Tag Archive for: tax

MBTAAnalysis: A look inside the MBTA

0 Comments

/

The MBTA shuttles over a million passengers a day around Greater…

https://pioneerinstitute.org/wp-content/uploads/CloseupClock-1.jpg

739

1244

Mary Connaughton

https://pioneerinstitute.org/wp-content/uploads/logo_440x96.png

Mary Connaughton2017-02-20 12:34:192017-02-21 09:47:58The Clock is Ticking…….

https://pioneerinstitute.org/wp-content/uploads/CloseupClock-1.jpg

739

1244

Mary Connaughton

https://pioneerinstitute.org/wp-content/uploads/logo_440x96.png

Mary Connaughton2017-02-20 12:34:192017-02-21 09:47:58The Clock is Ticking…….

Interstate Legal Skirmish: New Hampshire Takes Massachusetts Telecommuter Tax to the Supreme Court

Host Joe Selvaggi talks with legal scholar and George Mason University Law Professor Ilya Somin about the details, the merits, and the likely implications of the Supreme Court case, New Hampshire v. Massachusetts, on state taxation power, federalism, and the power to vote with one’s feet.

Connecticut’s Painful Journey: Wealth Squandered, Lessons Learned, Promise Explored

Host Joe Selvaggi talks with Connecticut Business and Industry Association’s President and CEO, Chris DiPentima, about what policy makers can learn from Connecticut’s journey from the wealthiest state in the nation, to one with more than a decade of negative job growth.

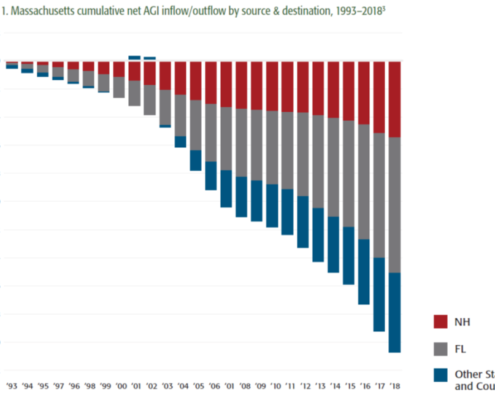

New Study Shows Significant Wealth Migration from Massachusetts to Florida, New Hampshire

Over the last 25 years, Massachusetts has consistently lost taxable income, especially to Florida and New Hampshire, via out-migration of the wealthy, according to a new Pioneer Institute study.

In “Do The Wealthy Migrate Away From High-Tax States? A Comparison of Adjusted Gross Income Changes in Massachusetts and Florida,” Pioneer Institute Research Director Greg Sullivan and Research Assistant Andrew Mikula draw on IRS data showing aggregate migration flows by amount of adjusted gross income (AGI). The data show a persistent trend of wealth leaving high-tax states for low-tax ones, especially in the Sun Belt.

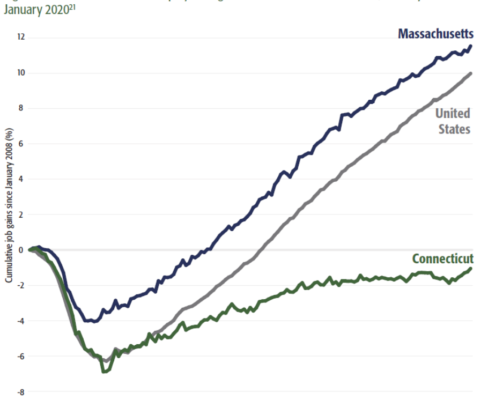

New Study Finds Tax Policy Drives Connecticut’s Ongoing Fiscal & Economic Crisis

Multiple rounds of tax increases aimed at high earners and corporations triggered an exodus from Connecticut of large employers and wealthy individuals, according to a new study published by Pioneer Institute.

Study: Economic Recovery from COVID Will Require Short-Term Relief, Long-Term Reforms

As the initial economic recovery from the COVID-19 pandemic has slowed, a new study from Pioneer Institute finds that governments must continue to provide short-term relief to stabilize small businesses as they simultaneously consider longer-term reforms to hasten and bolster recovery – all while facing a need to shore up public sector revenues.

Proposition 80 Won’t Generate $1.9 Billion Annual Projected Revenue

Passage of November 2018 ballot measure will make Massachusetts…

Proposition 80 Will Increase Out-Migration of High Earners and Businesses

Passage of November 2018 ballot measure would jeopardize Massachusetts’…

Study: New Federal Tax Law Would Exacerbate Economic Damage of Prop 80

This report earned media coverage on WGBH radio, WBZ radio,…

New Study Looks to Connecticut as Cautionary Tale for Impact of Proposed Ballot Initiative Hiking Taxes

Hear Greg Sullivan discuss this report on Bloomberg Radio.

Raising…

Study: Proposition 80 Would Give MA 2nd Highest Combined State & Federal Capital Gains Tax Rate in U.S.

Read coverage of this report in the Boston Herald: "Study: ‘Millionaire’s…

Big ACA Middle-Class Tax Increase in Mass, $87K for Small Biz Employee

Pioneer is releasing a new brief estimating the impact of…

Education Tax Credits: A Review of the Rhode Island Program and Assessment of Possibilities in Massachusetts

A Review of the Rhode Island Program and Assessment of Possibilities…

Rehabbing Urban Redevelopment: Working Paper on Building the Next Urban Economy

This report surveys 14 Massachusetts cities outside the immediate…