Financial Disclosures – As Important Now as Ever

NPR, The Wall Street Journal, The New York Times, and several other news outlets have reported that certain senators sold stocks just before the market crashed when the economic impact of Coronavirus came to light. Among them is North Carolina Senator Richard Burr.

The Wall Street Journal wrote:

Mr. Burr, chairman of the Senate Intelligence Committee, which has been receiving frequent briefings on the spread of Covid-19 since it emerged in China, made 33 stock trades on Feb. 13 worth between $628,000 and $1.7 million, according to the filings.

Mr. Burr, who is regarded as the Senate’s leading authority on pandemics as the author of the 2006 Pandemic and All-Hazards Preparedness Act, is also on the Senate health committee, which was briefed on the coronavirus on Jan. 24.

Newspaper accounts said while the senator was publicly downplaying the threat of the virus, privately he was warning others of the risks. There have been demands for a full investigation.

This story demonstrates why policymakers’ financial disclosures must be accessible to the media and to the public to ensure that our leaders are acting in the public interest, not their own interest. Such disclosures should be easy to access and anonymously obtained. At the state level, ease of access can vary widely.

Pioneer Institute has ranked each state on financial disclosure transparency. How does your state stack up?

See our video on Financial Disclosures below:

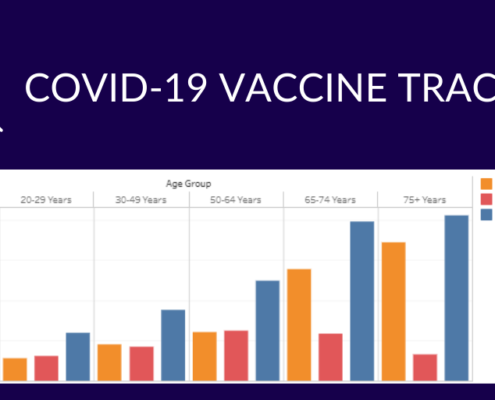

Get Our COVID-19 News, Tips & Resources!

Read Our COVID-19 News & Resources: