MBTAAnalysis: A look inside the MBTA

0 Comments

/

The MBTA shuttles over a million passengers a day around Greater…

https://pioneerinstitute.org/wp-content/uploads/CloseupClock-1.jpg

739

1244

Mary Connaughton

https://pioneerinstitute.org/wp-content/uploads/logo_440x96.png

Mary Connaughton2017-02-20 12:34:192017-02-21 09:47:58The Clock is Ticking…….

https://pioneerinstitute.org/wp-content/uploads/CloseupClock-1.jpg

739

1244

Mary Connaughton

https://pioneerinstitute.org/wp-content/uploads/logo_440x96.png

Mary Connaughton2017-02-20 12:34:192017-02-21 09:47:58The Clock is Ticking…….

Are Massachusetts taxes regressive? A common argument for a graduated income tax relies on a deeply flawed and outdated study

Advocates of the proposed surtax paint a picture of the Massachusetts tax system as highly regressive. They fail to mention that ITEP, the organization that produced the data upon which they rely, rated Massachusetts as having a more progressive tax system than 29 other states. ITEP fails to adequately explain their model’s treatment of the tax incidence of sales, excise, and property taxes, and they exclude a number of other aspects of the tax code that make it seem artificially regressive.

The Big Lure: Interstate Competition Exacerbates the Economic Fallout from Telecommuting Trends

This report finds that a spate of new incentive and subsidy programs seeking to lure talented workers and innovative businesses away from their home states could constitute an additional challenge to Massachusetts’ economic and fiscal recovery from COVID-19.

Statement before the MA Joint Committee on Revenue in Opposition to HB 86 (Pages 1-4) A legislative amendment to the Constitution to provide resources for education and transportation through an additional tax on incomes in excess of one million dollars.

Pioneer Institute's Jim Stergios submitted public testimony highlighting Pioneer’s very serious concerns about how the proposed graduated income tax amendment to the Massachusetts State Constitution would have a detrimental impact on the state’s economy as it begins to recover from the COVID-19 pandemic.

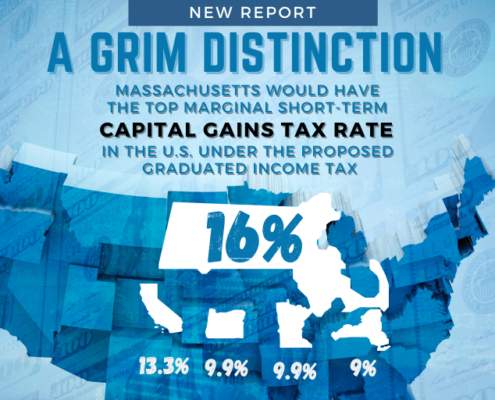

A Grim Distinction: Massachusetts would have top marginal short-term capital gains tax rate in the U.S. under the proposed graduated income tax

This report finds that, under a graduated income tax, Massachusetts’ top marginal short-term capital gains tax rate would be the highest in the nation, exacerbating a tax and regulatory environment that has made it hard for day traders and other investors to contribute to Massachusetts’ economy. By imposing a 4 percent income on all annual income over $1 million, including capital gains, the graduated income tax would penalize the capital formation that is the key to long-term growth and higher living standards for all in the Commonwealth.

The Graduated Income Tax Trap: A Tax on Small Businesses

This policy brief finds that the state constitutional amendment promoted by the Massachusetts Teachers Association and the Service Employees International Union to add a 4 percent surtax to all annual income above $1 million will adversely impact a significant number of pass-through businesses, ultimately slowing the Commonwealth’s economic recovery from COVID-19.

The Great Mismatch: The graduated income tax proposal’s gravely flawed escalation factor

The state constitutional amendment proposed by the Service Employees International Union and the Massachusetts Teachers Association to add a 4 percent surtax to all annual income above $1 million purports to use cost-of-living-based bracket adjustments as a safeguard that will ensure only millionaires will pay. But historic income growth trends suggest that bracket creep will cause many non-millionaires to be subject to the surtax over time, according to this report, "The Great Mismatch: The graduated income tax proposal’s gravely flawed escalation factor."

The Graduated Income Tax Trap: A retirement tax on small business owners

This report finds that, if passed, a constitutional amendment to impose a graduated income tax would raid the retirement plans of Massachusetts residents by pushing their owners into higher tax brackets on the sales of homes and businesses. The study aims to help the public fully understand the impact of the proposed new tax.

