Tag Archive for: wealth migration

MBTAAnalysis: A look inside the MBTA

0 Comments

/

The MBTA shuttles over a million passengers a day around Greater…

https://pioneerinstitute.org/wp-content/uploads/CloseupClock-1.jpg

739

1244

Mary Connaughton

https://pioneerinstitute.org/wp-content/uploads/logo_440x96.png

Mary Connaughton2017-02-20 12:34:192017-02-21 09:47:58The Clock is Ticking…….

https://pioneerinstitute.org/wp-content/uploads/CloseupClock-1.jpg

739

1244

Mary Connaughton

https://pioneerinstitute.org/wp-content/uploads/logo_440x96.png

Mary Connaughton2017-02-20 12:34:192017-02-21 09:47:58The Clock is Ticking…….

The Largest Groups Driving Massachusetts’s Migration

With Massachusetts losing billions in taxable income every year due to out-of-state migration, it is important to understand the demographics causing the biggest losses.

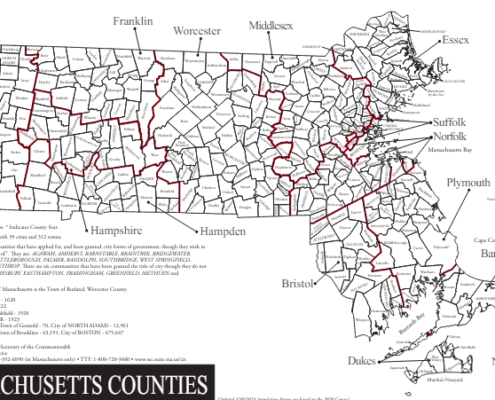

Migration to Massachusetts in 2022: Where Are People Going?

With thousands moving to Massachusetts every year, they bring income and assets that can affect the local economy. However, people from different regions of the country tend to favor different parts of Mass more or less, though the more urban area around Boston is al

Black Box Budget: Late, Loaded, and Lacking Transparency

Joe Selvaggi talks with Pioneer Institute’s Senior Fellow in Economic Opportunity Eileen McAnneny about the features and flaws of the recently passed 2024 Massachusetts state budget now waiting for Governor Healey’s approval.

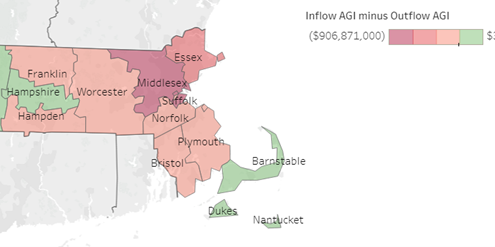

As States Compete for Talent and Families, Massachusetts Experienced a Six-Fold Increase in Lost Wealth Compared to a Decade Earlier

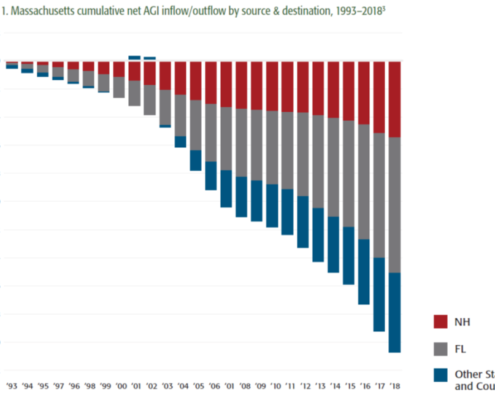

With competition for businesses and talent heating up across the country, in 2020 Massachusetts shed taxpayers and wealth at a clip six times faster than even just a decade ago. Between 2010 to 2020, Massachusetts’ net loss of adjusted gross Income (AGI) to other states due to migration grew from $422 million to $2.6 billion, according to recently released IRS data now available on Pioneer Institute’s Massachusetts IRS Data Discovery website. Over 71 percent of the loss was to Florida and New Hampshire, both no income tax states.

