Skill-based immigration could ease labor shortage

A recent Biden administration executive order that amends the Schedule A list, which identifies occupations experiencing labor shortages and allows immigrants in those occupations to expedite their employment in the U.S., could positively impact the hiring of skilled international workers for years to come — a welcome development as the country and Massachusetts struggle to attract talent amidst a worsening labor shortage.

New Report Explores Impact of Welfare Benefit Cliffs

In “Benefit Cliffs: A Literature Review on Welfare Structures as a Disincentive to Work,” Pioneer researcher Aidan Enright examines the extent to which complicated federal and state requirements related to welfare programs can provide a disincentive to employment or to working additional hours.

The MassLottery: A Bay Stater’s Favorite Pastime

The Massachusetts lottery made $5.9 billion in 2021, making it the fourth-highest source of revenue for the state. This confirms a long-standing trend: that Massachusettans love to play the lottery.

Study Finds Massachusetts Workforce Has Become More Female, Older, More Diverse

The Massachusetts labor force has transformed in recent decades, with some of the biggest changes being the advancement of women, workers getting older and more diverse, and a divergence in labor force participation rates based on levels of educational achievement, according to “At a Glance: The Massachusetts Labor Force,” a white paper written by Pioneer's Economic Research Associate Aidan Enright.

Licensing burdens thwart economic growth in Massachusetts

0 Comments

/

Immigrants account for 17% of Massachusetts residents but start a quarter of the Commonwealth’s new businesses. These entrepreneurs could create even more jobs that further lift wages and standard of living if not for the unnecessary obstacle of restrictive state and local occupational licensing laws.

What We Do and Don’t Know about Online Platform Rideshare/Delivery Workers in Massachusetts

After Massachusetts’ Supreme Judicial Court declared an initiative that was to appear on the November ballot unconstitutional, the issue of how to classify app-based rideshare/delivery workers is back in the hands of the state Legislature. A new study published by Pioneer Institute distills from the research literature eight questions legislators must answer before determining how to address this fast-growing industry.

Book Reveals How Tax Hike Amendment Would Damage Commonwealth’s Economic Competitiveness

If adopted, a constitutional amendment to hike state taxes that will appear on the ballot in November could erase the hard-earned progress Massachusetts has achieved toward economic competitiveness over the last 25 years and may not result in any additional education and transportation funding, according to a new book from Pioneer Institute, entitled Back to Taxachusetts?: How the proposed tax amendment would upend one of the nation’s best economies, which is a distillation of two dozen academic studies.

A Vision for Sustainable, Transit-oriented Development

In this public comment, Pioneer Institute examines the Massachusetts Department of Housing and Community Development's guidelines on how localities can comply with new zoning mandates around MBTA stations. While some of the compliance criteria and goal-setting language need further clarification and adjustment, overall Pioneer Institute is supportive of the vision for sustainable, transit-oriented development which, if properly implemented, will expand economic opportunity to a new generation of the state's residents.

The MBTA’s Looming Bus and Green Line Fare Evasion Crisis

This report warns that the MBTA will likely face a fare evasion crisis when it transitions to all-door boarding on buses, the Green Line, and the Mattapan trolley in 2023. General Manager Steve Poftak and MBTA staff have signaled the potential for a $25–30 million spike in fare evasion costs when the new AFC 2.0 system is implemented unless the MBTA institutes meaningful, enforceable penalties for fare evaders. In this report, Pioneer Institute makes recommendations for managing the AFC 2.0 contract and related fare evasion procedures going forward.

The Great Understatement: Far more taxpayers and businesses than previously estimated will be affected by the proposed surtax

This report finds that analyses from the Massachusetts Department of Revenue (MADOR, 2016) (and more recently, Tufts University’s Center for State Policy Analysis (2022)) dramatically underestimated the number of households and businesses impacted by the constitutionally-imposed tax hike that the legislature is putting before voters in November 2022. The proposed tax would impact multiples of the number of people previously estimated, over a nine-year period, since the majority of “millionaires” only earn $1 million once during that time.

The Far-Reaching Impact of a Massachusetts Surtax: Anecdotal Evidence and Data Analysis

This report shows that a proposed graduated income tax that will appear on the statewide ballot in November 2022 will have much more far-reaching implications than most people realize because the surtax also extends to “pass-through” income from entities such as S and limited liability corporations, partnerships, and sole proprietorships that are taxed on individual tax returns.

A Timely Tax Cut: How New Hampshire is Taking Advantage of Massachusetts’ Graduated Income Tax Proposal

As Massachusetts voters weigh an amendment to the state constitution to enact a surtax on million-dollar earners, they should be cognizant of how the policies of other states could interact with the tax hike to encourage an exodus of jobs and capital, especially in proximate jurisdictions. New Hampshire is a neighboring state that has already benefited from out-migration from Massachusetts to the tune of over $426 million in taxable income in 2019 alone. A new budget amendment there, passed in July 2021, will eliminate the interest and dividends tax by 2027, contributing to a divergence in tax policy that might attract an increasingly mobile workforce and entrepreneurial base.

