A Primer on Secondary Revenue Sources for Local Governments

Using Pioneer Institute’s MassAnalysis tool, one can find information on how municipal governments raise revenue to fund services. A majority of revenue comes from local taxes – mostly property taxes – but a significant portion comes from transfers from the state and from other governments. On top of taxes and transfers, local governments also finance spending using various fees and fines. While the different types of fees and fines might sound similar, their social and economic merits can vary widely.

Service charges (also known as user fees) are payments the public makes to government to use a public service. One example would be paying $10 to swim in a public pool or visit a public park. Economists tend to like this form of revenue, because the people who pay for the service are the beneficiaries of the service. These service charges are often considered a “benefits tax.” On the other hand, some critics have pointed out that user fees are often regressive—a $10 charge to swim in a public pool is much more burdensome for a low-income family. Furthermore, some argue that services often financed with user fees should be available free of charge. On the whole, however, service charges are considered an economically efficient revenue source.

Licensing fees and permits are fees government charges citizens before they can engage in a certain behavior. Local governments often charge businesses such as entertainment businesses, retail operations, and alcohol vendors licensing fees before they can operate. Local governments also charge fees for permits; before making significant renovations to a structure, someone must pay a permit fee. Similarly, governments often charge fees for inspections. For example, a restaurant might have to pay $100 for a health inspection.

In theory, these fees should only be high enough to cover the administrative cost of the licensing or permitting process. However, local governments often charge much more than the administrative cost to raise extra revenue for general services. This is a mistake; local-level business fees and regulations can significantly reduce economic activity and employment by creating unnecessary barriers to entry. As such, licensing fees are a flawed revenue source.

Fines and Forfeitures are money collected from citizens for breaking laws. That can range from something as trivial as a speeding ticket or a fine for fishing without a license, to seizing millions in assets from a drug deal. The latter practice has come under heavy scrutiny from both sides of the aisle in the past few years. Civil asset forfeiture means law enforcement can seize property if they suspect its involvement in a crime, with little regard for property rights or the innocence or guilt of the property owner. Massachusetts requires the lowest burden of proof of any state for law enforcement seizure of property, and the US Supreme Court recently dealt a constitutional blow to civil asset forfeiture policies.

Meanwhile, undermining property rights is an economic wrong as well as a legal and moral one. While civil asset forfeiture is flawed on all fronts, there is a place for fines. For example, traffic tickets have been shown to reduce the number of car accidents. In that way, fines can work like Pigouvian taxes, or taxes that disincentivize socially harmful behavior. That said, fines tend to be a regressive revenue source, and it’s almost impossible to structure them so higher-income people pay fines proportionate to their income, which would serve as both a deterrent to bad social behavior and arguably be more equitable and efficient. High fines are also unpopular, and can help spur frustration with government and social unrest.

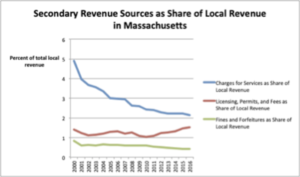

Over the past two decades, local governments in Massachusetts have changed their reliance on these secondary revenue sources. Since 2000, municipal governments have gone from raising an average of 5 percent of revenue using service charges to barely over 2 percent in 2016. On the other hand, licensing and permit fee revenue has risen from roughly 1 percent of local revenue to more than 1.5 percent since 2009. And fines and forfeitures’ share of local government revenue is half of what it was in 2000.

Source: MassAnalysis