Accountability for casino revenue targets needs to be “in the cards”

Co-authored by Andrew Mikula and Greg Sullivan

Everett’s Encore Boston Harbor has entered its third quarter of business with two pieces of good news. First, there has been renewed interest in the construction of a footbridge connecting the Orange Line to the shimmering resort casino, a major step towards improving accessibility and reducing traffic congestion in the vicinity. Second, USA Today named Encore as one of the best casinos outside of Las Vegas.

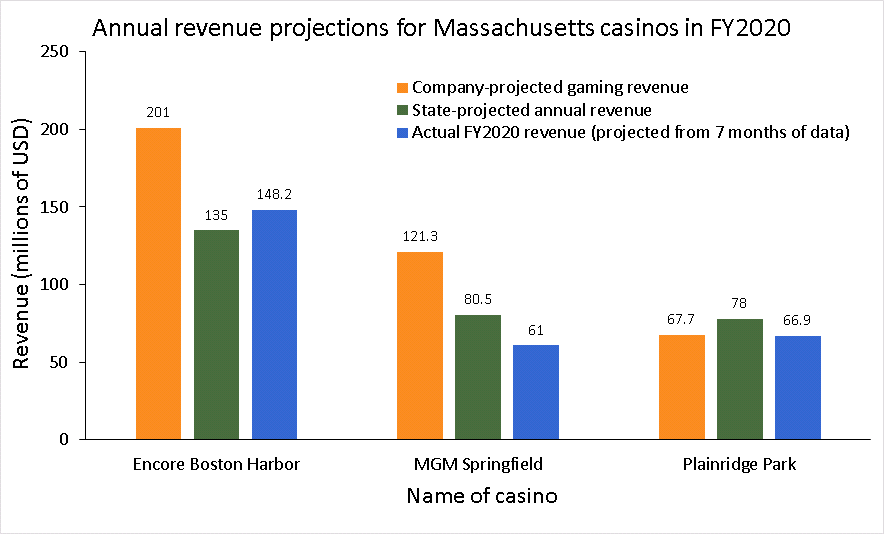

But there is also some bad news. The most recent Massachusetts Gaming Commission revenue report indicates that state revenue from Encore Boston Harbor will fall far short of the $201 million that the casino owner projected for fiscal year 2020 when it was vying for a Massachusetts casino license. If the income trend of the first seven months of FY2020 continues, the casino stands to pay $148.2 million in taxes to the Commonwealth, $52.8 million less than had been projected by Encore Boston for FY2020.

Thankfully, state leaders did not rely on Encore’s optimistic revenue projections when they formulated the Commonwealth’s FY2020 consensus revenue estimate (upon which the state budget is based). After MGM Springfield – the state’s first resort casino – vastly underperformed their own initial revenue projections last year, state officials operated under the assumption of just $135 million in revenue from Encore. Thus, if Encore’s revenue trend continues over the last two quarters of this fiscal year, the Commonwealth will receive $13.2 million more in state revenues than projected in the FY2020 consensus revenue estimate.

While state officials seem to have learned their lesson about relying on corporate promises to build a tax base, state coffers are still feeling the effects of revenue shortfalls at MGM Springfield and Plainridge Park, both of which underperformed against FY2020 state estimates over the first two quarters. For Plainridge, the state revenue estimate relies on $78 million, but if the current revenue trend continues, the Commonwealth will receive $66.9 million, or $11.1 million less. Meanwhile, MGM Springfield’s projected revenue shortfall for FY2020 ($19.5 million) is almost double that of Plainridge Park. Even with the state’s dose of pragmatism from the Encore estimate, the Commonwealth’s coffers are projected to be some $17.4 million short this fiscal year based on casino revenue through January 2020.

