MBTAAnalysis: A look inside the MBTA

0 Comments

/

The MBTA shuttles over a million passengers a day around Greater…

https://pioneerinstitute.org/wp-content/uploads/CloseupClock-1.jpg

739

1244

Mary Connaughton

https://pioneerinstitute.org/wp-content/uploads/logo_440x96.png

Mary Connaughton2017-02-20 12:34:192017-02-21 09:47:58The Clock is Ticking…….

https://pioneerinstitute.org/wp-content/uploads/CloseupClock-1.jpg

739

1244

Mary Connaughton

https://pioneerinstitute.org/wp-content/uploads/logo_440x96.png

Mary Connaughton2017-02-20 12:34:192017-02-21 09:47:58The Clock is Ticking…….

New Study Shows Significant Wealth Migration from Massachusetts to Florida, New Hampshire

Over the last 25 years, Massachusetts has consistently lost taxable income, especially to Florida and New Hampshire, via out-migration of the wealthy, according to a new Pioneer Institute study.

In “Do The Wealthy Migrate Away From High-Tax States? A Comparison of Adjusted Gross Income Changes in Massachusetts and Florida,” Pioneer Institute Research Director Greg Sullivan and Research Assistant Andrew Mikula draw on IRS data showing aggregate migration flows by amount of adjusted gross income (AGI). The data show a persistent trend of wealth leaving high-tax states for low-tax ones, especially in the Sun Belt.

Connecticut’s Dangerous Game: How the Nation’s Wealthiest State Scared Off Businesses and Worsened Its Fiscal Crisis

This report presents evidence that Connecticut’s embrace of an aggressive tax policy to pay for ballooning government expenditures — including a sharp corporate tax rate increase — has been a major driver in the loss of bedrock employers. Higher corporate tax rates, combined with hikes in the personal income tax and, especially, the estate tax, also appear to be a factor driving away a growing number of the state’s wealthiest residents.

A Snapshot of Massachusetts’ Construction Industry during a Decade-long Building Boom

In “A Snapshot of Massachusetts’ Construction industry during a Decade-long Building Boom,” data from 1998 through 2018 show variations in employment and the number of businesses within the construction industry throughout Massachusetts. The report even includes a map of employment concentration in the construction industry by town.

A Checklist for How to Revitalize the Industries Hit Hardest by COVID-19

This checklist combines the recommendations of studies published earlier this year offering recommendations for policy makers, organized in three sections: Immediate Relief, Tax Policy Changes and Permanent Reforms. Business owner recommendations are split into COVID-19 Health and Safety Protocols, Expanded Services and Steps to Improve Cash Flow.

Before COVID-19, the Hospitality & Food Industry was a Service Sector Economic Powerhouse

A new report from Pioneer Institute, “Before COVID-19, the Hospitality & Food Industry was a Service Sector Economic Powerhouse,” draws data from the MassEconomix web tool to analyze Hospitality and Food Industry employment across the state. Data spanning two decades from 1998 through 2018 show fluctuations in employment, firm size, and the share of businesses within the Hospitality and Food Industry throughout Massachusetts. The report shows a map of employment concentration in the Hospitality and Food Industry by town.

Economic Revitalization and Reinvention in Lowell, 1998-2018

In “Economic Revitalization and Reinvention in Lowell, 1998-2018,”…

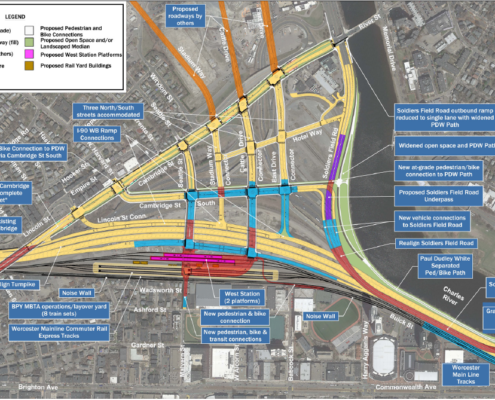

Public Testimony to the Joint Meeting of the MassDOT Board of Directors and Fiscal Management Control Board

Public Testimony to the Joint Meeting of the MassDOT Board of Directors and Fiscal Management Control Board regarding the Allston Multimodal Project, on Oct. 19th, 2020 by Mary Z. Connaughton, Pioneer Institute.

