A Bold New Agenda: Introducing Pioneer’s New Board Chair Adam Portnoy

/0 Comments/in Featured, News, Video /by Editorial StaffLast week, Pioneer Institute announced the appointment of Adam Portnoy, President and CEO of The RMR Group, as new Chair of our Board of Directors, succeeding Stephen D. Fantone, who recently stepped down after eight years of dedicated service. We are excited about this new stage in Pioneer’s development, and want to introduce Adam to all of you, our supporters.

In the video below, Adam shares thoughts on what inspired him to become more involved in Pioneer’s work, highlighting the Institute’s data-driven, forward-focused approach to advancing policy solutions and creating more opportunities for all. He also offers his vision for the future, building our community of supporters and increasing our public interest law activities to strengthen our policy impact – which is the core of the Institute’s new Pioneer2024 strategic plan. We hope you enjoy this chance to get to know Adam and hear his message!

Join us as we embark on this ambitious new agenda! Learn about membership opportunities.

Stay Connected!

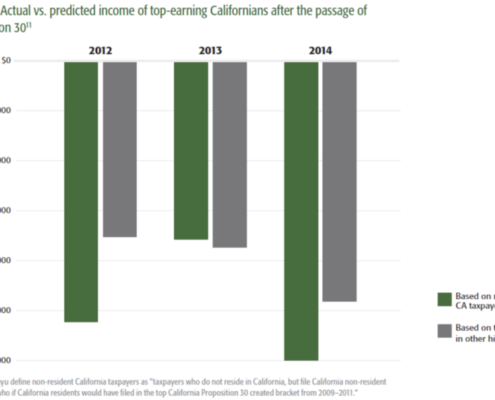

New Study Highlights Economic Fallout from California’s 2012 Tax Hike

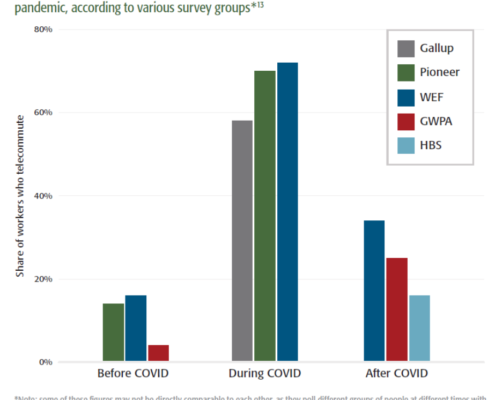

New Study Finds Pandemic-Spurred Technologies Lowered Barriers to Exit in High-Cost States

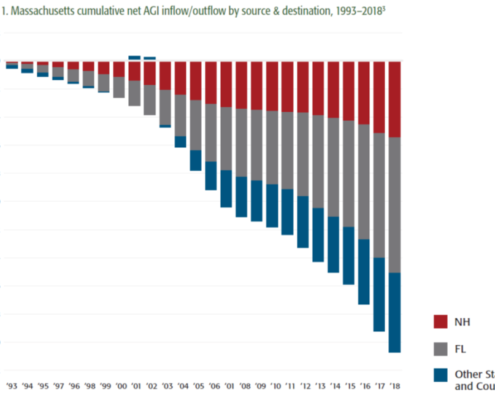

New Study Shows Significant Wealth Migration from Massachusetts to Florida, New Hampshire

New Book Offers Roadmap to Sustainability for Massachusetts Catholic Schools

Study: Massachusetts Should Embrace Direct Healthcare Options

California Tax Experiment: Policy Makers Receive Valuable Economics Lesson

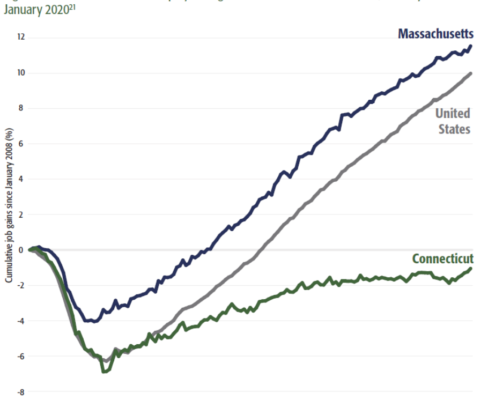

New Study Finds Tax Policy Drives Connecticut’s Ongoing Fiscal & Economic Crisis

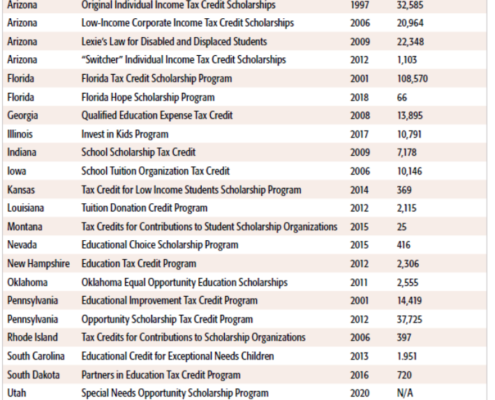

New Study Provides Toolkit for Crafting Education Tax-Credit Scholarship Programs

Pioneer Report Spotlights Decade-long Building Boom in Massachusetts Construction Industry

Pioneer Institute Statement on MBTA Service Cuts

Pioneer Checklist Includes Steps for Policy Makers, Business Owners to Revitalize Hardest-Hit Industries