Missing the Mark on Wealth Migration: Past Studies Drastically Undercounted Millionaires

Advocates of a constitutional amendment that would apply a 4 percent tax on all annual individual income over $1 million argue that similar taxes in other states have had little impact on the migration of millionaires, citing the research of Cornell University Associate Professor Cristobal Young, which suggests that “millionaires’ taxes” enacted in other states similar to the one being proposed in Massachusetts have had little impact on millionaire mobility. This paper demonstrates that he drastically undercounts millionaires, and outlines several ways in which he and tax advocates underestimate the number of people who will at some point in their lives be subject to a so-called millionaire’s tax and tax flight trends.

Public vs. Private Employment in Massachusetts: A Tale of Two Pandemics

This report finds that Massachusetts state government employment has been virtually flat during COVID-19 even as employment in the state’s private sector workforce remains nearly 10 percent below pre-pandemic levels, and questions whether it makes sense to shield public agencies from last year’s recession at the expense of taxpayers.

Lessons for Massachusetts from California’s “blank check” tax on high earners

Advocates claim a proposed 4 percent surtax on high earners will raise nearly $2 billion per year for education and transportation, but similar tax hikes in other states resulted in highly discretionary rather than targeted spending. That same result or worse is possible in Massachusetts because during the 2019 constitutional convention state legislators rejected — not just one, but two — proposed amendments requiring that the new revenues be directed to these purposes. After a 2012 tax hike in California aimed to increase education investments, the state legislature dedicated little more than the minimum required by law to education and redirected the majority of the funds to general government operations. The result was a soaring state payroll.

The Graduated Income Tax Amendment – A Shell Game?

This report shows that while supporters of a state constitutional amendment that would impose a 4 percent tax rate hike on annual income over $1 million claim additional revenue from the surtax will fund public education and transportation needs, the amendment in no way assures that there will be new spending on these priorities. In fact, without violating the amendment, total state education and transportation funding could stay the same or even fall.

How a 2012 income tax hike cost California billions of dollars in economic activity

This study finds that a 2012 income and sales tax increase in California, named “Proposition 30,” stifled business activity, accelerated out-migration among the wealthy, and ultimately reduced the state’s tax base. It also aims to share empirical data about the impact of tax policy decisions.

Barriers to Exit Lowered in High-Cost States as Pandemic-Related Technologies Changed Outlook

Both employers and households will find it easier to leave major job centers as technologies made commonplace by the COVID-19 pandemic have led to a rethinking of the geography of work.

Do The Wealthy Migrate Away From High-Tax States? A Comparison of Adjusted Gross Income Changes in Massachusetts and Florida

Massachusetts had a net outflow of $20.7 billion in adjusted gross income (AGI) between 1993 and 2018. The biggest beneficiaries of the wealth that fled the Commonwealth were Florida, which captured 47.5 percent of it, and New Hampshire, which captured 26.1 percent. Between 2012 and 2018, Florida saw a net AGI inflow of $88.9 billion. Affluent taxpayers are responsible for an outsized proportion of state tax revenue. The data also show a strong correlation between state taxes and migration. States like Florida and New Hampshire that have no state income tax have seen a net inflow of AGI from higher-tax states like Massachusetts.

Connecticut’s Dangerous Game: How the Nation’s Wealthiest State Scared Off Businesses and Worsened Its Fiscal Crisis

This report presents evidence that Connecticut’s embrace of an aggressive tax policy to pay for ballooning government expenditures — including a sharp corporate tax rate increase — has been a major driver in the loss of bedrock employers. Higher corporate tax rates, combined with hikes in the personal income tax and, especially, the estate tax, also appear to be a factor driving away a growing number of the state’s wealthiest residents.

A Snapshot of Massachusetts’ Construction Industry during a Decade-long Building Boom

In “A Snapshot of Massachusetts’ Construction industry during a Decade-long Building Boom,” data from 1998 through 2018 show variations in employment and the number of businesses within the construction industry throughout Massachusetts. The report even includes a map of employment concentration in the construction industry by town.

A Checklist for How to Revitalize the Industries Hit Hardest by COVID-19

This checklist combines the recommendations of studies published earlier this year offering recommendations for policy makers, organized in three sections: Immediate Relief, Tax Policy Changes and Permanent Reforms. Business owner recommendations are split into COVID-19 Health and Safety Protocols, Expanded Services and Steps to Improve Cash Flow.

Before COVID-19, the Hospitality & Food Industry was a Service Sector Economic Powerhouse

A new report from Pioneer Institute, “Before COVID-19, the Hospitality & Food Industry was a Service Sector Economic Powerhouse,” draws data from the MassEconomix web tool to analyze Hospitality and Food Industry employment across the state. Data spanning two decades from 1998 through 2018 show fluctuations in employment, firm size, and the share of businesses within the Hospitality and Food Industry throughout Massachusetts. The report shows a map of employment concentration in the Hospitality and Food Industry by town.

