Massachusetts is in the middle of a budget crisis. So why is it still subsidizing out-of-state horse owners?

In 2021, the Massachusetts legislature will consider raising taxes on corporations and wealthy individuals to finance social services in the Commonwealth during a challenging budget season. Proponents claim such an approach is necessary to avoid cuts to crucial services like healthcare and education.

Meanwhile, there are a number of state government programs that defy sound fiscal sense. Unlike raising taxes on the wealthy, it’s often politically difficult to cut these programs because a small group of people depend on the subsidies they provide for their livelihoods, paid for by the rest of the populace.

Take the horse breeding industry as an example. A recent update to MassOpenBooks.org, a government transparency data tool operated by Pioneer Institute, shows that Massachusetts has spent over $80 million subsidizing race horse owners since 2014 via the Race Horse Development Fund. The fund, established in 2011 to try and save a dying industry, received a large influx of money at around the time Plainridge Park Casino opened in Plainville. Race horse owners have lamented competition from other forms of gambling for decades, and at Plainridge the Commonwealth granted them 9 percent of gross gaming revenues in mitigation. The Race Horse Development Fund went on to weather a round of budget cuts in 2017 unscathed. That same budget cycle, state lawmakers cut funding for a program providing shelter to homeless children, Medicaid and, ironically, a gambling addiction rehab initiative.

Get our MassWatch updates!

More recently, similar programs in other states have come under fire for their wastefulness. Pennsylvania Governor Tom Wolf proposed a $200 million cut from that state’s Horse Racing Development Fund in April after it became clear that the pandemic would create state budget woes. Prior to this decision, the Horse Racing Development Fund received more annual revenue than the Pennsylvania Department of Agriculture or the Department of Health.

While Massachusetts doesn’t have as pervasive a horse breeding subsidy as Pennsylvania, cutting funds for the Race Horse Development Fund and similar special interest programs should certainly take priority over enacting additional taxes, which could wind up harming an already fragile economy. Instead, Massachusetts could use the fund’s money to help supplement its General Fund or, better yet, redirect the money to local government aid, which has historically been vulnerable to budget cuts during recessions.

Moreover, eliminating the Race Horse Development Fund could rival implementing the proposed millionaire’s tax in progressivity. The Fund has drawn ire in the past for being used chiefly to pay wealthy horse owners their winnings from races. Consider also that most of the state Race Horse Development Fund’s money comes from Plainridge Park Casino tax revenues, and low-income people tend to spend more of their income on gambling than the wealthy do.

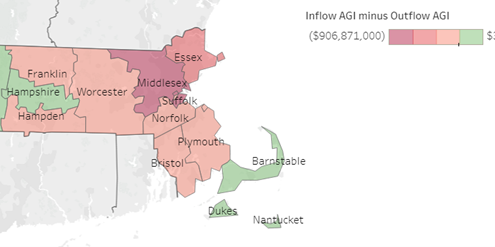

It’s also highly likely that most of the Race Horse Development Fund’s beneficiaries don’t even live in Massachusetts. The Standardbred Owners of Massachusetts, the organization that administers Plainridge Park’s $1.8 million Sire Stakes, has 67 members as of 2017, of which only 30 are Massachusetts residents. Meanwhile, 30 percent of the Race Horse Development Fund is earmarked for thoroughbred breeders, despite the fact that the last thoroughbred racing track in New England is now slated to become a massive real estate development.

All of that said, even eliminating the Race Horse Development Fund entirely would barely make a dent in the state’s projected $2-8 billion budget deficit for Fiscal Year 2021. The Massachusetts Legislature undeniably is facing some painful decisions in the near future. If raising more revenue is truly a necessity going into Fiscal Year 2021, the millionaire’s tax, despite being unsustainable and likely counterproductive, starts to look more appealing. But before lawmakers make these tough decisions, they should make an easy one: stop earmarking taxpayer money for tiny special interest groups with a negligible impact on the state economy.

See what other special interest groups and corporate vendors are getting state money at MassOpenBooks.org.

Andrew Mikula is a Research Assistant at the Pioneer Institute. Research areas of particular interest to Mr. Mikula include land use issues, the cost of living, and tax and regulatory structures. Mr. Mikula was previously the Lovett & Ruth Peters Economic Opportunity Fellow at the Institute. He has a B.A. in economics from Bates College.

Read More: