Telecommuting Tax Credit Stands to Help Public Transportation

Governor Baker recently proposed a telecommuting tax credit that would incentivize businesses to allow employees to work from home. The program is a part of a bill that would create a $2,000-per-employee tax credit, capped at $50 million annually, awarded to businesses that allow working from home as a way to reduce the number of cars on the road. The Governor hopes the program will reduce congestion and cut commuting times. According to U.S. Census Bureau data, Massachusetts ranks 20th in the country in the percentage of full-time telecommuters, with 4.7% of the workforce working from home. The tax credit is part of the Governor’s $18 billion long-term transportation spending plan.

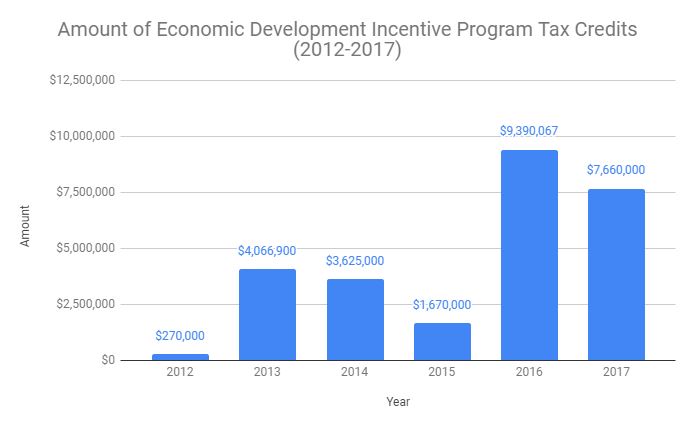

The telecommuter tax credit would presumably be part of the Economic Development Incentive Program (EDIP) that provides discretionary tax credits to companies that commit to retaining and/or creating full-time jobs. The increased tax credit would follow recent trends as, according to Pioneer Institute’s Massopenbooks.org, the amount of EDIP tax credits grew by 135% between 2012-2014 and 2015-2017. The credits aim to promote economic development while reducing the stress on Boston’s transportation network.

While the bill does not explicitly say it, another goal of the tax credit is to alleviate demand on the struggling public transportation network. According to Pioneer Institute’s MBTAAnalysis.com, ridership on the MBTA’s heavy rail system, which includes the continually delayed and underperforming Red and Blue Lines, increased by 14.2% between 2007 and 2017 and has seriously strained the aging system. The plan would increase the MBTA’s existing $8B capital plan by $2.7 billion to facilitate more rapid improvements.

The Governor’s bill is an acknowledgement of the many transportation issues Massachusetts faces. While providing funding to improve the infrastructure commuters rely on, the bill also incentivizes working from home in order to reduce ever-worsening congestion and improve MBTA service.

As an aside, Pioneer is pleased to report that the concept of a remote workers tax credit program was presented in Pioneer’s 2015 Agenda for Leadership.

Harris Foulkes is a Roger Perry Transparency Intern at Pioneer Institute and a rising sophomore at Amherst College studying Economics.