Public Statement Regarding the MBTA’s Lack of Transparency

The future finances of the MBTA’s employees depend on solid management of their pensions. Pioneer’s research points to real challenges due to sharp deterioration in the funding level of those pension funds. While we have been able to unearth troubling trends and several causes, as Pioneer Senior Fellow on Finance Iliya Atanasov has stated, “the insufficient transparency makes it impossible to know all the causes of their deteriorating financial condition.”

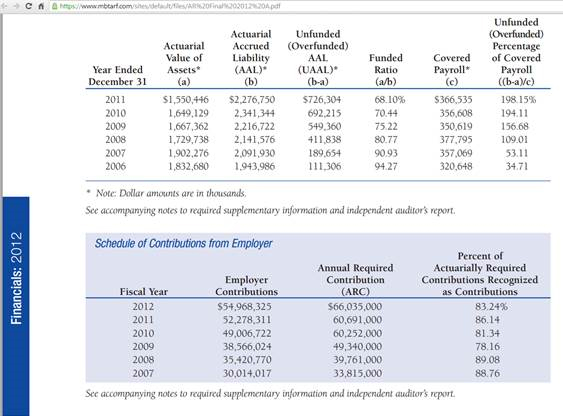

Pioneer is deeply concerned by two patterns arising from the T’s own responses to “Have the MBTA’s Retirement Plans Gone Off the Rails?” First, it is alarming just how oblivious T officials are to the financial condition of the MBTA’s retirement fund. Joseph Pesaturo’s statement that the MBTA funds 100 percent of the “actuarially required contribution” every year is clearly contradicted by the following table in the MBTA Retirement Fund’s own 2012 report. (The table below makes clear that for years the T has been paying about 78 to 89 percent of its required contribution.)

The second is that the T’s response is not substantive; instead, it is the usual diversionary spin. T officials don’t have a right to their own set of facts. Rather, they have a duty to uphold to their employees and to Massachusetts residents.

“Have the MBTA’s Retirement Plans Gone Off the Rails?” gives a blow-by-blow of what we understand about the sharply deteriorating finances of the MBTA’s retirement plans. Here are Fast 14 questions that Pioneer Senior Fellow Iliya Atanasov believes the T needs to answer to the public now:

1. Does the T have a good reason for stating that it is making its entire annual required contribution (ARC), when the MBTA Retirement Fund’s annual report contradicts that? (see above)

2. Why hasn’t the T been covering all of its annual pension cost since 2008?

3. Why has the net pension obligation on the MBTA’s balance sheet grown by $80 million in that period?

4. Why does the T use an open funding schedule which has no firm deadline and, according to the Governmental Accounting Standards Board, “when coupled with an amortization period of 30 to 40 years, produces no perceptible amortization of the unfunded actuarial liability”?

5. Why did the T increase the discount rate on its pension obligations at a time when other retirement systems are lowering theirs?

6. Why did most T employees contribute only 5.5% of compensation in 2013, while other public employees in the state have to pay in up to 11%?

7. Why have pension expenses increased by nearly 250% since 2001?

8. Why has the unfunded liability kept growing so fast after the “reforms” of 2009, reaching an unprecedented 198% of covered payroll as of the 2011 valuation?

9. Why are $2 billion in healthcare benefits for retirees not being advance-funded at all?

10. Why doesn’t the MBTA provide the “discussion and analysis that US generally accepted accounting principles [GAAP] require to be presented to supplement the basic financial statements” according to its auditors of from KPMG?

11. Why doesn’t the T post the actuarial valuations of its pension and OPEB liabilities online?

12. Why did the MBTA Retirement Fund not share on its website any of its financial statements until Pioneer contacted them regarding this research? More importantly, when will they make more information public?

13. Why is MBTARF not subject to regulatory oversight by the Public Employee Retirement Administration Commission?

14. Why doesn’t the T want to discuss substantive issues about their pensions in public? Why the diversionary spin?

The deterioration of the financial condition of the MBTA’s retirement fund is of concern to taxpayers and also to current and retired employees. T officials should not be satisfied with sweeping under the rug troubling long-term trends in the management of the pensions of the authority’s employees. We hope that either the MBTA will engage in a serious discussion of these matters – in public – or that the legislature will force them to.