Economic Revitalization and Reinvention in Lowell, 1998-2018

In “Economic Revitalization and Reinvention in Lowell, 1998-2018,”…

Broad Industry Sector Trends in Massachusetts, 1998-2018: A MassEconomix Report

Service-based industries have significantly outperformed manufacturing and other traditional blue-collar economic sectors in Massachusetts since 2008, according to a new report from Pioneer Institute that draws on data from the MassEconomix web tool.

The Long View: A Public Policy Roadmap for Saving Small Businesses During the COVID-19 Recovery Period

As the initial economic recovery from the COVID-19 pandemic has slowed, a new study from Pioneer Institute finds that governments must continue to provide short-term relief to stabilize small businesses as they simultaneously consider longer-term reforms to hasten and bolster recovery – all while facing a need to shore up public sector revenues.

Public Policy Guide for Economic Recovery from COVID-19 in the Retail and Hospitality Sectors

This new guide to economic recovery in the retail and hospitality industries published by Pioneer Institute calls for the federal and state governments to consider consumption-based refundable tax credits for brick and mortar businesses; the federal government to conduct a detailed study of the costs and benefits of suspending employer-side payroll taxes; businesses to pay special attention to developing and marketing their cleanliness, hygiene and contactless procedures; and third-party customer review sites to include comments about the implementation of COVID safety measures to provide options and reassurance to safety-minded consumers.

As the COVID-19 Pandemic Spurs Consumer Shift to E-Commerce, the Massachusetts Sales Tax Collection System Deserves Renewed Scrutiny

At a time when state tax revenues are plummeting, a plan to modernize sales tax collection could get money into state coffers more quickly. This report analyzes the merits of a two-part proposal Governor Baker included in his January state budget submission to streamline state sales tax collections. Sullivan and Mikula find that the first part of Baker’s plan makes sense and is entirely feasible because advances in electronic data processing and electronic funds transfer have eliminated the need for protracted remittance timetables.

Going Up: The Challenge of Reopening Shared Office Buildings in a COVID-19 World

This report finds that safely bringing employees back into workplaces presents a significant challenge for employers located in office buildings, particularly when it comes to elevator operations and building entry and exit. To address the challenge, managers must develop plans to control the flow of workers.

Telecommuting Survey Reveals Potential for Greater Shift Towards Remote Work After COVID-19 Pandemic

Citing an avoidance of the commute and more flexible scheduling, nearly 63 percent of respondents to Pioneer Institute’s survey, “Will You Commute To Work When The COVID-19 Crisis Is Over?” expressed a preference to work from home one day a week, and a plurality preferred two to three days a week, even after a COVID-19 vaccine is available.

Understaffing at Long-Term Care Facilities Is Not Unique to the Holyoke Soldiers’ Home. It’s Embedded in Federal Standards.

This study shows that standards enforced at the federal and state levels are insufficient to address chronic staffing issues reported by staff and residents’ families at the Holyoke Soldiers’ Home, making that facility particularly vulnerable to the COVID-19 pandemic.

COVID-19 will likely lead to a recession. Can Massachusetts municipal budgets handle one?

Using municipalities' experiences during the Great Recession, a new policy brief examines the likely impact of COVID-19 on local property taxes, as well as political implications for state aid. We list the municipal revenues by category among the least tax-reliant communities in MA, show the trajectory of tax revenue growth rate in Massachusetts state and local governments, and rank stabilization fund assets per capita among Massachusetts Gateway Cities.

Case Studies on Re-Opening National Economies, and What to Expect in the U.S. and Massachusetts

Based on case studies from Europe, Massachusetts’ strategy for beginning to emerge from the COVID-19 pandemic may include allowing businesses to open in phases and extending social distancing guidelines that include mask-wearing and maintaining distances between individuals. This report compares the reopening approaches of three European countries – Austria, Denmark, and Germany – to highlight approaches that could inform the Commonwealth’s reopening strategy.

A Look at the Massachusetts Industries that are Most Vulnerable Due to COVID-19

A new report using recent data provided by the Massachusetts Executive Office of Labor and Workforce Development shows that hospitality, retail trade, healthcare and social assistance, and construction are the industries that have suffered the most unemployment as a result of the coronavirus outbreak.

Unprecedented Massachusetts unemployment projections set the stage for a state budget crisis

The COVID-19 recession could cause Massachusetts’ unemployment rate to skyrocket to 25.4 percent by this June, according to a new policy brief published by Pioneer Institute. The Commonwealth’s unemployment rate was 2.5 percent in February.