MBTAAnalysis: A look inside the MBTA

0 Comments

/

The MBTA shuttles over a million passengers a day around Greater…

https://pioneerinstitute.org/wp-content/uploads/CloseupClock-1.jpg

739

1244

Mary Connaughton

https://pioneerinstitute.org/wp-content/uploads/logo_440x96.png

Mary Connaughton2017-02-20 12:34:192017-02-21 09:47:58The Clock is Ticking…….

https://pioneerinstitute.org/wp-content/uploads/CloseupClock-1.jpg

739

1244

Mary Connaughton

https://pioneerinstitute.org/wp-content/uploads/logo_440x96.png

Mary Connaughton2017-02-20 12:34:192017-02-21 09:47:58The Clock is Ticking…….

Greater Boston as a Global Competitor

This report finds that in order for Boston to become even more attractive to international companies and investors, Boston-area leaders must work to improve housing and healthcare affordability, transportation infrastructure, economic development policies, and education. Pioneer synthesized dozens of economic, lifestyle, and governance indicators into five categories of importance to Boston’s profile in the international competition for talent and investment.

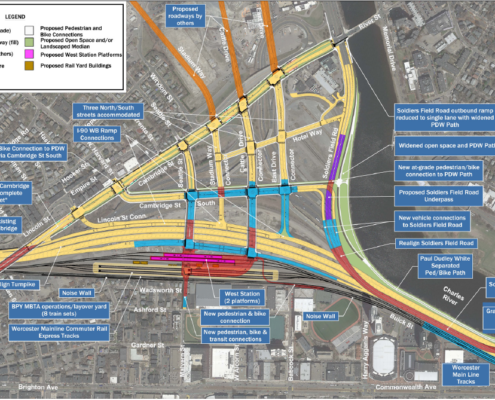

Public Comment on MassDOT’s I-90 Allston Multimodal Project National Environmental Policy Act Review Scoping Report

Pioneer Institute’s Public Comment calls on the Massachusetts Department of Transportation (MassDOT) to revise its Scoping Report on the I-90 Allston Multimodal Project and recommend an additional option to the Federal Highway Administration (FHWA). The Institute believes that closer analysis of an at-grade option may reveal that an at-grade design will shorten construction time, lower costs, create fewer negative economic and congestion impacts, and improve neighborhood access to parkland along the Charles River.

How Occupational Licensing Laws Reduce State and Local Tax Revenues: The Public Finance Case for Occupational Licensing Reform

This new report shows that overly burdensome occupational licensing requirements not only slow down the Massachusetts economy and cost the state tens of thousands of jobs, but also reduce state and local tax revenue.

The $8.5 Billion Marshall Plan for MBTA Needs

Going from much larger capital budgets to delivering the actual projects needed to repair and modernize the MBTA will require a “Marshall Plan” that includes improving T hiring practices and internal organization, as well as the strategic use of external resources.

The MBTAs Capital Spending Crisis

The Massachusetts Legislature must free the MBTA from overly restrictive procurement methods and the T must dramatically increase its project and contract management capacity if it is to reach aggressive capital spending targets aimed at upgrading the system and accommodating more riders.

The State of Zoning for Accessory Dwelling Units

A review of 100 cities and towns around (but not including) Boston finds that loosening local zoning laws to allow for the development of more accessory dwelling units (ADUs) would help ease the region’s housing shortage without creating any significant problems. This new study is published by Pioneer Institute in partnership with the Massachusetts Smart Growth Alliance.

Eight more responses to Professor Young—nine really

Pioneer's Greg Sullivan offers a rebuttal to Professor Cristobal Young's criticism of his recent report, "Eight Reasons to Question Professor Cristobal Young's Conclusions about Millionaire's".

Eight Reasons to Question Professor Cristobal Young’s Conclusions about Millionaires

The work of a Stanford University Professor whose research has formed the foundation of efforts, such as one scheduled to appear on the Massachusetts ballot in November, to impose surtaxes on high earners is flawed because it excludes the vast majority of millionaires, according to a new study published by Pioneer Institute.

Housing & Who’s a ‘Millionaire’ according to Proposition 80

The tax hike on those with annual taxable incomes of $1 million or more that would result from a proposed amendment to the state constitution scheduled to appear on the Commonwealth’s November ballot would likely ensnare an ever-increasing number of taxpayers because the index used to adjust the million-dollar threshold has historically grown at a far slower rate than the taxable income of Massachusetts taxpayers and increases in state home values.

Proposition 80 Will Not Raise $2 Billion and The Money Won’t Be Free

Passage of Proposition 80, the tax hike proposal scheduled to appear on the November 2018 Massachusetts ballot, will fail to generate the level of revenue growth projected by its backers.

Will The Wealthy Leave? They Already Are and Proposition 80 Will Only Make it Worse

Passage of Proposition 80, the tax hike proposal scheduled to…

The Federal Tax Reform Act’s cap on deductions of state income taxes has turned Proposition 80 into an economic time bomb for Massachusetts

This report finds that recent passage of the federal tax overhaul legislation will exacerbate the negative economic impact of Proposition 80, the proposed constitutional amendment scheduled to appear on Massachusetts’ November ballot that would add a 4 percent surtax on annual taxable income over $1 million.

Back to Taxachusetts? Lessons from Connecticut

This report urges proponents of a 2018 statewide ballot initiative that would add a surcharge on the state taxes of those earning over $1 million annually to look at the experience of Connecticut, where multiple rounds of tax hikes aimed at high earners triggered an exodus of large employers and high-earning individuals that resulted in declining tax revenue.

