Massachusetts is Losing Thousands of Taxpayers a Year. Where Are They Going?

In the past several years, Massachusetts has been experiencing a decline in population. In 2022, alone, Massachusetts lost a net 26,326 taxpayers (fourth highest in the country) to other U.S. states. This has led to staggering losses in adjusted gross income (AGI) for the state. According to the IRS, AGI is “total income minus deductions, or ‘adjustments’ to income that you are eligible to take,” which “includes dividends, capital gains, business and retirement income.” The net AGI loss for Massachusetts in fiscal 2022 was $3.87 billion. There is a clear pattern of taxpayers fleeing Massachusetts, but where are they going?

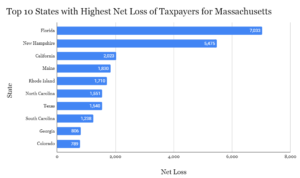

According to Mass IRS Data Discovery, Massachusetts’ largest net loss was to Florida, a no income tax state. In 2022, Massachusetts lost a net of 7,033 taxpayers to the Sunshine State, largely explained by Florida ranking as the most desirable state to retire in. New Hampshire served as a close second, as Massachusetts lost a net 5,475 taxpayers to their neighbor to the north. A large part of this may be attributed to its close proximity to Massachusetts and having no state income taxes and lower cost of living. A 2017 study showed that 15.3 percent of New Hampshire’s commuting labor force traveled to Massachusetts for work. New Hampshire serves as a convenient location for individuals who are satisfied with their job in Massachusetts, but not the high cost that comes with living in the state. California ranks third, falling significantly below Florida and New Hampshire, as Massachusetts lost a net 2,033 taxpayers to the state in 2022.

Data Retrieved from Mass IRS Data Discovery

Mass IRS Data Discovery makes it apparent that a large portion of migration from Massachusetts is to counties in other states that contain major economic hubs. The largest outflow of taxpayers from Massachusetts to California was to Los Angeles County, San Diego County, San Francisco County and Santa Clara County, all home to major cities. There was also major migration to most New York City boroughs (each borough is a county), Austin, TX, Providence, RI, and Chicago, IL. This is not an exhaustive list, but emphasizes a pattern of Massachusetts taxpayers migrating to urban localities in other states.

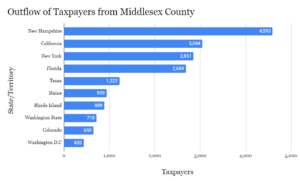

All counties in Massachusetts have faced some level of net taxpayer migration to other states, but Middlesex County has seen the biggest net loss, at 5,493 taxpayers. In terms of outflow from the county, an overwhelming majority went to New Hampshire and California, followed closely by Florida and New York, which are states that attract the most Massachusetts taxpayers. The chart below depicts total outflow of taxpayers from Middlesex County.

Data retrieved from Mass IRS Data Discovery.

It is clear that many Massachusetts residents find several other states more desirable. To combat the loss, Massachusetts must adopt policies that reduce taxes and the overall cost of living.

Dana DiChiro is a Roger Perry Government Transparency Intern at the Pioneer Institute for Summer 2024. She is a rising senior studying Government & Politics and Economics at the University of Maryland, College Park.