A List of the Top Pension Earners in 2018

The Massachusetts’ Teachers Retirement System and the Massachusetts State Employees’ Retirement System provided approximately $2.99 and $2.22 billion in benefits, respectively, for a total of $5.21 billion in 2018. According to Pioneer Institute’s MassOpenBooks, a government transparency tool that provides data on the Commonwealth’s retirement systems, these benefits went to 64,734 retirees in the Massachusetts’ Teachers Retirement System (MTRS) and 59,423 in the Massachusetts State Employees’ Retirement System (MSERS). MassOpenBooks users can sort general characteristics such as by year, employer, and/or individual. In 2018, the average MSERS retiree received $37,310 in pension benefits, but a large number of retirees were paid much more.

Source: MassOpenBooks

Not surprisingly, 5 out of the top 12 beneficiaries were employed by the University of Massachusetts Medical School. But what is remarkable is the fact that 5 of the remaining top 12 earners were from other parts of the UMass system. This means 85.5 percent of the benefits paid to the top 12 retirees went to former UMass employees. Of the top 100 pension earners, 58 percent are former employees of UMass, who account for 60 percent of the benefits provided to the 100. To understand these numbers in context, it is important to note that UMass retirees accounted for only 6.65 percent of retirees receiving benefits from the state system in 2018. In other words, UMass employees may make up a disproportionately high percentage of the top pension earners.

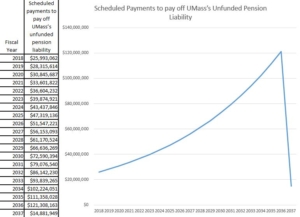

In 2018, UMass pensions accounted for $30.2 million of the benefits paid by the Commonwealth. Unfortunately, that amount only tells part of the story. As of 2018, the Commonwealth of Massachusetts has accrued $420.2 million in unfunded pension liability to UMass employees. The Commonwealth has proposed a plan to pay off the liability by 2037. However, even with strict adherence to the scheduled payments, the plan will result in Massachusetts taxpayers paying a total of $1.2 billion dollars by 2037. Moreover, the schedule is clearly backend loading the payments. As reported by the Pioneer Institute, the Commonwealth has been pushing off payments with each new funding schedule they have released. The current plan calls for more than 70 percent of the liability to be paid off between 2027 and 2036.

In light of the huge unfunded liability, it is more important than ever to scrutinize the government’s approach to pensions. There is an important question of what programs must be cut to pay off the current pension liability and future pensions. Additionally, what departments these diverted resources are assigned to must be viewed with a critical eye for disproportionate allotment. State leaders need to think long and hard about why they are promising benefits the Commonwealth clearly can’t afford. Instead of developing innovative solutions, they appear content to simply push the problem off on their successors.

Ana Rijal is a Wellesley Freedom Project intern for Pioneer Institute. She is a rising junior studying Psychology and Philosophy.