MBTAAnalysis: A look inside the MBTA

0 Comments

/

The MBTA shuttles over a million passengers a day around Greater…

https://pioneerinstitute.org/wp-content/uploads/CloseupClock-1.jpg

739

1244

Mary Connaughton

https://pioneerinstitute.org/wp-content/uploads/logo_440x96.png

Mary Connaughton2017-02-20 12:34:192017-02-21 09:47:58The Clock is Ticking…….

https://pioneerinstitute.org/wp-content/uploads/CloseupClock-1.jpg

739

1244

Mary Connaughton

https://pioneerinstitute.org/wp-content/uploads/logo_440x96.png

Mary Connaughton2017-02-20 12:34:192017-02-21 09:47:58The Clock is Ticking…….

Supply Chains Understood: Covid’s Global Demand Stress Test

https://www.podtrac.com/pts/redirect.mp3/chtbl.com/track/G45992/feeds.soundcloud.com/stream/1148317750-pioneerinstitute-hubwonk-ep-78-supply-chains-understood-covids-global-demand-stress-test.mp3

This…

Trevor Mattos Shows How Massachusetts Runs on Immigrants

This week on JobMakers, Host Denzil Mohammed talks with Trevor Mattos, research manager at Boston Indicators, the research center at The Boston Foundation, which educates state and local leaders on the important contributions immigrants are making. They discuss the urgency of this work, particularly in a time of divisive disinformation about immigrants and the uncertainty of the pandemic, and some of the surprising findings on the disproportionately large impact immigrant workers, entrepreneurs and innovators are having on the local economy

Public Statement on Implementation of the Charitable Giving Deduction

Despite being awash in cash, the state Legislature just overrode Gov. Charlie Baker’s veto of a provision to delay by yet another year a tax deduction for charitable donations. Rep. Mark Cusack, House chair of the Joint Committee on Revenue, said “it doesn’t mean no, just not now.” If not now, when?

Employment trends in the Greater Boston Area and Touristy Massachusetts Counties during the COVID-19 Pandemic

Using MassEconomix, Pioneer Institute’s database on employment…

Ely Kaplansky Goes from Immigrant to Inc. 5000 Insurance Entrepreneur

This week on JobMakers, host Denzil Mohammed talks with Ely Kaplansky, President & CEO of Kaplansky Insurance. Since 1974, Ely has created hundreds of jobs in Massachusetts and beyond, with 85 employees in 15 offices across the state today, and he has grown his business during the pandemic, such that Kaplansky Insurance was named to Inc. magazine’s "5000 Fastest-Growing Private Companies in America" list. His success fulfilled the dreams of his parents when they moved from Israel to America in 1955, with just the clothes on their backs and an aunt to take them in. Their journey began in the concentration camps of Germany, and Ely’s story is all about the opportunity and freedom America offers.

Umesh Bhuju Seeks a Fair Deal for Immigrants, Farmers & the Environment

This week on JobMakers, Host Denzil Mohammed talks with Umesh Bhuju, owner of Zumi’s Espresso in Ipswich, Massachusetts, about how a business model based on selling nothing but fair-trade products can thrive in a world driven by profit. He describes his early experiences in his homeland of Nepal, where he witnessed child labor, and how that has shaped his pursuit of the American dream.

COVID-19 and Unemployment Rates in the Cape and Islands

The COVID-19 pandemic has had a large impact on unemployment…

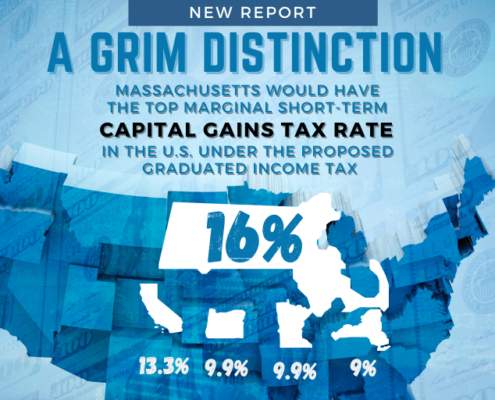

This Is No Time for a Tax Increase

This is no time to threaten Massachusetts’ prospects for an immediate economic recovery and the long-term competitiveness of the Commonwealth’s businesses. As Massachusetts lawmakers prepare to vote on whether to send a proposed constitutional amendment that would impose a 4 percent surtax on residents who earn $1 million or more in a year to the statewide ballot in 2022, Pioneer Institute urges them to recognize that tax policy sizably impacts business and job location decisions and that jobs are more mobile than ever.

Putting in the Extra Hours: The Spike in Mass. Department of Public Health Overtime Pay during COVID-19

During the heat of the COVID-19 pandemic, Massachusetts Department of Public Health (DPH) payroll data presented a 29.09% increase in the average employee’s overtime pay from the previous year. Pioneer wanted to dig deeper into the Department’s compensation trends to put the $5M bump in 2020 DPH overtime pay into perspective.

Jitka Borowick on Starting a Small Business during COVID

This week on JobMakers, Guest Host Jo Napolitano talks with Jitka Borowick, Founder & CEO of Cleangreen, a cleaning service committed to environmentally-friendly practices, and Nove Yoga, launched during COVID. Jitka grew up under communism in the Czech Republic. Determined to learn English, she made her way to the U.S., initially with plans to stay for only one year - but ended up making it her home. Jitka shares the difficulties of learning another language and culture, her pathway to entrepreneurship, her courageous decision to open a new business during a pandemic, and how her companies have successfully adapted to the challenges so many small businesses have encountered over the past year.

Mahmud Jafri Builds on a Pakistani Legacy in America

This week on JobMakers, Host Denzil Mohammed talks with Mahmud Jafri, who built on a legacy started by his grandfather and began importing hand-knitted rugs from his native Pakistan, creating opportunities especially for women who traditionally couldn’t work outside the home. Today, he has three Dover Rug & Home stores across Massachusetts, including the Back Bay.

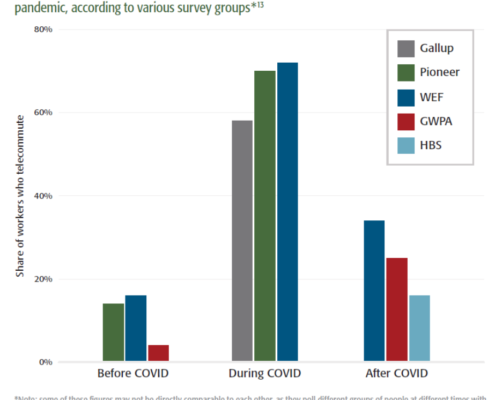

Study Says Interstate Tax Competition, Relocation Subsidies Exacerbate Telecommuting Trends

A spate of new incentive and subsidy programs seeking to lure talented workers and innovative businesses away from their home states could constitute an additional challenge to Massachusetts’ economic and fiscal recovery from COVID-19, according to a new study published by Pioneer Institute.

Study Warns Massachusetts Tax Proposal Would Deter Investment, Stifling the “Innovation Economy”

A state constitutional amendment promoted by the Massachusetts Teachers Association and the Service Employees International Union adding a 4 percent surtax to all annual income above $1 million could devastate innovative startups dependent on Boston’s financial services industry for funding, ultimately hampering the region’s recovery from the COVID-19 economic recession, according to a new study published by Pioneer Institute.

Study Shows the Adverse Effects of Graduated Income Tax Proposal on Small Businesses

The state constitutional amendment promoted by the Massachusetts Teachers Association and the Service Employees International Union to add a 4 percent surtax to all annual income above $1 million will adversely impact a significant number of pass-through businesses, ultimately slowing the Commonwealth’s economic recovery from COVID-19, according to a new study published by Pioneer Institute.

New Study Warns Graduated Income Tax Will Harm Many Massachusetts Retirees

If passed, a constitutional amendment to impose a graduated income tax would raid the retirement plans of Massachusetts residents by pushing their owners into higher tax brackets on the sales of homes and businesses, according to a new study published by Pioneer Institute. The study, entitled “The Graduated Income Tax Trap: A retirement tax on small business owners,” aims to help the public fully understand the impact of the proposed new tax.

Study: Graduated Income Tax Proponents Rely on Analyses That Exclude the Vast Majority Of “Millionaires” to Argue Their Case

Advocates for a state constitutional amendment that would apply a 4 percent surtax to households with annual earnings of more than $1 million rely heavily on the assumption that these proposed taxes will have little impact on the mobility of high earners. They cite analyses by Cornell University Associate Professor Cristobal Young, which exclude the vast majority of millionaires, according to a new study published by Pioneer Institute.

Report Contrasts State Government and Private Sector Employment Changes During Pandemic

Massachusetts state government employment has been virtually flat during COVID-19 even as employment in the state’s private sector workforce remains nearly 10 percent below pre-pandemic levels, according to a new study published by Pioneer Institute. The study, “Public vs. Private Employment in Massachusetts: A Tale of Two Pandemics,” questions whether it makes sense to shield public agencies from last year’s recession at the expense of taxpayers.

Wealth Migration Trends: Remote Work Technology Empowers Workers to Live Anywhere

Host Joe Selvaggi talks with Pioneer Institute’s Andrew Mikula about his recent research into migration trends of high-income individuals, how pandemic-related technologies may accelerate that movement, and what challenges these changes present for policy makers.

New Study Finds Pandemic-Spurred Technologies Lowered Barriers to Exit in High-Cost States

Both employers and households will find it easier to leave major job centers as technologies made commonplace by the COVID-19 pandemic have led to a rethinking of the geography of work, according to a new study published by Pioneer Institute.

Interstate Legal Skirmish: New Hampshire Takes Massachusetts Telecommuter Tax to the Supreme Court

Host Joe Selvaggi talks with legal scholar and George Mason University Law Professor Ilya Somin about the details, the merits, and the likely implications of the Supreme Court case, New Hampshire v. Massachusetts, on state taxation power, federalism, and the power to vote with one’s feet.

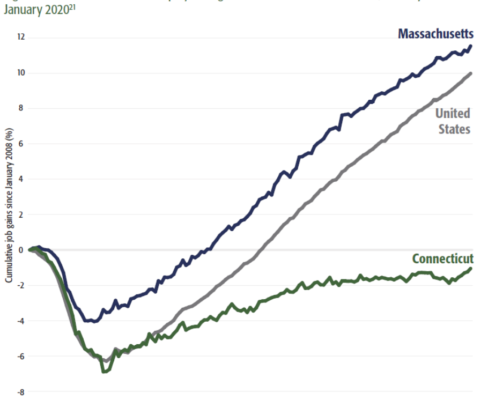

Connecticut’s Painful Journey: Wealth Squandered, Lessons Learned, Promise Explored

Host Joe Selvaggi talks with Connecticut Business and Industry Association’s President and CEO, Chris DiPentima, about what policy makers can learn from Connecticut’s journey from the wealthiest state in the nation, to one with more than a decade of negative job growth.

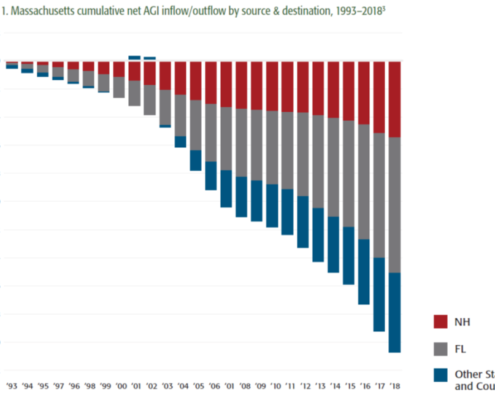

New Study Shows Significant Wealth Migration from Massachusetts to Florida, New Hampshire

Over the last 25 years, Massachusetts has consistently lost taxable income, especially to Florida and New Hampshire, via out-migration of the wealthy, according to a new Pioneer Institute study.

In “Do The Wealthy Migrate Away From High-Tax States? A Comparison of Adjusted Gross Income Changes in Massachusetts and Florida,” Pioneer Institute Research Director Greg Sullivan and Research Assistant Andrew Mikula draw on IRS data showing aggregate migration flows by amount of adjusted gross income (AGI). The data show a persistent trend of wealth leaving high-tax states for low-tax ones, especially in the Sun Belt.

Intrepid Restauranteurs Endure: Passion for Community, Patrons, and Staff Mean Failure is Not on the Menu

Host Joe Selvaggi talks with Massachusetts Restaurant Association President and CEO Bob Luz about the devastating effects of the pandemic and lockdowns on restaurants. They discuss the industry's creative strategy for survival, plans for reaching beyond the crisis, and the many positive improvements for this vital sector that employs 10% of the workforce in the commonwealth.

California Tax Experiment: Policy Makers Receive Valuable Economics Lesson

Host Joe Selvaggi talks with Stanford University Economics Professor Joshua Rauh about his research on the reaction of Californians to a tax increase, from his report, “The Behavioral Response to State Income Taxation of High Earners, Evidence from California.” Prof. Rauh shares how his research offers tax policy makers insight into the likely effects of similar increases in their own states, including here in Massachusetts.

New Study Finds Tax Policy Drives Connecticut’s Ongoing Fiscal & Economic Crisis

Multiple rounds of tax increases aimed at high earners and corporations triggered an exodus from Connecticut of large employers and wealthy individuals, according to a new study published by Pioneer Institute.

Unemployment Insurance Rescue: Employer Advocate Seeks Relief to Catalyze Pandemic Recovery

Joe Selvaggi talks with John Regan, President and CEO of Associated Industries of Massachusetts, about the impact of higher UI rates on employers and what legislators can do to help mitigate the pain.

Pioneer Report Spotlights Decade-long Building Boom in Massachusetts Construction Industry

In the lead-up to the COVID-19 crisis, the Massachusetts construction industry enjoyed a boom in select subsectors, though employment numbers had yet to recover from the setbacks of the Great Recession, according to a new report from Pioneer Institute that draws data from the MassEconomix web tool.

Pioneer Checklist Includes Steps for Policy Makers, Business Owners to Revitalize Hardest-Hit Industries

Combining the recommendations of studies published earlier this year, Pioneer Institute has released “A Checklist for How to Revitalize the Industries Hit Hardest by COVID-19.” The recommendations for policy makers are organized in three sections: Immediate Relief, Tax Policy Changes and Permanent Reforms. Business owner recommendations are split into COVID-19 Health and Safety Protocols, Expanded Services and Steps to Improve Cash Flow.

Pioneer Report Highlights Pre-Pandemic Employment Growth in Massachusetts’ Hospitality & Food Industry

In the lead-up to the COVID-19 crisis, the Massachusetts Hospitality and Food Industry enjoyed generally positive employment growth, according to a new report from Pioneer Institute that draws data from the MassEconomix web tool. Most of the Hospitality and Food Industry employment across the state is concentrated in full-service restaurants and hotels.

Targeted government help for small business is needed

Covid-19 will frame economic policy discussions for years to come, just as the Great Recession did a decade ago. The economic impact of the pandemic includes widespread job losses, and millions of Americans are at risk of falling into poverty. Covid-19 is also accelerating pre-existing market trends – such as automation and online shopping – and their potentially devastating impact on the thousands of small businesses vulnerable to these market shifts. Will these businesses be able to adapt?