Volatility and Expansion at the MassCEC

This blog entry was edited from its original version on July 28, 2016.

In 2008, the Massachusetts Clean Energy Technology Center (MassCEC) was established by the state Legislature, and it opened its doors the following year. The center’s mission is to promote the development of clean energy in Massachusetts, improve quality of life, and gradually help the Commonwealth transition towards renewable sources of energy.

Its legislative mandate enumerates 10 goals, including the development of jobs in clean energy, support for education and workforce training, and financing for clean energy companies and projects. In accordance with M.G.L. ch. 23J §2, 10, MassCEC is directed to focus on assisting low and moderate-income communities in all its programs, making clean energy investments a tool of social change as well as energy modernization. The center’s programs are primarily financed by the Renewable Energy Trust (RET), which has existed since 1997 but was transferred to the MassCEC in 2009.

By law, the center is funded by a small surcharge on the electricity consumed by ratepayers across Massachusetts. Penalties on power companies for noncompliance with mandated increases in renewable power generation provide some additional revenue. In practice however, the center’s financing has been in large part derived from state grants – a departure from the Legislature’s original intentions.

According to MassCEC’s 2013 Financial Statements, 47 percent of the center’s revenues came from the ratepayer surcharge in fiscal 2013, and this was deposited in the RETF. A further 46 percent of total funding for FY13, however, came from the Commonwealth, either in the form of grants for the construction of the New Bedford Marine Commerce Terminal (NBMCT) or through general appropriations. The remaining 7 percent of revenue was realized through interest on the trust fund and charges for facility use.

In fiscal 2014, the discrepancy between the legally mandated and actual sources of revenue became even more pronounced. Fully 70 percent of the center’s 2014 revenue came either through state grants for the NBMCT or general state appropriations. This amounted to about $63.7 million in state money for a center that is supposed to be independently-funded.

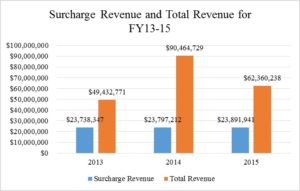

In its fiscal 2015 financial report, the MassCEC stopped including colorful pie charts of revenue sources, but the trend of reliance on state grants continued. State – and for the first time, federal – grants accounted for just under 57 percent of the center’s annual revenue. It is crucial to note that the overall size of the center’s budget in a given year is largely dependent on outside grants, as shown in the chart below. Data for this chart are taken from the 2013, 2014, and 2015 financial reports.

As the chart shows, funding from MassCEC’s primary revenue source (the electric surcharge) has been steady and predictable. However, external revenue has been volatile. The fiscal 2016 budget has not been released in full as of June 23, 2016, but a brief rundown mentions that, “there are currently no state funds budgeted,” for the center in 2016, listing just $30.5 million in total projected revenue for the year, less than half of total revenue for 2015. Just how much state money has gone to the center in 2016 (if any) will become clear when an audited financial report is released.

Regardless of what happened in fiscal 2016, this sort of unpredictability is troubling. Planning becomes challenging when revenue fluctuates wildly from year to year.

An additional consideration here is that the MassCEC’s payroll has expanded rapidly since 2010. The Massachusetts Open Checkbook website shows that payroll (provided by calendar year) expanded from $3,300,534 in 2011 to $5,058,455 in 2015 – an increase of 53 percent in just four years. Between 2011 and 2015, the number of full time employees at the center rose from 51 to 64, a 25 percent increase. (Note: these numbers were edited on July 28, 2016, after the MassCEC made Pioneer aware of an error in employee accounting). Furthermore, these employment numbers do not include fellows compensated for their work, whose pay can be significant. Over the course of 2015, for instance, the center paid 27 fellows an average of $9,412. Has there been an increase in the center’s output over the past 5 years to justify the expansion of the center’s personnel?

The 2015 Massachusetts Clean Energy Industry Report, commissioned by the MassCEC from a private research organization, shows that total public investment in clean energy actually declined from 2010 to 2014, by nearly 84 percent. While this report considers federal grants (which declined from their historical highs after the American Recovery and Reinvestment Act) as well as MassCEC funding, the marked growth that Massachusetts has seen in clean energy sector employment and value has been almost entirely the result of private investment, rather than public financing.

Furthermore, the Open Checkbook website shows that total grants paid by the MassCEC fell from $65,613,159 in fiscal year 2011 to $26,090,249 in fiscal 2015, a precipitous decline of more than 60 percent. These grants are, “provided to individuals, companies, or other entities to encourage the development, deployment, and adoption of clean energy technology,” and the management of these grants comprises the bulk of the center’s work. As the total size of outgoing grants has fallen, payroll has continued to climb.

The MassCEC refutes these statistics, pointing instead to a 128% increase in grants “funded with ratepayer dollars” from 2011 to 2016. While these statistics may be accurate, they do not show the entire picture. Payouts from one revenue source (the ratepayer surcharge) may be going up, but there has been a marked decrease in total outflows from all revenue sources, including state grants.

Such a large and rapid expansion of payroll would be tough to justify even when revenues are steadily increasing. But the MassCEC’s finances are unstable and difficult to predict during annual budgeting process, when payroll and hiring decisions must be made for the year. Additionally, the center’s commissioned research has shown that overall public investment in clean energy is declining, further calling into question the center’s expansion. It is troubling to see that employment numbers at the center have risen so rapidly while the center’s investment in clean energy has fallen dramatically. The MassCEC should explain its strategy and publicly justify its rapidly growing payroll.

While the core revenue provided for by law has remained steady, and the trust fund has been productive, a reliance on state and federal grants has made the MassCEC vulnerable to external decisions and economic risks. Furthermore, an unsustainably rapid increase in employment – amidst both financial uncertainty and a decline in investment activity – calls into question the center’s future plans.