Broad Industry Sector Trends in Massachusetts, 1998-2018: A MassEconomix Report

Service-based industries have significantly outperformed manufacturing and other traditional blue-collar economic sectors in Massachusetts since 2008, according to a new report from Pioneer Institute that draws on data from the MassEconomix web tool.

The Long View: A Public Policy Roadmap for Saving Small Businesses During the COVID-19 Recovery Period

As the initial economic recovery from the COVID-19 pandemic has slowed, a new study from Pioneer Institute finds that governments must continue to provide short-term relief to stabilize small businesses as they simultaneously consider longer-term reforms to hasten and bolster recovery – all while facing a need to shore up public sector revenues.

As the COVID-19 Pandemic Spurs Consumer Shift to E-Commerce, the Massachusetts Sales Tax Collection System Deserves Renewed Scrutiny

At a time when state tax revenues are plummeting, a plan to modernize sales tax collection could get money into state coffers more quickly. This report analyzes the merits of a two-part proposal Governor Baker included in his January state budget submission to streamline state sales tax collections. Sullivan and Mikula find that the first part of Baker’s plan makes sense and is entirely feasible because advances in electronic data processing and electronic funds transfer have eliminated the need for protracted remittance timetables.

A Look at the Massachusetts Industries that are Most Vulnerable Due to COVID-19

A new report using recent data provided by the Massachusetts Executive Office of Labor and Workforce Development shows that hospitality, retail trade, healthcare and social assistance, and construction are the industries that have suffered the most unemployment as a result of the coronavirus outbreak.

Greater Boston as a Global Competitor

This report finds that in order for Boston to become even more attractive to international companies and investors, Boston-area leaders must work to improve housing and healthcare affordability, transportation infrastructure, economic development policies, and education. Pioneer synthesized dozens of economic, lifestyle, and governance indicators into five categories of importance to Boston’s profile in the international competition for talent and investment.

Eight more responses to Professor Young—nine really

Pioneer's Greg Sullivan offers a rebuttal to Professor Cristobal Young's criticism of his recent report, "Eight Reasons to Question Professor Cristobal Young's Conclusions about Millionaire's".

Eight Reasons to Question Professor Cristobal Young’s Conclusions about Millionaires

The work of a Stanford University Professor whose research has formed the foundation of efforts, such as one scheduled to appear on the Massachusetts ballot in November, to impose surtaxes on high earners is flawed because it excludes the vast majority of millionaires, according to a new study published by Pioneer Institute.

Housing & Who’s a ‘Millionaire’ according to Proposition 80

The tax hike on those with annual taxable incomes of $1 million or more that would result from a proposed amendment to the state constitution scheduled to appear on the Commonwealth’s November ballot would likely ensnare an ever-increasing number of taxpayers because the index used to adjust the million-dollar threshold has historically grown at a far slower rate than the taxable income of Massachusetts taxpayers and increases in state home values.

Will The Wealthy Leave? They Already Are and Proposition 80 Will Only Make it Worse

Passage of Proposition 80, the tax hike proposal scheduled to…

The Federal Tax Reform Act’s cap on deductions of state income taxes has turned Proposition 80 into an economic time bomb for Massachusetts

This report finds that recent passage of the federal tax overhaul legislation will exacerbate the negative economic impact of Proposition 80, the proposed constitutional amendment scheduled to appear on Massachusetts’ November ballot that would add a 4 percent surtax on annual taxable income over $1 million.

