Tag Archive for: capital gains

MBTAAnalysis: A look inside the MBTA

0 Comments

/

The MBTA shuttles over a million passengers a day around Greater…

https://pioneerinstitute.org/wp-content/uploads/CloseupClock-1.jpg

739

1244

Mary Connaughton

https://pioneerinstitute.org/wp-content/uploads/logo_440x96.png

Mary Connaughton2017-02-20 12:34:192017-02-21 09:47:58The Clock is Ticking…….

https://pioneerinstitute.org/wp-content/uploads/CloseupClock-1.jpg

739

1244

Mary Connaughton

https://pioneerinstitute.org/wp-content/uploads/logo_440x96.png

Mary Connaughton2017-02-20 12:34:192017-02-21 09:47:58The Clock is Ticking…….

Pioneer Institute Statement on the State Legislature’s FY2024 Tax Relief Package

The recent advancement of a tax bill H. 4104, that is expected to be enacted by the Legislature this week after languishing for more than 20 months, puts Massachusetts taxpayers one step closer to realizing some tax relief. However, it may be too little to tackle the Commonwealth’s affordability and competitiveness challenges.

Senate Tax Package Misses the Mark on Competitiveness

The Senate tax package, S.2397, is heavy on provisions that reduce the tax burden for certain taxpayers, thereby helping those that qualify for the expanded credits and deductions. The bill, however, is light on provisions that will improve the Commonwealth’s competitiveness.

Study: Net Out-Migration of Wealth from Massachusetts Nearly Quintupled from 2012-2021

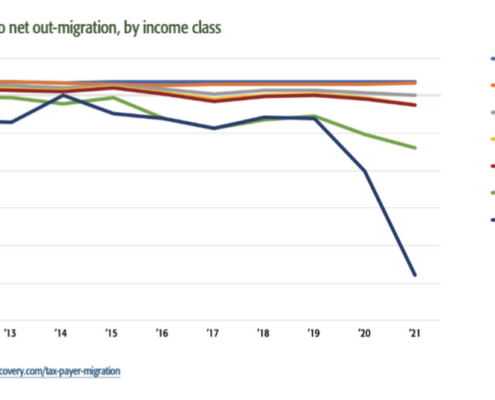

IRS data reveals that net out-migration from Massachusetts is accelerating rapidly and is greatest among affluent residents who pay the most in state taxes, according to a Pioneer Institute analysis. Between 2019 and 2021, Massachusetts rose from ninth to fourth among all states in net out-migration of wealth, behind only California, New York, and Illinois.

Public Statement on the House’s Proposed Tax Reform and Budget

Pioneer Institute applauds key tax reform provisions advanced by the Speaker and House leadership, including a reduced short-term capital gains tax rate and implementation of a single sales factor apportionment. But leadership must do more to bolster the state’s economic competitiveness and slow out-migration of wealth and business owners that endangers the commonwealth’s economic future.

Debunking Tax Migration Myths

Provisions of Gov. Healey’s $876 million tax package targeted to higher-income earners — including revisions to the estate tax and a reduction in the tax rate for short-term capital gains — are important for encouraging taxpayers subject to them to remain in Massachusetts, according to a new analysis from Pioneer Institute.

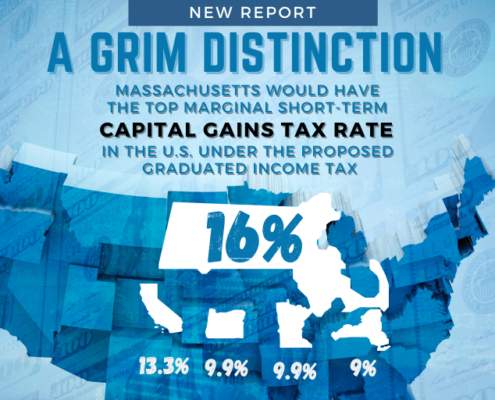

Study Warns Massachusetts Tax Proposal Would Deter Investment, Stifling the “Innovation Economy”

A state constitutional amendment promoted by the Massachusetts Teachers Association and the Service Employees International Union adding a 4 percent surtax to all annual income above $1 million could devastate innovative startups dependent on Boston’s financial services industry for funding, ultimately hampering the region’s recovery from the COVID-19 economic recession, according to a new study published by Pioneer Institute.

Study: Proposition 80 Would Give MA 2nd Highest Combined State & Federal Capital Gains Tax Rate in U.S.

Read coverage of this report in the Boston Herald: "Study: ‘Millionaire’s…