000 more than doubling from 3,035 in 2012 to 7,418 in 2022. Gross tax filer inflow under $200,000 only grew from 66,721 to 70,728 in the same period – a far smaller percentage increase. The associated AGI with inflow migration over $200,000 also grew from $1.5 billion to $5.2 billion in 2022.

Figure 1: Made from data from MassIRSDataDiscovery

Unfortunately, growth in out-migration has outpaced that of in-migration for those in the $200,000+ income range, as the net AGI change in this income bracket grew from a $500 million net loss in 2012 to a $2.15 billion net loss in 2022. In comparison, net AGI loss across all migration was $3.87 billion in 2022.

Age:

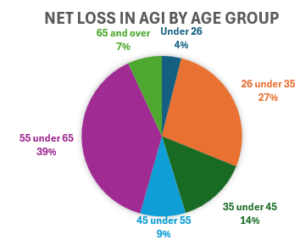

When looking at age, another demographic contributing to Massachusetts’ growing AGI loss is migrants aged 55 to under 65 years old. This group accounted for over $1.5 billion in net AGI loss in 2022, despite accounting for only 9,311 of 103,148 total outflow tax returns according to MassIRSDataDiscovery. This is largely caused by their incredibly high AGI per return – $290,259 for outflowing tax returns. More than $1.2 billion of the net AGI loss attributable to those in this age range was from those with an AGI of $200,000 or more.

Figure 2: Made with data from MassIRSDataDiscovery: 2022

The second largest source of AGI loss by age group is migrants aged 26 to under 35, causing a net loss of nearly $1.1 billion in AGI. Likely due in part to the greater ease of mobility for younger residents and the exceptionally high costs of living in Massachusetts, this age group has far more outflowing returns than any other, accounting for nearly 40,000 of the state’s approximately 100,000 outflow tax returns. This large amount of tax returns likely drives the outsized effect this group has on the state’s total AGI loss.

Importantly, people aged 26 to under 35 cause an AGI loss that spreads across income ranges. In all income ranges between $25,000 and $200,000, this age group creates the most substantial net loss (usually more than double the next largest). Even in the $200,000+ income range, those aged 26 to under 35 have the second largest net loss, only behind those aged 55 to under 65.

Figure 3: MassIRSDataDiscovery

About the Author: Raif Boit is a Roger Perry Transparency Intern at Pioneer Institute for the summer of 2024. He is a rising freshman at Harvard College.