Tag Archive for: Proposition 30

MBTAAnalysis: A look inside the MBTA

0 Comments

/

The MBTA shuttles over a million passengers a day around Greater…

https://pioneerinstitute.org/wp-content/uploads/CloseupClock-1.jpg

739

1244

Mary Connaughton

https://pioneerinstitute.org/wp-content/uploads/logo_440x96.png

Mary Connaughton2017-02-20 12:34:192017-02-21 09:47:58The Clock is Ticking…….

https://pioneerinstitute.org/wp-content/uploads/CloseupClock-1.jpg

739

1244

Mary Connaughton

https://pioneerinstitute.org/wp-content/uploads/logo_440x96.png

Mary Connaughton2017-02-20 12:34:192017-02-21 09:47:58The Clock is Ticking…….

Study Finds Massachusetts Graduated Income Tax May Be a “Blank Check” and Not Increase Funding for Designated Priorities

Advocates claim a proposed 4 percent surtax on high earners will raise nearly $2 billion per year for education and transportation, but similar tax hikes in other states resulted in highly discretionary rather than targeted spending, according to a new policy brief published by Pioneer Institute. That same result or worse is possible in Massachusetts because during the 2019 constitutional convention state legislators rejected — not just one, but two — proposed amendments requiring that the new revenues be directed to these purposes.

New Study Highlights Economic Fallout from California’s 2012 Tax Hike

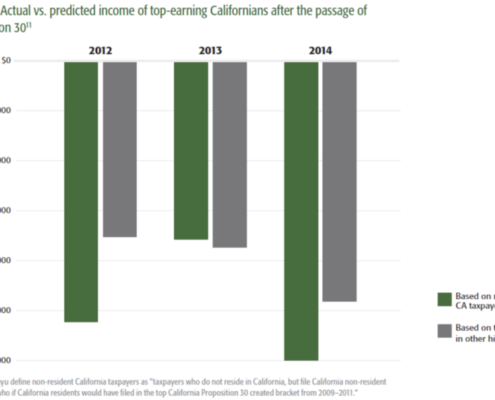

A 2012 income and sales tax increase in California, named “Proposition 30,” stifled business activity, accelerated out-migration among the wealthy, and ultimately reduced the state’s tax base, according to a new study published by Pioneer Institute that aims to share empirical data about the impact of tax policy decisions.

How a 2012 income tax hike cost California billions of dollars in economic activity

This study finds that a 2012 income and sales tax increase in California, named “Proposition 30,” stifled business activity, accelerated out-migration among the wealthy, and ultimately reduced the state’s tax base. It also aims to share empirical data about the impact of tax policy decisions.