Massachusetts’s Debt and Liability in 2023

Funding public projects through the issuance of debt has significant impacts on governments and underlying economies. Government bonds can fund much-needed infrastructure but can also present a sword of Damocles as they come due. This delicate balance between funding and risk is especially apparent at the national level, where debt surpassed $35 trillion for the first time in 2024.

However, local and state governments also have debt, and Massachusetts’ total liability for primary state government (including debt, pension liability, and more) totaled $120 billion in fiscal year 2023 (FY23) according to the state Comptroller’s annual comprehensive financial report (ACFR).

Debt and GDP

With $120 billion in liabilities in FY23, Massachusetts’ debt equates to 16 percent of its $733 billion gross domestic product (GDP). To put that percentage into perspective, countries are considered at higher risk of the economic downsides of debt when the debt to GDP ratio exceeds 60 percent. It’s important to note that state debt is not counted in the US national debt (123 percent of GDP).

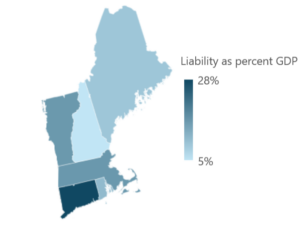

When compared to other New England states, Massachusetts’ debt is not out of line. While it does have the highest total liability by far – Connecticut, which has the second largest liability, has $94 billion – the Commonwealth’s liability as a percentage of GDP is close to the 15 percent average for New England. Its high total liability is offset by a GDP five times greater than any other New England State except Connecticut.

Figure 1. Liabilities as percentage of total GDP. GDP taken from US Bureau of Economic Analysis. Total liabilities taken from primary government net statement from 2023 Annual Comprehensive Financial Reports (ACFR) from MA, CT, NH, VT, ME, and RI.

Liability Growth and Inflation

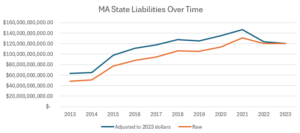

Pre-pandemic Massachusetts had significant liability growth, with total primary government liability jumping from $48 billion in 2013 to $77 billion in 2015 and reaching $131 billion in 2021. However, in recent years, liabilities have actually gone down, dropping to $120 billion in 2023.This recent reduction is even more apparent in light of inflation. The Commonwealth’s total liability in 2021 was $147 billion in 2023 dollars. Thus, from 2021 to 2023, the actual value of Massachusetts’s liability dropped 18 percent to $120 billion.

Figure 2. Uses data from Massachusetts Annual Comprehensive Financial Reports and from Bureau of Labor Statistics’s Inflation Calculator.

Liability per Capita

Massachusetts’s liability per capita is relatively high, reaching $17,082, second to Connecticut among New England states. Comparatively, New Hampshire is on the low end of the spectrum with per capita debt of $4,373. However, this higher liability per capita is offset by Massachusetts’s GDP per capita of $87,760 (chained 2017 dollars) while New Hampshire’s is $65,086.

Figure 3. Calculated using population data from Census Bureau and state liability data from Massachusetts Annual Comprehensive Financial Reports.

However, to understand the true liability facing every citizen in Massachusetts, we must also account for federal and local debts. The national debt of $35.06 trillion across 337 million Americans translates to per-capita debt of $104,000. According to Mass Analysis, the total Massachusetts municipal debt of $16.5 billion in 2022 across 7 million Bay State residents translates to per-capita debt of $2,351. Combined with the state liability per capita of $17,082 (which may be higher as this is based on primary government and may not include some other aspects), total per capita debt for someone in MA is about $123,000.

Even in a wealthy state like Massachusetts, this debt paints a troubling picture. Large debt can put the economy at risk in many ways, including billions of dollars in interest payments, slower economic growth, slower wage growth, and higher inflation, and while Massachusetts’ state debt has decreased recently, the larger national debt has not.

About the Author: Raif Boit is a Roger Perry Transparency Intern at Pioneer Institute for the summer of 2024. He is a rising freshman at Harvard College.