Tag Archive for: tax credit scholarship

MBTAAnalysis: A look inside the MBTA

0 Comments

/

The MBTA shuttles over a million passengers a day around Greater…

https://pioneerinstitute.org/wp-content/uploads/CloseupClock-1.jpg

739

1244

Mary Connaughton

https://pioneerinstitute.org/wp-content/uploads/logo_440x96.png

Mary Connaughton2017-02-20 12:34:192017-02-21 09:47:58The Clock is Ticking…….

https://pioneerinstitute.org/wp-content/uploads/CloseupClock-1.jpg

739

1244

Mary Connaughton

https://pioneerinstitute.org/wp-content/uploads/logo_440x96.png

Mary Connaughton2017-02-20 12:34:192017-02-21 09:47:58The Clock is Ticking…….

Tax credit scholarship program would give Catholic schools fighting chance

I am among the countless individuals whose lives have been shaped by Catholic education; in my case, it was attending high school at Austin Prep. Despite a stellar record, Catholic schools are facing a grim financial picture. But a recent U.S. Supreme Court decision gives new hope to the schools and to the many Massachusetts families with children who would benefit from attending them.

Tax Credits, Religious Schools And You

Six years ago, I met with Erica Smith of the Institute for Justice in a Montana coffee shop, where I agreed to be the lead plaintiff in a lawsuit about the use of funds from a state education tax credit program for children attending religious schools. This past June, in Espinoza v. Montana Department of Revenue, the U.S. Supreme Court reversed Montana’s highest court and ruled that if parents use funds from the program to access private education, religious school options cannot be excluded.

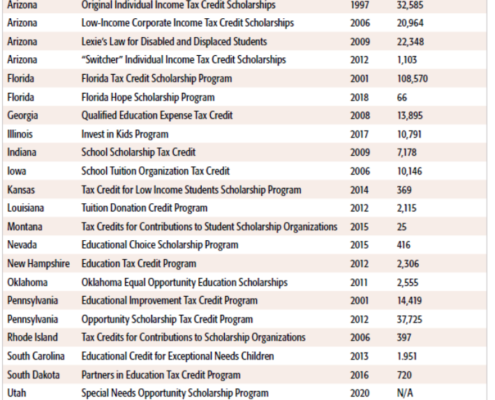

New Study Provides Toolkit for Crafting Education Tax-Credit Scholarship Programs

In the wake of a U.S. Supreme Court ruling that struck down a key impediment to private school choice, Pioneer Institute has published a toolkit for designing tax-credit scholarship programs. Now available in 18 states, nearly 300,000 students nationwide use tax-credit scholarships to attend the school of their family’s choice. TCS policies create an incentive for taxpayers to contribute to nonprofit scholarship organizations that aid families with tuition and, in some states, other K–12 educational expenses. This paper explores the central design features of TCS policies—such as eligibility, the tax credit value, credit caps, and academic accountability provisions—and outlines the different approaches taken by the TCS policies in each state.