Back to Taxachusetts? Lessons from Connecticut

This report urges proponents of a 2018 statewide ballot initiative that would add a surcharge on the state taxes of those earning over $1 million annually to look at the experience of Connecticut, where multiple rounds of tax hikes aimed at high earners triggered an exodus of large employers and high-earning individuals that resulted in declining tax revenue.

Economic Freedom of North America 2017

Economic Freedom of North America 2017 is the thirteenth edition of the Fraser Institute’s annual report. This year it measures the extent to which the policies of individual provinces and states were, in 2015, supportive of economic freedom, the ability of individuals to act in the economic sphere free of undue restrictions.

Back to Taxachusetts Series: Capital Gains

This report shows that if Massachusetts voters approve Proposition 80, scheduled to appear on the statewide ballot next year, Massachusetts’ top capital gains tax rate would go from 30th highest in the nation to fourth and the commonwealth’s highest combined state and federal rate would move from 25th to second.

A Road to Financing

This manual was prepared as part of the Urban Business Alliance (UBA)- a unique initiative of Pioneer’s Center for Urban Entrepreneurship that helps low- and moderate-income entrepreneurs by bolstering the skills of the community-based business advisors they look to for assistance.

Rebuilding the Ladder to Self- Sufficiency: Workfare and Welfare Reform

The full implementation of welfare reform in Massachusetts required a waiver from the federal government. The commonwealth requested such a waiver to allow for the work requirement, time limits, job training, and the centralization of its public assistance system. The waiver was granted for all except time limits.

A Challenge to Economic Freedom: Declining Labor Participation

The fact is that the unemployment rate doesn't tell the whole story. Strictly defined as the percentage of the population who are out of work and actively seeking employment, this metric provides a very narrow lens through which to evaluate labor market performance. A look at labor participation rates — the labor force as a percentage of the civilian non-institutional population — helps paint a more accurate picture.

Regaining Massachusetts’ Edge in Research and Development

Massachusetts’ ranking among the states in overall R&D spending by industry rose from fifth to second between 1991 and 2006, but although it’s ranking improved, Massachusetts – and every other state – lost market share over that period to California, which had enacted much stronger tax incentives. In fact, the commonwealth’s market share of national R&D spending by industry actually declined between 1991 and 2011. Over that same period California increased its industrial R&D spending by more than its top seven competitor states combined, including Massachusetts.

Recovering from a Recession

Flash forward a decade and the US cycle starting in 2001 was 4 years; conversely, and ominously for the state, Massachusetts never returned to its February 2001 employment peak, as seen in Figure 1 B. It came close in March 2008, but again began losing jobs due to the latest recession. Nevertheless, if for the purposes of comparison we allow coming close to stand in for a return to peak employment, Massachusetts had a 7-year cycle sinking into and then coming out of the 2001 recession.

The Big Shrink: Declining Establishment Size in Massachusetts

The Big Shrink adds to our understanding by examining the shrinking size of Massachusetts' firms and the causes of this economy-wide phenomenon in order to determine whether the trend has systemic impacts on our economy and, therefore, one hopes, on policy formation. The paper finds that reduction in firm size is widespread, holding true for all industries and most establishment types.

Massachusetts’ New Economy

"Massachusetts’ New Economy" was presented by Jim Stergios in 2011.

Creating Jobs: Reforming Unemployment Insurance in Massachusetts

As states and nations aggressively promote their business climates, the high cost of doing business in Massachusetts requires ongoing remediation for the Commonwealth to sustain its competitive advantage.

Keeping Massachusetts Competitive

Massachusetts is a state with many economic and competitive strengths, but policymakers, elected officials, and business leaders must not ignore its weaknesses. Massachusetts offers compelling advantages to companies looking to expand businesses or start new ones, but other states are chipping away at the state's advantages in this area.

Playing the Lottery: The Impact of Interstate Relocation on Massachusetts Jobs

The study's first major finding is that Massachusetts is losing the relocation game: many more establishments have moved out of state than have entered, and the trend has worsened since 2000. At the net level, Massachusetts has lost 2,152 establishments and 24,088 jobs during this time period.