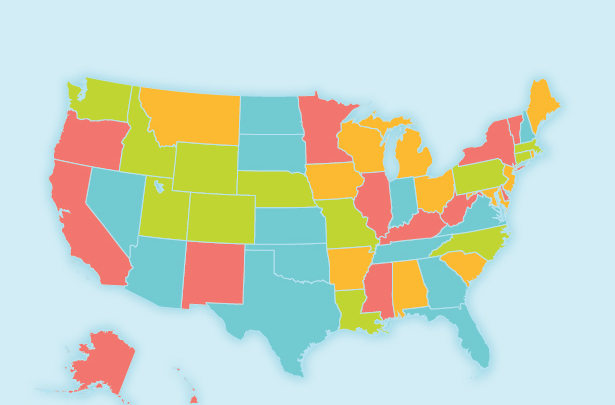

Report: Economic Freedom Up Slightly Across U.S.

Massachusetts ranks 13th in North American index

BOSTON – Massachusetts ranks 13th out of all 50 states in this year’s Economic Freedom of North America report, released today by the Pioneer Institute in conjunction with Canada’s Fraser Institute.

“Massachusetts has real competitive advantages over other states – a top-rate education system, talent across financial services, consulting and important research and innovation sectors,” said Jim Stergios, executive director of Pioneer Institute. “But state government has also advanced policies that make Massachusetts an expensive place to live and work. We have a well-earned reputation for over-regulation and huge debt obligations that are a drag on the economy. Several issues on the ballot in 2018, including additional tax increases and restrictions on labor freedoms, would only erode Massachusetts’ standing further.”

For the third year in a row, New Hampshire has the highest level of economic freedom among all U.S. states. It scored 8.3 out of 10 in this year’s report, which measures government spending, taxation and labor market restrictions using data from 2015, the most recent year of available comparable data.

“The freest economies operate with comparatively less government interference, relying more on personal choice and markets to decide what’s produced, how it’s produced and how much is produced. As government imposes restrictions on these choices, there’s less economic freedom and less opportunity for prosperity,” said Fred McMahon, the Dr. Michael A. Walker Research Chair in Economic Freedom at the Fraser Institute and report co-author.

After New Hampshire, the freest states are Florida and Texas (tied for 2nd), South Dakota (4th) and Tennessee (5th). For the third year in a row, New York was ranked least free (50th), followed by California (49th), New Mexico and West Virginia (tied for 47th), and Hawaii and Mississippi (tied for 45th).

The report includes an additional all-government ranking, which adds federal government policy to the index and includes the 50 U.S. states, 32 Mexican states, and 10 Canadian provinces.

Since 2004, the average score for U.S. states in the all-government index has fallen from 8.20 to 7.78 out of 10 in 2015, driven largely by changes at the federal level.

In the most-free states, the average per capita income in 2015 was seven percent above the national average compared to roughly five percent below the national average in the least-free states.

“The link between economic freedom and prosperity is clear—people who live in states that support comparatively low taxation, limited government, and flexible labor markets have higher living standards and greater economic opportunity,” said Dean Stansel, economics professor at Southern Methodist University and co-author of the report.

The Economic Freedom of North America report, also co-authored by José Torra, the head of research at the Mexico City-based Caminos de la Libertad, is an offshoot of the Fraser Institute’s Economic Freedom of the World index, the result of over a quarter-century of work by more than 60 scholars, including three Nobel laureates.

See the full report at fraserinstitute.org and fraserinstitute.org/economic-freedom.

About the Economic Freedom Index

Economic Freedom of North America (EFNA) measures the degree to which the policies and institutions of states/provinces support economic freedom. This year’s publication ranks 92 provincial/state governments in Canada, the United States and Mexico. The report also updates data in earlier reports in instances where data has been revised.

For more information on the EFNA Network, datasets and previous Economic Freedom of North America reports, visit www.fraserinstitute.org/economic-freedom. And you can ‘Like’ the Economic Freedom Network on Facebook at facebook.com/EconomicFreedomNetwork.

###

Pioneer Institute is an independent, non-partisan, privately funded research organization that seeks to improve the quality of life in Massachusetts through civic discourse and intellectually rigorous, data-driven public policy solutions based on free market principles, individual liberty and responsibility, and the ideal of effective, limited and accountable government.

Related Research