The SALT Cap: An Accelerator for Tax Flight from Massachusetts

After the authors of the proposed graduated tax in Massachusetts submitted their proposal for legislative approval in 2017, the federal government placed a $10,000 limitation of deductibility of state and local taxes on federal tax returns. This unforeseen change in the federal tax code had the effect of turning what would have been a 58 percent increase in average state income tax payments among Massachusetts millionaires, from $160,786 to $254,355, into what is essentially a 147 percent increase when the federal SALT limitation is included in the calculation. This substantial change should be taken into consideration by voters when they contemplate approving the surtax proposal.

PILOT Agreements: Nonprofits’ Fair Portion or Government Extortion?

A new white paper by Pioneer Institute calls for increased transparency over the basis for payment in lieu of taxes (“PILOT”) agreements between municipal governments and nonprofit organizations, while also encouraging nonprofits to publicize and expand the community benefits they provide.

Tax Flight of the Wealthy: An Academic Literature Review

A new literature review by Pioneer Institute shows that many existing academic studies find that wealthy individuals are particularly sensitive to changes in tax policy. Other studies explicitly warn policymakers that behavioral responses to taxing the rich could erode the tax base and ultimately strain state budgets. The Pioneer Institute study ties the results of these academic pieces into Massachusetts’ current graduated income tax proposal.

Are Massachusetts taxes regressive? A common argument for a graduated income tax relies on a deeply flawed and outdated study

Advocates of the proposed surtax paint a picture of the Massachusetts tax system as highly regressive. They fail to mention that ITEP, the organization that produced the data upon which they rely, rated Massachusetts as having a more progressive tax system than 29 other states. ITEP fails to adequately explain their model’s treatment of the tax incidence of sales, excise, and property taxes, and they exclude a number of other aspects of the tax code that make it seem artificially regressive.

The Big Lure: Interstate Competition Exacerbates the Economic Fallout from Telecommuting Trends

This report finds that a spate of new incentive and subsidy programs seeking to lure talented workers and innovative businesses away from their home states could constitute an additional challenge to Massachusetts’ economic and fiscal recovery from COVID-19.

Statement before the MA Joint Committee on Revenue in Opposition to HB 86 (Pages 1-4) A legislative amendment to the Constitution to provide resources for education and transportation through an additional tax on incomes in excess of one million dollars.

Pioneer Institute's Jim Stergios submitted public testimony highlighting Pioneer’s very serious concerns about how the proposed graduated income tax amendment to the Massachusetts State Constitution would have a detrimental impact on the state’s economy as it begins to recover from the COVID-19 pandemic.

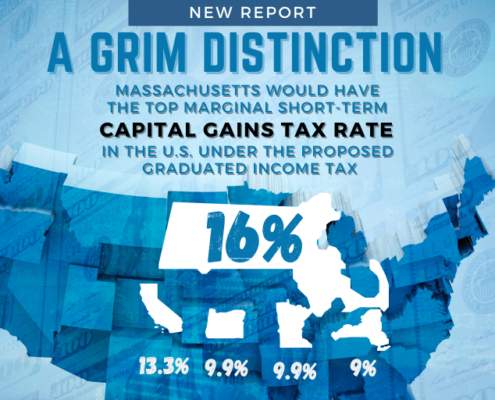

A Grim Distinction: Massachusetts would have top marginal short-term capital gains tax rate in the U.S. under the proposed graduated income tax

This report finds that, under a graduated income tax, Massachusetts’ top marginal short-term capital gains tax rate would be the highest in the nation, exacerbating a tax and regulatory environment that has made it hard for day traders and other investors to contribute to Massachusetts’ economy. By imposing a 4 percent income on all annual income over $1 million, including capital gains, the graduated income tax would penalize the capital formation that is the key to long-term growth and higher living standards for all in the Commonwealth.

The Graduated Income Tax Trap: A Tax on Small Businesses

This policy brief finds that the state constitutional amendment promoted by the Massachusetts Teachers Association and the Service Employees International Union to add a 4 percent surtax to all annual income above $1 million will adversely impact a significant number of pass-through businesses, ultimately slowing the Commonwealth’s economic recovery from COVID-19.

The Great Mismatch: The graduated income tax proposal’s gravely flawed escalation factor

The state constitutional amendment proposed by the Service Employees International Union and the Massachusetts Teachers Association to add a 4 percent surtax to all annual income above $1 million purports to use cost-of-living-based bracket adjustments as a safeguard that will ensure only millionaires will pay. But historic income growth trends suggest that bracket creep will cause many non-millionaires to be subject to the surtax over time, according to this report, "The Great Mismatch: The graduated income tax proposal’s gravely flawed escalation factor."

