MassAnalysis: Understanding local debts

Although they must maintain balanced budgets, Massachusetts municipalities routinely go into debt to fund local projects. By borrowing and issuing bonds, they can opt to finance everything from new schools to the acquisition of conservation land. Using MassAnalysis, a powerful data tool created by the Pioneer Institute, let’s explore some of these debt figures across the Commonwealth and gain insights on the positions of various communities.

When it comes to financing local projects, municipalities are limited by Proposition 2 ½ which passed by referendum in 1982, limiting annual property tax increases to 2.5 percent of the assessed value in any given municipality. However, through a town-wide vote, a community can pass a temporary debt exclusion tax hike or can override the 2.5 percent limit.

Municipalities fund local projects by issuing bonds. These bonds are exempt from federal taxes and often from state taxes as well, making them particularly attractive to investors. Most bonds in Massachusetts are what are known as general obligation bonds, with payments made from general funds that are not tied to specific revenue source. General obligation bonds are backed by the full faith and credit of the issuing municipality.

Large cities with numerous projects typically have the most outstanding debt. But the amount of debt per person varies widely. The four cities with the most overall debt in 2016 were Boston with $1.2 billion, Worcester, $622.2 million, Cambridge, $405 million, and Fall River, $250.4 million. However, based on 2016 populations, Cambridge is the most indebted of the top four at $3,666 per resident. Worcester was close behind at $3,388, trailed by $2,875 in Fall River and $1,786 in Boston. However, other communities actually ranked higher in terms of debt per capita. For instance, Wellesley, with 28,909 people in 2016, stood at $5,246.

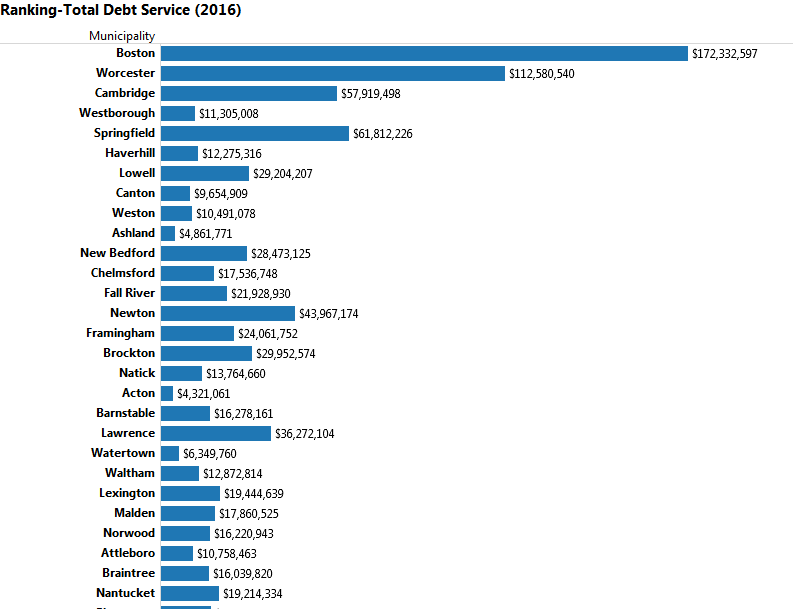

For many cities and towns, debt service is a significant budgetary line item. In 2016, Boston led the Commonwealth in debt service obligations, paying over $172 million. Worcester paid $112.5 million and Cambridge $57.9 million.

Many communities hover close to their debt limits. In 2016, Southbridge and Fall River were both above 90 percent of their limits, while Maynard, Holyoke and Lunenburg were above 80 percent. Massachusetts General Law, Section 10, Chapter 44 stipulates that municipalities “shall not authorize indebtedness to an amount exceeding five per cent of the equalized valuation of the city or town.” However, debt limits don’t always offer much clarity on the financial position of municipalities, in part because debt limits can be altered through debt exclusion votes. The same law states that cities and towns can surpass the five percent threshold with the approval of the finance committee, but must still stay within 10 percent of the equalized valuation.

Too much spending can easily harm municipal credit ratings. Reining in indebtedness is important not only for future borrowing but also to prevent local budgets from becoming hollowed out by long-term principal and interest payments. Comparative data can help to guide the discussion for citizens and policymakers.

About MassAnalysis

MassAnalysis is a powerful tool for comparing Massachusetts municipalities across multiple categories to draw meaningful comparisons from diverse data. Citizens and policymakers can compare education, crime, financial strength, tax rates, revenues and expenditures to make sense of how communities are performing. Learn more at massanalysis.com.