Economic Freedom of North America 2017

Economic Freedom of North America 2017 is the thirteenth edition of the Fraser Institute’s annual report. This year it measures the extent to which the policies of individual provinces and states were, in 2015, supportive of economic freedom, the ability of individuals to act in the economic sphere free of undue restrictions.

Back to Taxachusetts Series: Capital Gains

This report shows that if Massachusetts voters approve Proposition 80, scheduled to appear on the statewide ballot next year, Massachusetts’ top capital gains tax rate would go from 30th highest in the nation to fourth and the commonwealth’s highest combined state and federal rate would move from 25th to second.

Leveling the playing field: the need for taxi reform in the Commonwealth

In Leveling the playing field: the need for taxi reform in the Commonwealth, authors Matt Blackbourn and Gregory Sullivan describe some of the unfair and outdated regulatory restrictions that cab operators face, and offer recommendations for the ride-for-hire task force, to be established by new legislation.

Important Considerations for Regulating Ridesharing in Massachusetts

Legislation recently approved by the Massachusetts House to create a new Ride for Hire Division within the state Department of Public Utilities to regulate Transportation Network Companies like Uber, Lyft and Fasten includes a number of fair and sensible protections for TNC customers, but goes too far to protect the outdated system of taxi medallions controlled by government regulators.

A New Start for Massachusetts Middle Cities

This white paper calls for the creation of an Infrastructure Investment Fund that would use excess money drawn from the Massachusetts Convention Center Fund to jumpstart economic activity in parts of Massachusetts that have not benefited from Greater Boston’s boom, through a competitive process built around local reforms.

Ten Years Later: Trends in Urban Redevelopment

This report updates a 2006 study of 14 Massachusetts cities with populations of more than 40,000 and average per-capita annual incomes of below $25,000 (Pittsfield is the one city in the study in which per-capita income is greater than $25,000). It provides a report card on how these Middle Cities are faring a decade after our last analysis, in terms of economic development, financial administration, education, and public safety. The aim is to inform the current policy discourse on redevelopment strategies in these important cities to identify municipalities and policy approaches that may serve as models for all Middle Cities.

A Road to Financing

This manual was prepared as part of the Urban Business Alliance (UBA)- a unique initiative of Pioneer’s Center for Urban Entrepreneurship that helps low- and moderate-income entrepreneurs by bolstering the skills of the community-based business advisors they look to for assistance.

Rebuilding the Ladder to Self- Sufficiency: Workfare and Welfare Reform

The full implementation of welfare reform in Massachusetts required a waiver from the federal government. The commonwealth requested such a waiver to allow for the work requirement, time limits, job training, and the centralization of its public assistance system. The waiver was granted for all except time limits.

A Challenge to Economic Freedom: Declining Labor Participation

The fact is that the unemployment rate doesn't tell the whole story. Strictly defined as the percentage of the population who are out of work and actively seeking employment, this metric provides a very narrow lens through which to evaluate labor market performance. A look at labor participation rates — the labor force as a percentage of the civilian non-institutional population — helps paint a more accurate picture.

Regaining Massachusetts’ Edge in Research and Development

Massachusetts’ ranking among the states in overall R&D spending by industry rose from fifth to second between 1991 and 2006, but although it’s ranking improved, Massachusetts – and every other state – lost market share over that period to California, which had enacted much stronger tax incentives. In fact, the commonwealth’s market share of national R&D spending by industry actually declined between 1991 and 2011. Over that same period California increased its industrial R&D spending by more than its top seven competitor states combined, including Massachusetts.

Does Boston Convention & Exhibition Center Expansion Really Pay for Itself?

With the Massachusetts Convention Center Authority (MCCA) claiming that no new taxes or fees would be needed to expand the Boston Convention and Exhibition Center (BCEC), it came as no surprise that a $1 billion convention center expansion bill sailed through a November Joint Committee on State Administration hearing without opposition. But when something seems too good to be true, it usually is, and a closer look at the convention center legislation reveals that the "no new taxes or fees" claim isn't quite as airtight as they've led us to believe.

The Logic of Pension Valuation: A Response to Robert Novy-Marx

In a recently published article,1 Robert Novy-Marx identifies what he believes are inconsistencies in the valuation methods espoused by the Governmental Accounting Standards Board (GASB). He advocates that current GASB methodologies for determining the discount rate be replaced by what some academic economists call a “fair-value” or “risk-adjusted” rate of return.

Recovering from a Recession

Flash forward a decade and the US cycle starting in 2001 was 4 years; conversely, and ominously for the state, Massachusetts never returned to its February 2001 employment peak, as seen in Figure 1 B. It came close in March 2008, but again began losing jobs due to the latest recession. Nevertheless, if for the purposes of comparison we allow coming close to stand in for a return to peak employment, Massachusetts had a 7-year cycle sinking into and then coming out of the 2001 recession.

The Big Shrink: Declining Establishment Size in Massachusetts

The Big Shrink adds to our understanding by examining the shrinking size of Massachusetts' firms and the causes of this economy-wide phenomenon in order to determine whether the trend has systemic impacts on our economy and, therefore, one hopes, on policy formation. The paper finds that reduction in firm size is widespread, holding true for all industries and most establishment types.

Massachusetts’ New Economy

"Massachusetts’ New Economy" was presented by Jim Stergios in 2011.

Creating Jobs: Reforming Unemployment Insurance in Massachusetts

As states and nations aggressively promote their business climates, the high cost of doing business in Massachusetts requires ongoing remediation for the Commonwealth to sustain its competitive advantage.

Keeping Massachusetts Competitive

Massachusetts is a state with many economic and competitive strengths, but policymakers, elected officials, and business leaders must not ignore its weaknesses. Massachusetts offers compelling advantages to companies looking to expand businesses or start new ones, but other states are chipping away at the state's advantages in this area.