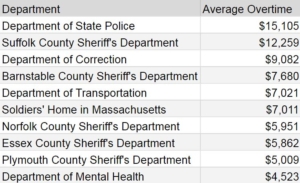

MassOpenBooks: A Look at the Top Departments by Average Overtime Pay in 2018

In 2018, the Commonwealth provided a total of $368.15 million in overtime pay to state employees. MassOpenBooks, Pioneer Institute’s government transparency tool, sorts through and presents this data in an accessible manner. Below is a chart that lists the top 10 departments by average overtime pay for 2018.

Source: MassOpenBooks

As indicated in the payroll section of MassOpenBooks, the Department of State Police has been the top agency for average overtime pay since 2010, the earliest year for which data has been made available by the state. From this time to 2018, average overtime pay increased 34.73 percent. This change is particularly concerning, considering the department’s recent overtime scandal.

The State Police Department is not the only law enforcement agency to experience large increases in overtime. The Department of Corrections (DOC) reflects a similar, but more extreme, trend.

According to a DOC report, the prison population has decreased every year since 2012. Specifically, from 2015 to 2018, the prison population decreased by 14.85 percent. Despite this decrease, overtime pay at the DOC continues to rise. In 2015, the average overtime pay at the DOC was $3,381. In 2018, the average was $9,082. This amounts to a massive 168.62 percent increase in average overtime pay in just four years.

The total overtime pay at the DOC has also increased significantly, rising from $19,256,071 in 2015 to $48,081,913 in 2018 – an increase of approximately 150 percent. Considering the previously mentioned prison population decrease, one has to question why there has been such a dramatic increase in overtime pay.

One explanation for this discrepancy may lie in DOC hiring practices. From 2015 to 2018, there has been an 8.19 percent decrease in the number of DOC employees. In Massachusetts, employees are entitled to 1.5 times their hourly wage for time worked beyond 40 hours a week. If the DOC has fewer employees, each may need to work more overtime. Is this the right course?

The issue of overtime increases at the DOC came into the spotlight with the case of Raymond Wallace. After being charged with two violent crimes, Wallace attempted to escape in July 2016 when he was involved in a shootout resulting in injury. After the shooting, Wallace was held at the Lemuel Shattuck Hospital, a DOC facility in Jamaica Plain. According to The Salem News, “if he [Essex County Sheriff Kevin Coppinger] has enough staff on duty during a shift, he can send someone to Boston for the Shattuck detail…But frequently, he doesn’t… [Which] forces him to tap into his overtime budget”. This lead to a cost of nearly $2 million in overtime pay over 4.5 years to guard a single inmate.

Deciding between increased hiring and providing more overtime is one that all agencies have to consider. MassOpenBooks facilitates transparency by making payroll and overtime data accessible so the public can question governmental practices – and hopefully get answers.

Get our MassWatch updates!

Related posts:

Ana Rijal is a Wellesley Freedom Project intern for Pioneer Institute. She is a rising junior studying Psychology and Philosophy.

Metropolitan Transportation Authority of the State of New York from United States of America, CC BY 2.0

Metropolitan Transportation Authority of the State of New York from United States of America, CC BY 2.0

Kenneth C. Zirkel, CC BY-SA 4.0

Kenneth C. Zirkel, CC BY-SA 4.0

John Phelan, CC BY 3.0

John Phelan, CC BY 3.0