The Real Source of UMass R&D Spending

UMass issued a report and a press release Tuesday citing a record level of research and development spending at UMass in fiscal year 2015.

“Despite the tightening of the funding environment, the University of Massachusetts saw sponsored research increase by 4.3 percent during the past year, reaching a record $629 million, President Marty Meehan announced today.”

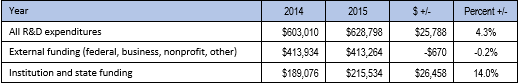

What might not be immediately evident from the UMass announcement is that all of the 4.3 percent increase in UMass R&D spending in FY2015 was attributable to funding provided by the state and UMass itself, which amounted to an increase of $26.5 million, a 14 percent increase from 2014 to 2015. Externally-funded research, from federal, business, nonprofit, other sources, actually declined by $670,000 from 2014-2015, representing a 0.2 percent reduction.

Figure 1. UMass R&D expenditures UMass report 2014-2015 (000s)

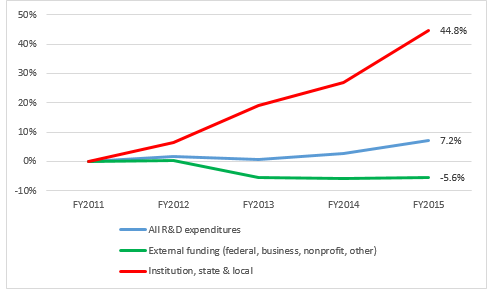

According to data submitted by UMass to the National Science Foundation Higher Education Research and Development Survey, as currently published on the NSF website, externally-funded research at the five UMass campuses declined by 5.6 percent from FY2011 to FY2015, while self-funded research, from university and state funds, increased by 44.8 percent. From FY2011 to FY2015, self-funded research (by UMass and the state) increased by $66.6 million while externally-funded research decreased by $24.6 million.

Figure 2. UMass R&D expenditures by NSF 2011-2015

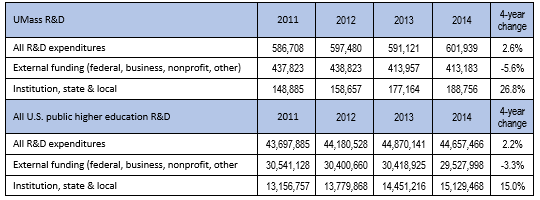

Figure 3. UMass R&D expenditures by NSF 2011-2015 (000s)

In an environment of declining external R&D funding, UMass and other U.S. public higher education institutions have adopted an apparent strategy of increasing self-funded research. At U.S. public higher education institutions between 2011 and 2014 (the most recent year for which national data is currently available), external R&D funding has declined by 3.3 percent while self-funded research (by institution, state, and local funding) has increased by 15 percent. At UMass, external R&D funding has decreased by a greater percent than the national average (5.6 percent versus 3.3 percent) and self-funded research has increased by a greater percentage (26.8 percent versus 15.9 percent).

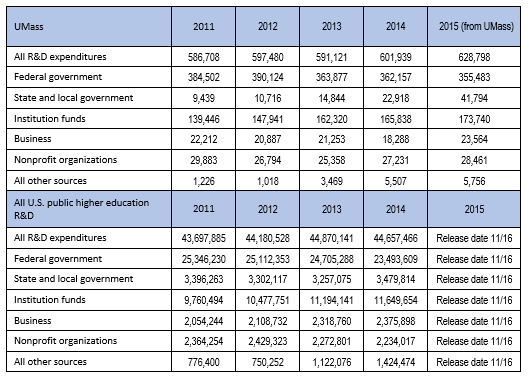

Figure 4. Comparison of R&D at UMass and U.S. public higher education institutions by NSF 2011-2014 (000s)***see below for further breakdown of funding

Pioneer is planning to release an upcoming series of reports detailing the changes taking place at UMass, and the challenging road it faces moving forward. The reports will feature recommendations on how UMass can maximize its effectiveness as an affordable university for Massachusetts residents.

UMass President Marty Meehan has deservedly won high praise for his efforts at enhancing the prestige of the state university system, and the increases in R&D expenditures are designed to do just that. However, if future increases in R&D spending at UMass are going to be largely dependent on funding by the university itself, from tuition, fees, and state appropriations, as has happened since FY2011, the current financial strain at UMass will be exacerbated.

Figure 5. Detailed breakdown of R&D funding at UMass and U.S. public higher education institutions by NSF 2011-2015