A Bold New Agenda: Introducing Pioneer’s New Board Chair Adam Portnoy

/0 Comments/in Featured, News, Video /by Editorial StaffLast week, Pioneer Institute announced the appointment of Adam Portnoy, President and CEO of The RMR Group, as new Chair of our Board of Directors, succeeding Stephen D. Fantone, who recently stepped down after eight years of dedicated service. We are excited about this new stage in Pioneer’s development, and want to introduce Adam to all of you, our supporters.

In the video below, Adam shares thoughts on what inspired him to become more involved in Pioneer’s work, highlighting the Institute’s data-driven, forward-focused approach to advancing policy solutions and creating more opportunities for all. He also offers his vision for the future, building our community of supporters and increasing our public interest law activities to strengthen our policy impact – which is the core of the Institute’s new Pioneer2024 strategic plan. We hope you enjoy this chance to get to know Adam and hear his message!

Join us as we embark on this ambitious new agenda! Learn about membership opportunities.

Stay Connected!

Study Suggests How to Advance Fairness, Predictability of “Payment in Lieu of Taxes” Programs Aimed at Nonprofits

Public Statement on Implementation of the Charitable Giving Deduction

Public Statement on the MA Legislature’s Blanket Pension Giveaway

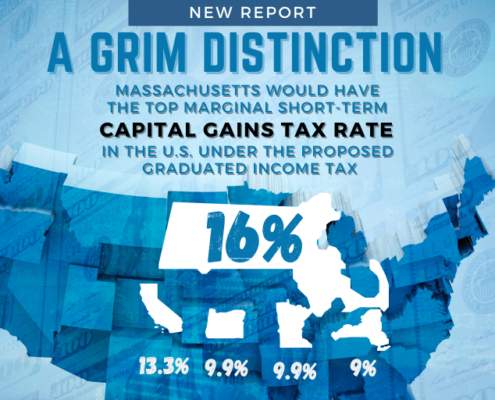

Study Says Massachusetts Surtax Proposal Could Reduce Taxable Income in the State by Over $2 Billion

This Is No Time for a Tax Increase

Study: Massachusetts Should Retain Additional Healthcare System Flexibility Granted During Pandemic

Study Finds Deep Flaws in Advocates’ Claims that the Massachusetts Tax Code is Regressive

Open Letter: Extend the Term of the MBTA’s Fiscal and Management Control Board

Study Calls for Better Reporting on Impact of COVID-19 in Eldercare Facilities

Study Says Interstate Tax Competition, Relocation Subsidies Exacerbate Telecommuting Trends

7 Reasons to Reject the Graduated Tax and Instead Focus on Growing Jobs