Large corporations looking to expand gambling operations into the Bay State have little incentive to give realistic revenue projections to bureaucrats, but state consultants’ estimates for casino profits also tend to be too optimistic. In 2014, HLT Advisory, a consultant for the Massachusetts Gaming Commission, projected that the Commonwealth would collect between $106.2 million and $145.2 million in gaming taxes from Plainridge Park during its first full year of operation. State revenues amounted to only $78.4 million that year. More accurate was HLT’s estimate for long-term revenue potential at Plainridge Park after the Boston-area and Springfield-area casinos were in full operation. Plainridge Park is projected to produce $66.9 million in state tax revenue in FY2020 if current trends continue, right in the middle of the $62.9 to $70.1 million range predicted by the consultant under a moderate pricing scenario.

If trends of the first seven months of FY2020 continue through the next five, the Commonwealth is projected to receive $276.1 million from the three casinos. This amounts to $113.9 million less than the casino owners had projected during the casino licensing competition, but only $17.4 million less than projected in the FY2020 consensus revenue estimate.

Figure 1. Comparison of Casino owners’ tax revenue projections, consensus revenue estimates, and current projection for FY2020 (in millions of USD)

| Name of Casino | Casino owner’s projection | FY2020 Consensus revenue estimate | Current projection | Difference between Casino owner’s projection and current projection | Difference between FY2020 Consensus revenue estimate and current projection |

| Encore Boston Harbor | $201.0 | $135.0 | $148.2 | $52.8 | -$13.2 |

| MGM Springfield | $121.3 | $80.5 | $61.0 | $60.3 | $19.5 |

| Plainridge Park | $67.7 | $78.0 | $66.9 | $0.8 | $11.1 |

| TOTAL | $390.0 | $293.5 | $276.1 | $113.9 | $17.4 |

Figure 2: Tax revenue projections for Massachusetts casinos in FY2020(*) (**)

*MGM Springfield’s company projection is based on the 2nd full year of operation, or September 2019 – August 2020, not FY2020

**Plainridge Park’s company projection is based on an estimate disclosed by the Massachusetts Gaming Commission as part of a public records request initiated by Pioneer Institute. The source material is not readily available online

While Encore is currently on pace to outperform the Commonwealth’s consensus revenue estimate, state leaders should be cognizant of the fact that new casinos tend to exhibit a “honeymoon” effect in terms of customer spending. In fact, the largest monthly tax volumes accrued by the state from MGM Springfield and Plainridge Park both came in the businesses’ first full month of operation.

The bottom line of this overestimation of casinos’ economic value is that the state is receiving less tax money than projected to go towards several needy programs. For example, at MGM Springfield and Encore Boston Harbor, 20 percent of state tax revenue from gross gaming revenue goes towards local aid; at Plainridge Park, the corresponding figure is 82 percent. While casinos still have no shortage of opponents in Massachusetts, underwhelming profits for MGM and Encore also mean fewer tax dollars for vital services, as tax revenues from casinos are also earmarked for education, transportation infrastructure, and – less importantly – the state Race Horse Development Fund.

Still, the financial structure of Massachusetts’ gambling industry is not yet fully formed. At one point in 2019, the Commonwealth was poised to become just the second state after Tennessee to legalize sports betting, but discussions of the issue in the legislature have since stalled.

Some observers have proposed holding casinos accountable for their misleading revenue projections by levying flat taxes. Under this system, gambling businesses would be required to pay at least a certain amount in taxes every year, and additional casino revenue beyond that initial amount would be taxed at a lower rate. Besides the benefits of a more accountable gambling industry, this approach would also help stabilize tax revenues during recessions.

Andrew Mikula is the Lovett & Ruth Peters Economic Opportunity Fellow at the Pioneer Institute. Research areas of particular interest to Mr. Mikula include urban issues, affordability, and regulatory structures. Mr. Mikula was previously a Roger Perry Government Transparency Intern at the Institute and studied economics at Bates College.

Gregory W. Sullivan is the Research Director at the Pioneer Institute, overseeing the divisions PioneerPublic and PioneerOpportunity. He also previously served as Inspector General of the Commonwealth of Massachusetts for 10 years and in the Massachusetts House of Representatives for 17 years. Mr. Sullivan has a Master’s degree in public administration from the Kennedy School at Harvard University and a second Master’s degree concentrating in finance from the Sloan School at MIT.