Municipalities of Massachusetts with the Highest Debt Service Expenditure

In the public sector, debt service refers to both repayments and interest paid “on long term obligations of public debtors and long-term private obligations guaranteed by a public entity.” In Massachusetts, debt service expenditures differ among municipalities based on the characteristics of the locality, including size and budget.

According to Pioneer Institute’s MassAnalysis tool, in 2019 the five municipalities with the highest debt service expenditures (in dollars) were Boston, Worcester, Cambridge, Peabody, and Lowell (respectively). In 2019, Boston spent the most ($182,470,769) on debt service (Figure 1), representing 5% of its operating budget. In the same year, Worcester spent $90,753,444, or 12% of its operating budget on debt service. Cambridge spent $68,410,826, representing 10% of its budget. Peabody spent $52,270,825 on debt service, a whopping 29% of its operating budget. Finally, Lowell spent $36,906,976, or 9% of its budget, on debt service that year.

Figure 1. Municipalities of Massachusetts with the highest expenditures on debt service (in dollars).

All five of these municipalities are either urban or “semi-urban,” including major regional urban centers, metro core communities, and subregional urban centers. Long-term accumulated debt, payments to retirement plans for employees, and maintaining aging infrastructure may leave a city in debt, on which the municipality must make payments from its operating budget. Additionally, legacy costs (“company costs associated with health care fees and other benefits for its current employees and retired pensioners”) account for a large percentage of most cities’ budgets, and this percentage is growing. More money allocated toward legacy costs leaves less to pay for other expenses, leaving cities with more debt. This phenomenon describes why these urban and semi-urban centers spent more on debt service in 2019: because they had more debt. However, this problem may be worse in other U.S. cities, as Boston tends to have comparatively low legacy cost.

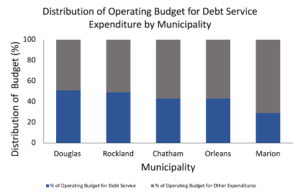

In 2019, the five Massachusetts municipalities with the highest debt service as a percentage of operating budgets were Douglas, Rockland, Chatham, Orleans, and Marion, respectively. In 2019, 51% of the total budget went to debt service in Douglas (Figure 2), and the town spent $17,145,899 on debt service. Rockland spent 49% of its total budget on debt service that year, a total of $35,384,674. Both Chatham and Orleans allocated 43% of their total budgets to debt service in 2019. Chatham spent $21,789,107 on debt service and Orleans spent $18,071,602. These municipalities may allocate more of their budgets toward debt service because of new debt associated with wastewater treatment plans in parts of Cape Cod, including Orleans and Chatham. Marion spent 29% of its total budget toward debt service in 2019, but that only amounted to $8,768,444.

Figure 2. Massachusetts municipalities spending the largest portions of their operating budgets on debt service.

Per capita debt service expenditures also differ by municipality. Those with the highest per capita expenditure on debt service in 2019 were Rowe, Orleans, Chatham, Bolton, and Stockbridge, respectively.

Figure 3. Massachusetts municipalities with the highest per capita expenditures on debt service.

Rowe spent an average of $1,655 per capita on debt service in 2019 (Figure 3). In Cape Cod, Orleans spent $1,199 per capita on debt service, and it was $1,120 in Chatham. Perhaps per capita debt service expenditures appear to be higher in these parts of Cape Cod because the data is skewed in these municipalities due to the small number of year-round residents. Bolton spent $963 per capita on debt service, and Stockbridge had an average expenditure of $808.

Since the most current data on debt service is from 2019, it will be interesting to see how debt service expenditures may have changed as a result of COVID-19 and the pandemic’s economic impact.

About the Author: Emily Donovan is a Roger Perry Government Transparency Intern at Pioneer Institute for the summer of 2021. She is a rising senior studying Animal Behavior at Bucknell University.