Northwest Massachusetts’ Reliance on Industry Levies

Western Massachusetts is a more rural part of the state, and town governments there generally have less resources than many other towns. However, three neighboring towns in northwestern Massachusetts – Rowe, Monroe, and Florida – have emerged as outliers, spending comparatively more per capita for services than their neighbors by large margins.

Rowe spends $10,471 per capita, Monroe spends $8,396, and Florida spends $5,420. Compare this to nearby towns such as Adams, which spends only $2,149 per capita and Plainfield which spends $4,109. This higher spending is partly due to their relatively low populations, as these towns are among the smallest in Massachusetts.

| Town | Population | Per Capita Spending |

| Rowe | 421 | $10,471 |

| Monroe | 115 | $8,396 |

| Florida | 681 | $5,420 |

| Charlemont | 1,181 | $3,585 |

| Savoy | 646 | $3,757 |

| Leyden | 734 | $2,550 |

| Windsor | 818 | $3,056 |

| Adams | 8,047 | $2,149 |

| Plainfield | 629 | $4,109 |

Figure 1: Mass Analysis 2022

Debt and Lack of Reliance on State Funding

According to Mass Analysis, Florida and Rowe have no debt, while Monroe had debt of $1,063,608 in 2022, significant for its size. Over 80 percent of its debt was accumulated between 2018 and 2019, but it has consistently decreased since then. Service on the debt makes up 6 percent of the town’s operating budget – slightly above the statewide average of 5.8 percent.

These towns also don’t rely heavily on state funding to provide for their budget. According to Mass Analysis, state revenues made up just 11.3 percent of Monroe’s total revenue in 2022 and only 4 percent of Rowe’s total revenue. Florida receives a higher 16.7 percent of their funding from the state but is still below the Massachusetts average of 20.9 percent.

Low Residential Tax Rates

In addition, these towns boast low tax rates despite their high spending per capita. According to Mass Analysis, Rowe has a residential tax rate of 5.18 (dollars per thousand dollars of value); Monroe and Florida have higher residential tax rates of 11.51 and 8.46, respectively. In comparison, the nearby towns of Charlemont and Adams respectively have residential tax rates of 20.13 and 18.15.

High Industrial Tax Levies

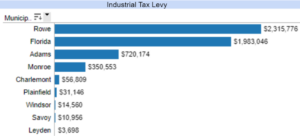

Another distinct feature of these towns is that they derive a significant percentage of their revenue from industrial tax levies – taxes on property used for manufacturing, producing, processing or fabricating materials. These taxes also apply to property used in the storage, transmission, or generation of utilities. Significant sources of industrial taxes in these towns may include New England Power Company, Great River Hydroelectric, and Yankee Atomic Electric Company (owner of the decommissioned Yankee Rowe nuclear power plant). According to Mass Analysis during 2022, 94.3 percent of Rowe’s revenue came from taxes, totaling $4.3 million. Two-and-a-half million dollars, or 55 percent of those taxes were industrial taxes. Similarly, in Florida, MA, $3.3 million, totaling 80.1 percent of revenue, came from taxes. $2.1 million, totaling 64.5 percent of all tax revenue, came from industrial taxes. Monroe follows the same pattern.

Figure 2: Mass Analysis 2023

In comparison, other towns both nearby and across the state rely less heavily on industrial taxes. Across Massachusetts, $21.2 billion was collected in local taxes in 2022, according to Mass Analysis. Of these only $947 million came from industrial taxes, totaling just 4.5 percent of all tax revenue. In the neighboring town of Charlemont, industrial taxes made up only $44,167 of $3.5 million in tax revenue. Similarly in the nearby town of Adams, only $740,035 out of $13.7 million of tax revenue came from industrial taxes – a far smaller portion than in Rowe, Monroe, and Florida.

In fact, the additional funding these towns receive from their higher industrial tax revenue accounts for a significant portion of their higher per capita spending. In 2023, Rowe’s per capita industrial tax levy of $5,501 far exceeded the statewide average per capita industrial tax levy of $145. This makes up most of the difference between Rowe’s spending per capita and the spending per capita of other towns. Similarly, in Monroe, the industrial tax levy per capita of $3,048 made up a significant portion of the difference between its spending per capita and that of other towns. These towns’ small population allows their significant industry tax levies to have an outsized effect on the revenue towns collect per capita.

Figure 3: Mass Analysis 2023

About the Author: Raif Boit is a Roger Perry Transparency Intern at Pioneer Institute for the summer of 2024. He is a rising freshman at Harvard College.

John Phelan, CC BY 3.0

John Phelan, CC BY 3.0