Progressive Policy Study: Californians Dreamin’ While Jobs and People Leavin’

Hubwonk host Joe Selvaggi talks with California Policy Center president Will Swaim about how the state’s ambitious policies have combined to stick its residents with the highest cost of living and a tax regime that discourages investment, innovation, and its vital entrepreneurial class.

Competition Amongst States: How Tax Policy Drives Residents to Seek Better Value

This week on Hubwonk (our debut video & audio edition), Host Joe Selvaggi talks with research analyst Andrew Mikula about the findings from his recent report, A Timely Tax Cut, in which he explored the relationship between state tax rates and policy and the direction of interstate migration.

Study Says Massachusetts Surtax Proposal Could Reduce Taxable Income in the State by Over $2 Billion

As voters now begin to weigh the potential impact of a ballot proposal to increase taxes on business owners, retirees and wealthier households, a new literature review by Pioneer Institute shows that many existing academic studies find that wealthy individuals are particularly sensitive to changes in tax policy. Other studies explicitly warn policymakers that behavioral responses to taxing the rich could erode the tax base and ultimately strain state budgets.

7 Reasons to Reject the Graduated Tax and Instead Focus on Growing Jobs

Pioneer Institute's Statement before the Joint Committee on Revenue In Opposition to: HB 86 (Pages 1-4), a legislative amendment to the Constitution to provide resources for education and transportation through an additional tax on incomes in excess of one million dollars.

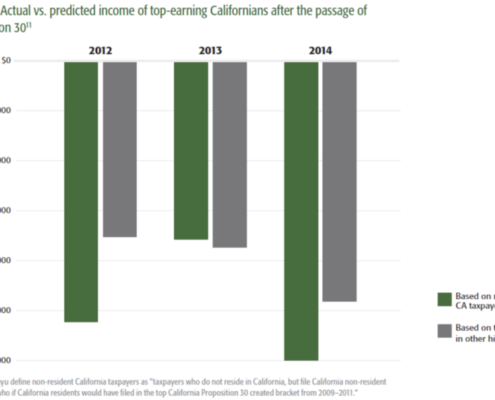

New Study Highlights Economic Fallout from California’s 2012 Tax Hike

A 2012 income and sales tax increase in California, named “Proposition 30,” stifled business activity, accelerated out-migration among the wealthy, and ultimately reduced the state’s tax base, according to a new study published by Pioneer Institute that aims to share empirical data about the impact of tax policy decisions.

How a 2012 income tax hike cost California billions of dollars in economic activity

This study finds that a 2012 income and sales tax increase in California, named “Proposition 30,” stifled business activity, accelerated out-migration among the wealthy, and ultimately reduced the state’s tax base. It also aims to share empirical data about the impact of tax policy decisions.

New Study Shows Significant Wealth Migration from Massachusetts to Florida, New Hampshire

Over the last 25 years, Massachusetts has consistently lost taxable income, especially to Florida and New Hampshire, via out-migration of the wealthy, according to a new Pioneer Institute study.

In “Do The Wealthy Migrate Away From High-Tax States? A Comparison of Adjusted Gross Income Changes in Massachusetts and Florida,” Pioneer Institute Research Director Greg Sullivan and Research Assistant Andrew Mikula draw on IRS data showing aggregate migration flows by amount of adjusted gross income (AGI). The data show a persistent trend of wealth leaving high-tax states for low-tax ones, especially in the Sun Belt.

Do The Wealthy Migrate Away From High-Tax States? A Comparison of Adjusted Gross Income Changes in Massachusetts and Florida

Massachusetts had a net outflow of $20.7 billion in adjusted gross income (AGI) between 1993 and 2018. The biggest beneficiaries of the wealth that fled the Commonwealth were Florida, which captured 47.5 percent of it, and New Hampshire, which captured 26.1 percent. Between 2012 and 2018, Florida saw a net AGI inflow of $88.9 billion. Affluent taxpayers are responsible for an outsized proportion of state tax revenue. The data also show a strong correlation between state taxes and migration. States like Florida and New Hampshire that have no state income tax have seen a net inflow of AGI from higher-tax states like Massachusetts.