Happy Thanksgiving from Pioneer Institute!

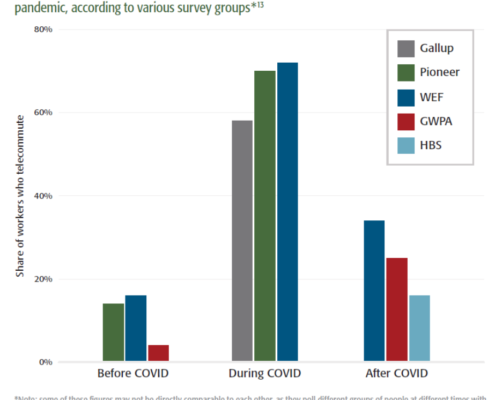

As we welcome the holiday season, I would like to thank you for everything you do with and for Pioneer. We are grateful for your support today and everyday. We are grateful for a nation that has shown incredible resilience in recovering from a global pandemic. For innovation in the life sciences to develop and distribute vaccines. For learning pods, homeschooling, and private and parochial models that have kept our kids engaged, whether in-person or remote. For telehealth and regulatory changes to give patients greater access to medical care. For the MBTA’s commitment to infrastructure investments to improve service for the Bay State’s one million commuters. Lastly, for a business community that has overcome the challenge of extended closures, is now contending with unprecedented labor and supply shortages – and will soon face the threat of a ballot measure that could impose a major state tax increase. With your continued support, Pioneer will remain active on these issues and many more.

As we gather with family and friends this Thanksgiving, I want to encourage our community to be part of bringing our country back together, one dinner table at a time. Let’s remember that political conversations are not taboo, only those long on anger and short on policy substance. Let’s be grateful for the opportunity to be with loved ones, for all we have—and, most of all, for our freedoms.

Happy Thanksgiving,

Jim Stergios, Executive Director

PS – Giving Tuesday is around the corner. If you’d like to get a jump on making your end of year donation, you can do so here!

Recent Posts: