MBTAAnalysis: A look inside the MBTA

0 Comments

/

The MBTA shuttles over a million passengers a day around Greater…

https://pioneerinstitute.org/wp-content/uploads/CloseupClock-1.jpg

739

1244

Mary Connaughton

https://pioneerinstitute.org/wp-content/uploads/logo_440x96.png

Mary Connaughton2017-02-20 12:34:192017-02-21 09:47:58The Clock is Ticking…….

https://pioneerinstitute.org/wp-content/uploads/CloseupClock-1.jpg

739

1244

Mary Connaughton

https://pioneerinstitute.org/wp-content/uploads/logo_440x96.png

Mary Connaughton2017-02-20 12:34:192017-02-21 09:47:58The Clock is Ticking…….

Milton Shuts the Door

on Multifamily Housing Plans

The MBTA Communities Act, passed in 2021, provides that the 177 communities serviced by the MBTA must create multifamily zones to spur housing development close to public transportation. But the issue is an emotionally charged one, with passions high on both sides. And Milton residents in February rejected a plan to create such housing ‚ choosing a loss of some state funding over an approximately 25 percent increase in their housing stock, along with the possibility of greater congestion.

on Multifamily Housing Plans

Pioneer Statement on Continuing Slide in Massachusetts’ Revenue

The Commonwealth’s tax collections continue to slide, totaling $3.594 billion in January, $268 million below what the state collected in January 2023, and short of the revised benchmark by $263 million. Massachusetts state government must live within its means by reducing FY2025 spending. The days of fiscal surpluses, unprecedented increases in year-over-year spending, and flowing federal aid have come to an end.

Pioneer Statement on Decline in State Revenues

The Commonwealth’s finances have stumbled hard in recent months, and based on a report the Department of Revenue (DOR) sent to the Legislature in January, the trend shows no signs of easing. Massachusetts needs a renewed emphasis on fiscal discipline and pro-growth policies to make the state economically competitive again.

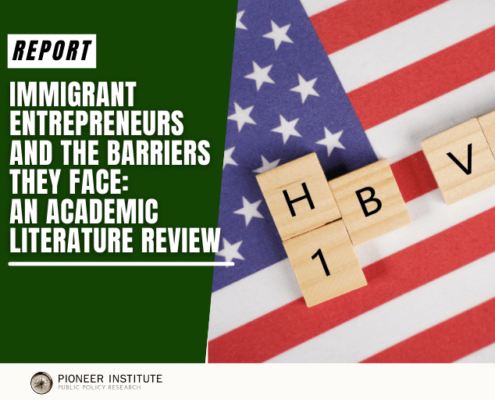

Skill-based immigration could ease labor shortage

A recent Biden administration executive order that amends the Schedule A list, which identifies occupations experiencing labor shortages and allows immigrants in those occupations to expedite their employment in the U.S., could positively impact the hiring of skilled international workers for years to come — a welcome development as the country and Massachusetts struggle to attract talent amidst a worsening labor shortage.

My Musings on Massachusetts’ Fiscal Picture

Since the start of FY2024 on July 1, 2023, the state has experienced six straight months of revenues falling short of expectations. The single biggest factor is the unprecedented growth of the state budget since FY2021. The $15 billion increase in state spending contextualizes the seemingly modest projected revenue growth of 1.6 percent for FY2024 by highlighting that the base is very inflated.

The Massachusetts Workforce: Abundant Resources, Steep Challenges

Massachusetts features a strong workforce training system with abundant resources yet faces challenges in matching jobs and applicants, training youth, and attracting sufficient numbers of skilled immigrants, according to a pair of studies from Pioneer Institute.

New Report Explores Impact of Welfare Benefit Cliffs

In “Benefit Cliffs: A Literature Review on Welfare Structures as a Disincentive to Work,” Pioneer researcher Aidan Enright examines the extent to which complicated federal and state requirements related to welfare programs can provide a disincentive to employment or to working additional hours.

Pioneer Institute Statement on the State Legislature’s FY2024 Tax Relief Package

The recent advancement of a tax bill H. 4104, that is expected to be enacted by the Legislature this week after languishing for more than 20 months, puts Massachusetts taxpayers one step closer to realizing some tax relief. However, it may be too little to tackle the Commonwealth’s affordability and competitiveness challenges.

Senate Tax Package Misses the Mark on Competitiveness

The Senate tax package, S.2397, is heavy on provisions that reduce the tax burden for certain taxpayers, thereby helping those that qualify for the expanded credits and deductions. The bill, however, is light on provisions that will improve the Commonwealth’s competitiveness.

Study: Immigrant Entrepreneurs Benefit N.E. Economy, Despite Facing Obstacles to Growth

BOSTON – Immigrants in Massachusetts and New England are more likely to be self-employed, but the businesses they own tend to be in different industries than those owned by the U.S. born, according to a new study published by Pioneer Institute.

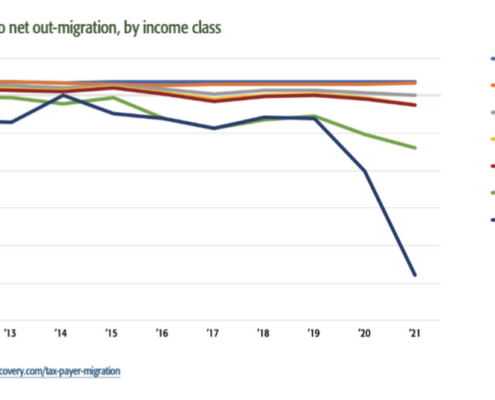

Study: Net Out-Migration of Wealth from Massachusetts Nearly Quintupled from 2012-2021

IRS data reveals that net out-migration from Massachusetts is accelerating rapidly and is greatest among affluent residents who pay the most in state taxes, according to a Pioneer Institute analysis. Between 2019 and 2021, Massachusetts rose from ninth to fourth among all states in net out-migration of wealth, behind only California, New York, and Illinois.

Study Finds Massachusetts Workforce Has Become More Female, Older, More Diverse

The Massachusetts labor force has transformed in recent decades, with some of the biggest changes being the advancement of women, workers getting older and more diverse, and a divergence in labor force participation rates based on levels of educational achievement, according to “At a Glance: The Massachusetts Labor Force,” a white paper written by Pioneer's Economic Research Associate Aidan Enright.

Public Statement on the House’s Proposed Tax Reform and Budget

Pioneer Institute applauds key tax reform provisions advanced by the Speaker and House leadership, including a reduced short-term capital gains tax rate and implementation of a single sales factor apportionment. But leadership must do more to bolster the state’s economic competitiveness and slow out-migration of wealth and business owners that endangers the commonwealth’s economic future.

Debunking Migration Myths, Part 2

As Pioneer Institute's Aidan Enright explains in a new policy brief, the Bay State's tax policies are driving out-migration. With high-income earners heading for states such as New Hampshire and Florida that have no income tax, Massachusetts could see a loss of $4.36B in total reported income.

Debunking Tax Migration Myths

Provisions of Gov. Healey’s $876 million tax package targeted to higher-income earners — including revisions to the estate tax and a reduction in the tax rate for short-term capital gains — are important for encouraging taxpayers subject to them to remain in Massachusetts, according to a new analysis from Pioneer Institute.

Gov. Healey’s Tax Plan: Not Enough on Competitiveness

In an effort to deliver "an affordable, equitable and competitive tax structure for Massachusetts," Governor Maura Healey on Feb. 28 unveiled her tax package. While her proposal makes significant strides in addressing affordability and indirectly improves equity, it does little to address the issues of competitiveness.

Immigrant Entrepreneurs and the Barriers They Face: An Academic Literature Review

Immigrants have started a quarter of all businesses in Massachusetts despite making up just 17 percent of the state workforce, and those establishments appear to be more innovative than those founded by native-born Americans. Despite these contributions, shrinking federal visa caps and red tape are among the factors making it more difficult for immigrants to come to the U.S.

What We Do and Don’t Know about Online Platform Rideshare/Delivery Workers in Massachusetts

After Massachusetts’ Supreme Judicial Court declared an initiative that was to appear on the November ballot unconstitutional, the issue of how to classify app-based rideshare/delivery workers is back in the hands of the state Legislature. A new study published by Pioneer Institute distills from the research literature eight questions legislators must answer before determining how to address this fast-growing industry.

Book Reveals How Tax Hike Amendment Would Damage Commonwealth’s Economic Competitiveness

If adopted, a constitutional amendment to hike state taxes that will appear on the ballot in November could erase the hard-earned progress Massachusetts has achieved toward economic competitiveness over the last 25 years and may not result in any additional education and transportation funding, according to a new book from Pioneer Institute, entitled Back to Taxachusetts?: How the proposed tax amendment would upend one of the nation’s best economies, which is a distillation of two dozen academic studies.

The MBTA’s Automated Fare Collection Modernization Contract: Over-Budget And Behind Schedule, But Now Back On Track

This new study unearths previously unseen communications between the MBTA and its contractors, showing that the MBTA’s efforts to modernize its fare collection system, including allowing payments with credit cards and bringing “tap and go” technology to Commuter Rail and ferry lines, was riddled with technological challenges and difficulties overseeing contractors as early as 2019, culminating in a 3-year delay to the project’s full implementation. The report also highlights key insights regarding the MBTA’s administrative capacity and hiring efforts needed to oversee the project’s implementation.

A Vision for Sustainable, Transit-oriented Development

In this public comment, Pioneer Institute examines the Massachusetts Department of Housing and Community Development's guidelines on how localities can comply with new zoning mandates around MBTA stations. While some of the compliance criteria and goal-setting language need further clarification and adjustment, overall Pioneer Institute is supportive of the vision for sustainable, transit-oriented development which, if properly implemented, will expand economic opportunity to a new generation of the state's residents.

Why the Legislature would likely use the proposed tax amendment as a blank check

This report shows that the plaintiffs in Anderson v. Healey have good reason to demand a more accurate description of the graduated income tax amendment. Experience from other states and the actions of the Massachusetts Legislature demonstrate that voters should be given a more realistic picture of how the revenue is likely to be spent before going to the polls in November.

Bus Rapid Transit: Costs and Benefits of a Transit Alternative

Bus rapid transit (BRT) incorporates unique features such as dedicated lanes to provide reliable and cost-effective service while reducing congestion and its detrimental environmental impacts.

The MBTA’s Looming Bus and Green Line Fare Evasion Crisis

This report warns that the MBTA will likely face a fare evasion crisis when it transitions to all-door boarding on buses, the Green Line, and the Mattapan trolley in 2023. General Manager Steve Poftak and MBTA staff have signaled the potential for a $25–30 million spike in fare evasion costs when the new AFC 2.0 system is implemented unless the MBTA institutes meaningful, enforceable penalties for fare evaders. In this report, Pioneer Institute makes recommendations for managing the AFC 2.0 contract and related fare evasion procedures going forward.

The Great Understatement: Far more taxpayers and businesses than previously estimated will be affected by the proposed surtax

This report finds that analyses from the Massachusetts Department of Revenue (MADOR, 2016) (and more recently, Tufts University’s Center for State Policy Analysis (2022)) dramatically underestimated the number of households and businesses impacted by the constitutionally-imposed tax hike that the legislature is putting before voters in November 2022. The proposed tax would impact multiples of the number of people previously estimated, over a nine-year period, since the majority of “millionaires” only earn $1 million once during that time.

The Far-Reaching Impact of a Massachusetts Surtax: Anecdotal Evidence and Data Analysis

This report shows that a proposed graduated income tax that will appear on the statewide ballot in November 2022 will have much more far-reaching implications than most people realize because the surtax also extends to “pass-through” income from entities such as S and limited liability corporations, partnerships, and sole proprietorships that are taxed on individual tax returns.

A Timely Tax Cut: How New Hampshire is Taking Advantage of Massachusetts’ Graduated Income Tax Proposal

As Massachusetts voters weigh an amendment to the state constitution to enact a surtax on million-dollar earners, they should be cognizant of how the policies of other states could interact with the tax hike to encourage an exodus of jobs and capital, especially in proximate jurisdictions. New Hampshire is a neighboring state that has already benefited from out-migration from Massachusetts to the tune of over $426 million in taxable income in 2019 alone. A new budget amendment there, passed in July 2021, will eliminate the interest and dividends tax by 2027, contributing to a divergence in tax policy that might attract an increasingly mobile workforce and entrepreneurial base.

The SALT Cap: An Accelerator for Tax Flight from Massachusetts

After the authors of the proposed graduated tax in Massachusetts submitted their proposal for legislative approval in 2017, the federal government placed a $10,000 limitation of deductibility of state and local taxes on federal tax returns. This unforeseen change in the federal tax code had the effect of turning what would have been a 58 percent increase in average state income tax payments among Massachusetts millionaires, from $160,786 to $254,355, into what is essentially a 147 percent increase when the federal SALT limitation is included in the calculation. This substantial change should be taken into consideration by voters when they contemplate approving the surtax proposal.

PILOT Agreements: Nonprofits’ Fair Portion or Government Extortion?

A new white paper by Pioneer Institute calls for increased transparency over the basis for payment in lieu of taxes (“PILOT”) agreements between municipal governments and nonprofit organizations, while also encouraging nonprofits to publicize and expand the community benefits they provide.

Tax Flight of the Wealthy: An Academic Literature Review

A new literature review by Pioneer Institute shows that many existing academic studies find that wealthy individuals are particularly sensitive to changes in tax policy. Other studies explicitly warn policymakers that behavioral responses to taxing the rich could erode the tax base and ultimately strain state budgets. The Pioneer Institute study ties the results of these academic pieces into Massachusetts’ current graduated income tax proposal.