Tag Archive for: Connecticut

MBTAAnalysis: A look inside the MBTA

0 Comments

/

The MBTA shuttles over a million passengers a day around Greater…

https://pioneerinstitute.org/wp-content/uploads/CloseupClock-1.jpg

739

1244

Mary Connaughton

https://pioneerinstitute.org/wp-content/uploads/logo_440x96.png

Mary Connaughton2017-02-20 12:34:192017-02-21 09:47:58The Clock is Ticking…….

https://pioneerinstitute.org/wp-content/uploads/CloseupClock-1.jpg

739

1244

Mary Connaughton

https://pioneerinstitute.org/wp-content/uploads/logo_440x96.png

Mary Connaughton2017-02-20 12:34:192017-02-21 09:47:58The Clock is Ticking…….

Part I: It May Be Better to Be Unemployed in Massachusetts than in Connecticut or New Hampshire

Connecticut, Massachusetts, and New Hampshire all rank among…

Study Finds Prevalence of Entrepreneurship Tied to Regulatory Environment, Portion of Immigrants

The prevalence of entrepreneurship is linked to both the regulatory environment and the portion of foreign-born immigrants in a jurisdiction, according to a new study published by Pioneer Institute.

How did tax hikes work out for Connecticut?

Pioneer Institute's Charlie Chieppo shares data on the economic impact of tax increases in Connecticut - which has the 2nd highest state and local tax burden in the country and ranks 49th in private sector wage and job growth. As Massachusetts considers a proposal to raise income taxes, it is important to learn from the experience of other states. Learn more.

New Report: Massachusetts Maintains Reasonable Debt Relative to GSP

Massachusetts has more debt than any New England state. Can we afford to pay it off or will we hand it down to future generations?

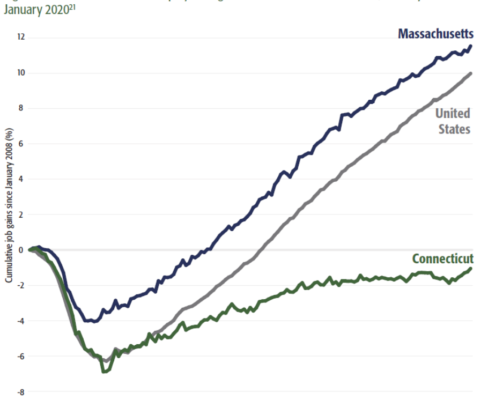

Connecticut’s Painful Journey: Wealth Squandered, Lessons Learned, Promise Explored

Host Joe Selvaggi talks with Connecticut Business and Industry Association’s President and CEO, Chris DiPentima, about what policy makers can learn from Connecticut’s journey from the wealthiest state in the nation, to one with more than a decade of negative job growth.

New Study Finds Tax Policy Drives Connecticut’s Ongoing Fiscal & Economic Crisis

Multiple rounds of tax increases aimed at high earners and corporations triggered an exodus from Connecticut of large employers and wealthy individuals, according to a new study published by Pioneer Institute.

Connecticut’s Dangerous Game: How the Nation’s Wealthiest State Scared Off Businesses and Worsened Its Fiscal Crisis

This report presents evidence that Connecticut’s embrace of an aggressive tax policy to pay for ballooning government expenditures — including a sharp corporate tax rate increase — has been a major driver in the loss of bedrock employers. Higher corporate tax rates, combined with hikes in the personal income tax and, especially, the estate tax, also appear to be a factor driving away a growing number of the state’s wealthiest residents.

New Study Looks to Connecticut as Cautionary Tale for Impact of Proposed Ballot Initiative Hiking Taxes

Hear Greg Sullivan discuss this report on Bloomberg Radio.

Raising…