Pioneer Urges Gov. Baker to Take Bolder Action on Public Records Reform

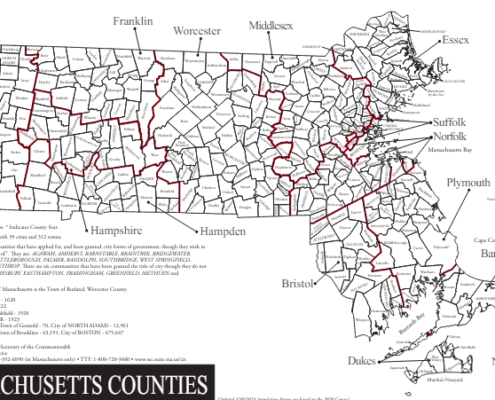

Governor’s Office in Massachusetts is one of only a handful to claim full blanket exemption from public records laws

Pioneer Institute has sent a letter to Governor Charlie Baker’s office asking that he extend his administration’s public records reform initiative to the Governor’s Office through formal means such as an executive order or a gubernatorial memorandum. Such a bold act would be a win-win for the Baker administration and for the residents of Massachusetts.

Pioneer recognizes that the public records reform law Governor Baker signed in June – the first revision to that law since 1973 – was a significant step forward.

Nonetheless, both the Center for Public Integrity and The Reporters Committee for Freedom of the Press in recent years have ranked Massachusetts’ public records and open meetings laws among the weakest in the nation. One of the reasons given was the Supreme Judicial Court’s 1997 ruling in Lambert v. Judicial Nominating Council, which has been interpreted as exempting the Governor’s Office from public records requests.

Since Lambert, every Governor has asserted that the state’s public records law does not apply to their office. This reliance has become a bad habit that Pioneer believes Governor Baker can, and should, rehabilitate.

Pioneer argues that even though an executive action could be amended or rescinded, future Governors would come under intense pressure to stay the course. It also believes that such a reform wouldn’t be overly burdensome since the Governor’s Office in Massachusetts is one of only a handful to claim full blanket exemption from public records laws, and about thirty other states have minimal exceptions to public records requests while managing just fine.

Pioneer Institute is an independent, non-partisan, privately funded research organization that seeks to improve the quality of life in Massachusetts through civic discourse and intellectually rigorous, data-driven public policy solutions based on free market principles, individual liberty and responsibility, and the ideal of effective, limited and accountable government.

Related Commentary on Government Transparency: