MBTAAnalysis: A look inside the MBTA

0 Comments

/

The MBTA shuttles over a million passengers a day around Greater…

https://pioneerinstitute.org/wp-content/uploads/CloseupClock-1.jpg

739

1244

Mary Connaughton

https://pioneerinstitute.org/wp-content/uploads/logo_440x96.png

Mary Connaughton2017-02-20 12:34:192017-02-21 09:47:58The Clock is Ticking…….

https://pioneerinstitute.org/wp-content/uploads/CloseupClock-1.jpg

739

1244

Mary Connaughton

https://pioneerinstitute.org/wp-content/uploads/logo_440x96.png

Mary Connaughton2017-02-20 12:34:192017-02-21 09:47:58The Clock is Ticking…….

Study: “Millionaire’s Tax” Would Have Far-Reaching Effects on “Pass-Through” Businesses

A proposed graduated income tax that will appear on the statewide ballot in November 2022 will have much more far-reaching implications than most people realize because the surtax also extends to “pass-through” income from entities such as S and limited liability corporations, partnerships, and sole proprietorships that are taxed on individual tax returns, according to a new study published by Pioneer Institute.

Study Warns that New Hampshire Tax Policies Would Exacerbate Impacts of a Graduated Income Tax

Drawing on migration patterns between Massachusetts and states like Rhode Island and Tennessee, Pioneer Institute is releasing a study showing a direct correlation between personal income tax rates and household domestic migration patterns between 2004 and 2019. The study suggests that instituting a graduated income tax will shrink the tax base and deter talented workers and innovative employers from coming to and staying in the Bay State.

Study Finds SALT Deduction Cap, Graduated Income Tax Will Combine to More Than Double Tax Burden on Some Households

A provision of the federal Tax Cuts and Jobs Act of 2017 strictly limiting deductions for state and local taxes (SALT) will greatly exacerbate the adverse effects of a proposal to create a constitutionally mandated graduated income tax, according to a new study published by Pioneer Institute.

Study Suggests How to Advance Fairness, Predictability of “Payment in Lieu of Taxes” Programs Aimed at Nonprofits

A new white paper by Pioneer Institute calls for increased transparency over the basis for payment in lieu of taxes (“PILOT”) agreements between municipal governments and nonprofit organizations, while also encouraging nonprofits to publicize and expand the community benefits they provide.

Public Statement on Implementation of the Charitable Giving Deduction

Despite being awash in cash, the state Legislature just overrode Gov. Charlie Baker’s veto of a provision to delay by yet another year a tax deduction for charitable donations. Rep. Mark Cusack, House chair of the Joint Committee on Revenue, said “it doesn’t mean no, just not now.” If not now, when?

Study Says Massachusetts Surtax Proposal Could Reduce Taxable Income in the State by Over $2 Billion

As voters now begin to weigh the potential impact of a ballot proposal to increase taxes on business owners, retirees and wealthier households, a new literature review by Pioneer Institute shows that many existing academic studies find that wealthy individuals are particularly sensitive to changes in tax policy. Other studies explicitly warn policymakers that behavioral responses to taxing the rich could erode the tax base and ultimately strain state budgets.

This Is No Time for a Tax Increase

This is no time to threaten Massachusetts’ prospects for an immediate economic recovery and the long-term competitiveness of the Commonwealth’s businesses. As Massachusetts lawmakers prepare to vote on whether to send a proposed constitutional amendment that would impose a 4 percent surtax on residents who earn $1 million or more in a year to the statewide ballot in 2022, Pioneer Institute urges them to recognize that tax policy sizably impacts business and job location decisions and that jobs are more mobile than ever.

Study Finds Deep Flaws in Advocates’ Claims that the Massachusetts Tax Code is Regressive

Proponents of a state constitutional amendment to add a 4 percent surtax on all households with annual income above $1 million frequently cite 2015 data from the Institute on Taxation and Economic Policy, which argues that the Massachusetts tax code is regressive, but a new study published by Pioneer Institute debunks many of the underlying assumptions used in ITEP’s 2015 report.

Study Says Interstate Tax Competition, Relocation Subsidies Exacerbate Telecommuting Trends

A spate of new incentive and subsidy programs seeking to lure talented workers and innovative businesses away from their home states could constitute an additional challenge to Massachusetts’ economic and fiscal recovery from COVID-19, according to a new study published by Pioneer Institute.

7 Reasons to Reject the Graduated Tax and Instead Focus on Growing Jobs

Pioneer Institute's Statement before the Joint Committee on Revenue In Opposition to: HB 86 (Pages 1-4), a legislative amendment to the Constitution to provide resources for education and transportation through an additional tax on incomes in excess of one million dollars.

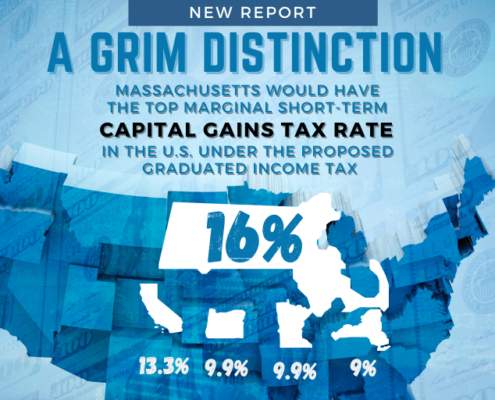

Study Warns Massachusetts Tax Proposal Would Deter Investment, Stifling the “Innovation Economy”

A state constitutional amendment promoted by the Massachusetts Teachers Association and the Service Employees International Union adding a 4 percent surtax to all annual income above $1 million could devastate innovative startups dependent on Boston’s financial services industry for funding, ultimately hampering the region’s recovery from the COVID-19 economic recession, according to a new study published by Pioneer Institute.

Study Shows the Adverse Effects of Graduated Income Tax Proposal on Small Businesses

The state constitutional amendment promoted by the Massachusetts Teachers Association and the Service Employees International Union to add a 4 percent surtax to all annual income above $1 million will adversely impact a significant number of pass-through businesses, ultimately slowing the Commonwealth’s economic recovery from COVID-19, according to a new study published by Pioneer Institute.

Study: Graduated Income Tax Proposal Fails to Protect Taxpayers from Bracket Creep

The state constitutional amendment proposed by the Service Employees International Union and the Massachusetts Teachers Association to add a 4 percent surtax to all annual income above $1 million purports to use cost-of-living-based bracket adjustments as a safeguard that will ensure only millionaires will pay. But historic income growth trends suggest that bracket creep will cause many non-millionaires to be subject to the surtax over time, according to a new study published by Pioneer Institute.

Pioneer Institute, The Immigrant Learning Center Co-Produce New Weekly Podcast

Pioneer Institute is pleased to announce the launch of JobMakers, a new weekly podcast that explores the world of risk-taking immigrants who create new products, services, and jobs in New England and across the United States. JobMakers is produced in collaboration with The Immigrant Learning Center (ILC) of Malden, MA.

New Study Warns Graduated Income Tax Will Harm Many Massachusetts Retirees

If passed, a constitutional amendment to impose a graduated income tax would raid the retirement plans of Massachusetts residents by pushing their owners into higher tax brackets on the sales of homes and businesses, according to a new study published by Pioneer Institute. The study, entitled “The Graduated Income Tax Trap: A retirement tax on small business owners,” aims to help the public fully understand the impact of the proposed new tax.

Study: Graduated Income Tax Proponents Rely on Analyses That Exclude the Vast Majority Of “Millionaires” to Argue Their Case

Advocates for a state constitutional amendment that would apply a 4 percent surtax to households with annual earnings of more than $1 million rely heavily on the assumption that these proposed taxes will have little impact on the mobility of high earners. They cite analyses by Cornell University Associate Professor Cristobal Young, which exclude the vast majority of millionaires, according to a new study published by Pioneer Institute.

Report Contrasts State Government and Private Sector Employment Changes During Pandemic

Massachusetts state government employment has been virtually flat during COVID-19 even as employment in the state’s private sector workforce remains nearly 10 percent below pre-pandemic levels, according to a new study published by Pioneer Institute. The study, “Public vs. Private Employment in Massachusetts: A Tale of Two Pandemics,” questions whether it makes sense to shield public agencies from last year’s recession at the expense of taxpayers.

Study Finds Massachusetts Graduated Income Tax May Be a “Blank Check” and Not Increase Funding for Designated Priorities

Advocates claim a proposed 4 percent surtax on high earners will raise nearly $2 billion per year for education and transportation, but similar tax hikes in other states resulted in highly discretionary rather than targeted spending, according to a new policy brief published by Pioneer Institute. That same result or worse is possible in Massachusetts because during the 2019 constitutional convention state legislators rejected — not just one, but two — proposed amendments requiring that the new revenues be directed to these purposes.

Report: Proposed Graduated Income Tax Might Not Increase State Education and Transportation Spending

While supporters of a state constitutional amendment that would impose a 4 percent tax rate hike on annual income over $1 million claim additional revenue from the surtax will fund public education and transportation needs, the amendment in no way assures that there will be new spending on these priorities. In fact, without violating the amendment, total state education and transportation funding could stay the same or even fall, according to a new review published by Pioneer Institute.

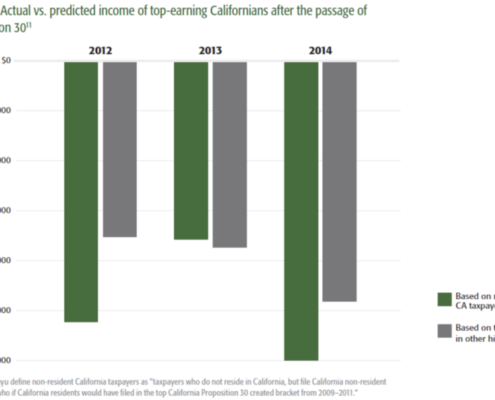

New Study Highlights Economic Fallout from California’s 2012 Tax Hike

A 2012 income and sales tax increase in California, named “Proposition 30,” stifled business activity, accelerated out-migration among the wealthy, and ultimately reduced the state’s tax base, according to a new study published by Pioneer Institute that aims to share empirical data about the impact of tax policy decisions.

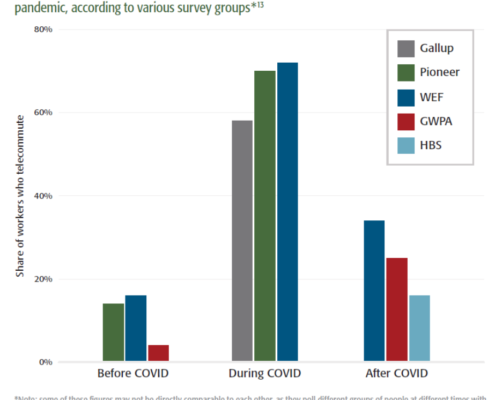

New Study Finds Pandemic-Spurred Technologies Lowered Barriers to Exit in High-Cost States

Both employers and households will find it easier to leave major job centers as technologies made commonplace by the COVID-19 pandemic have led to a rethinking of the geography of work, according to a new study published by Pioneer Institute.

New Study Shows Significant Wealth Migration from Massachusetts to Florida, New Hampshire

Over the last 25 years, Massachusetts has consistently lost taxable income, especially to Florida and New Hampshire, via out-migration of the wealthy, according to a new Pioneer Institute study.

In “Do The Wealthy Migrate Away From High-Tax States? A Comparison of Adjusted Gross Income Changes in Massachusetts and Florida,” Pioneer Institute Research Director Greg Sullivan and Research Assistant Andrew Mikula draw on IRS data showing aggregate migration flows by amount of adjusted gross income (AGI). The data show a persistent trend of wealth leaving high-tax states for low-tax ones, especially in the Sun Belt.