The Graduated Income Tax Trap: A retirement tax on small business owners

This report finds that, if passed, a constitutional amendment to impose a graduated income tax would raid the retirement plans of Massachusetts residents by pushing their owners into higher tax brackets on the sales of homes and businesses. The study aims to help the public fully understand the impact of the proposed new tax.

Missing the Mark on Wealth Migration: Past Studies Drastically Undercounted Millionaires

Advocates of a constitutional amendment that would apply a 4 percent tax on all annual individual income over $1 million argue that similar taxes in other states have had little impact on the migration of millionaires, citing the research of Cornell University Associate Professor Cristobal Young, which suggests that “millionaires’ taxes” enacted in other states similar to the one being proposed in Massachusetts have had little impact on millionaire mobility. This paper demonstrates that he drastically undercounts millionaires, and outlines several ways in which he and tax advocates underestimate the number of people who will at some point in their lives be subject to a so-called millionaire’s tax and tax flight trends.

Public vs. Private Employment in Massachusetts: A Tale of Two Pandemics

This report finds that Massachusetts state government employment has been virtually flat during COVID-19 even as employment in the state’s private sector workforce remains nearly 10 percent below pre-pandemic levels, and questions whether it makes sense to shield public agencies from last year’s recession at the expense of taxpayers.

Lessons for Massachusetts from California’s “blank check” tax on high earners

Advocates claim a proposed 4 percent surtax on high earners will raise nearly $2 billion per year for education and transportation, but similar tax hikes in other states resulted in highly discretionary rather than targeted spending. That same result or worse is possible in Massachusetts because during the 2019 constitutional convention state legislators rejected — not just one, but two — proposed amendments requiring that the new revenues be directed to these purposes. After a 2012 tax hike in California aimed to increase education investments, the state legislature dedicated little more than the minimum required by law to education and redirected the majority of the funds to general government operations. The result was a soaring state payroll.

The Graduated Income Tax Amendment – A Shell Game?

This report shows that while supporters of a state constitutional amendment that would impose a 4 percent tax rate hike on annual income over $1 million claim additional revenue from the surtax will fund public education and transportation needs, the amendment in no way assures that there will be new spending on these priorities. In fact, without violating the amendment, total state education and transportation funding could stay the same or even fall.

How a 2012 income tax hike cost California billions of dollars in economic activity

This study finds that a 2012 income and sales tax increase in California, named “Proposition 30,” stifled business activity, accelerated out-migration among the wealthy, and ultimately reduced the state’s tax base. It also aims to share empirical data about the impact of tax policy decisions.

Barriers to Exit Lowered in High-Cost States as Pandemic-Related Technologies Changed Outlook

Both employers and households will find it easier to leave major job centers as technologies made commonplace by the COVID-19 pandemic have led to a rethinking of the geography of work.

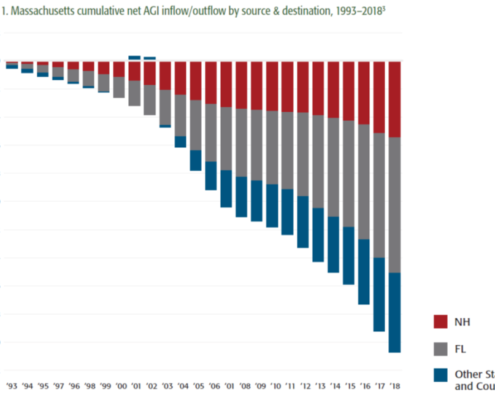

New Study Shows Significant Wealth Migration from Massachusetts to Florida, New Hampshire

Over the last 25 years, Massachusetts has consistently lost taxable income, especially to Florida and New Hampshire, via out-migration of the wealthy, according to a new Pioneer Institute study.

In “Do The Wealthy Migrate Away From High-Tax States? A Comparison of Adjusted Gross Income Changes in Massachusetts and Florida,” Pioneer Institute Research Director Greg Sullivan and Research Assistant Andrew Mikula draw on IRS data showing aggregate migration flows by amount of adjusted gross income (AGI). The data show a persistent trend of wealth leaving high-tax states for low-tax ones, especially in the Sun Belt.

Connecticut’s Dangerous Game: How the Nation’s Wealthiest State Scared Off Businesses and Worsened Its Fiscal Crisis

This report presents evidence that Connecticut’s embrace of an aggressive tax policy to pay for ballooning government expenditures — including a sharp corporate tax rate increase — has been a major driver in the loss of bedrock employers. Higher corporate tax rates, combined with hikes in the personal income tax and, especially, the estate tax, also appear to be a factor driving away a growing number of the state’s wealthiest residents.