California Tax Experiment: Policy Makers Receive Valuable Economics Lesson

Host Joe Selvaggi talks with Stanford University Economics Professor Joshua Rauh about his research on the reaction of Californians to a tax increase, from his report, “The Behavioral Response to State Income Taxation of High Earners, Evidence from California.” Prof. Rauh shares how his research offers tax policy makers insight into the likely effects of similar increases in their own states, including here in Massachusetts.

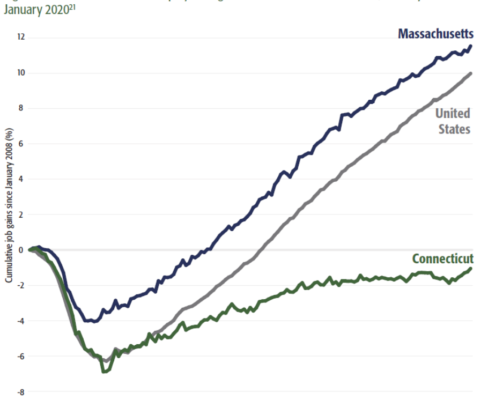

New Study Finds Tax Policy Drives Connecticut’s Ongoing Fiscal & Economic Crisis

Multiple rounds of tax increases aimed at high earners and corporations triggered an exodus from Connecticut of large employers and wealthy individuals, according to a new study published by Pioneer Institute.

Pioneer Report Spotlights Decade-long Building Boom in Massachusetts Construction Industry

In the lead-up to the COVID-19 crisis, the Massachusetts construction industry enjoyed a boom in select subsectors, though employment numbers had yet to recover from the setbacks of the Great Recession, according to a new report from Pioneer Institute that draws data from the MassEconomix web tool.

Pioneer Checklist Includes Steps for Policy Makers, Business Owners to Revitalize Hardest-Hit Industries

Combining the recommendations of studies published earlier this year, Pioneer Institute has released “A Checklist for How to Revitalize the Industries Hit Hardest by COVID-19.” The recommendations for policy makers are organized in three sections: Immediate Relief, Tax Policy Changes and Permanent Reforms. Business owner recommendations are split into COVID-19 Health and Safety Protocols, Expanded Services and Steps to Improve Cash Flow.

Pioneer Report Highlights Pre-Pandemic Employment Growth in Massachusetts’ Hospitality & Food Industry

In the lead-up to the COVID-19 crisis, the Massachusetts Hospitality and Food Industry enjoyed generally positive employment growth, according to a new report from Pioneer Institute that draws data from the MassEconomix web tool. Most of the Hospitality and Food Industry employment across the state is concentrated in full-service restaurants and hotels.

Pioneer Report Highlights Employment Growth in Lowell, Massachusetts

In 2018, employment in Lowell, Massachusetts finally surpassed its pre-Great Recession peak, according to a new report from Pioneer Institute that draws data from the MassEconomix web tool. Before COVID-19, job growth in the city was driven largely by a resurgence in manufacturing and a continued high concentration of healthcare firms.

Pioneer Report Underscores Wide Disparities in Economic Performance between Industry Sectors in Massachusetts

Service-based industries have significantly outperformed manufacturing and other traditional blue-collar economic sectors in Massachusetts since 2008, according to a new report from Pioneer Institute that draws on data from the MassEconomix web tool. In “Broad Industry Sector Trends in Massachusetts, 1998-2018,” two decades of data show fluctuating employment changes across the state, as well as changes in firm size and the types of firms disproportionately headquartered in the Commonwealth.

Study: Economic Recovery from COVID Will Require Short-Term Relief, Long-Term Reforms

As the initial economic recovery from the COVID-19 pandemic has slowed, a new study from Pioneer Institute finds that governments must continue to provide short-term relief to stabilize small businesses as they simultaneously consider longer-term reforms to hasten and bolster recovery – all while facing a need to shore up public sector revenues.