Tag Archive for: California

MBTAAnalysis: A look inside the MBTA

0 Comments

/

The MBTA shuttles over a million passengers a day around Greater…

https://pioneerinstitute.org/wp-content/uploads/CloseupClock-1.jpg

739

1244

Mary Connaughton

https://pioneerinstitute.org/wp-content/uploads/logo_440x96.png

Mary Connaughton2017-02-20 12:34:192017-02-21 09:47:58The Clock is Ticking…….

https://pioneerinstitute.org/wp-content/uploads/CloseupClock-1.jpg

739

1244

Mary Connaughton

https://pioneerinstitute.org/wp-content/uploads/logo_440x96.png

Mary Connaughton2017-02-20 12:34:192017-02-21 09:47:58The Clock is Ticking…….

Progressive Policy Study: Californians Dreamin’ While Jobs and People Leavin’

Hubwonk host Joe Selvaggi talks with California Policy Center president Will Swaim about how the state’s ambitious policies have combined to stick its residents with the highest cost of living and a tax regime that discourages investment, innovation, and its vital entrepreneurial class.

Study Finds Massachusetts Graduated Income Tax May Be a “Blank Check” and Not Increase Funding for Designated Priorities

Advocates claim a proposed 4 percent surtax on high earners will raise nearly $2 billion per year for education and transportation, but similar tax hikes in other states resulted in highly discretionary rather than targeted spending, according to a new policy brief published by Pioneer Institute. That same result or worse is possible in Massachusetts because during the 2019 constitutional convention state legislators rejected — not just one, but two — proposed amendments requiring that the new revenues be directed to these purposes.

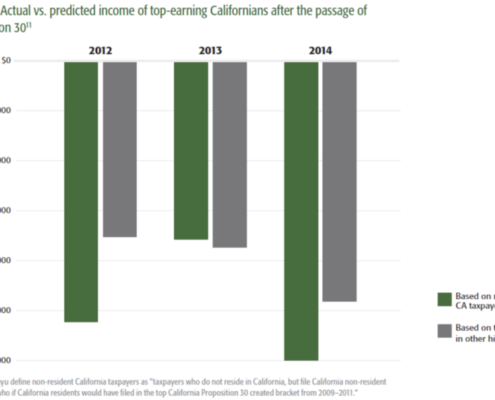

New Study Highlights Economic Fallout from California’s 2012 Tax Hike

A 2012 income and sales tax increase in California, named “Proposition 30,” stifled business activity, accelerated out-migration among the wealthy, and ultimately reduced the state’s tax base, according to a new study published by Pioneer Institute that aims to share empirical data about the impact of tax policy decisions.

How a 2012 income tax hike cost California billions of dollars in economic activity

This study finds that a 2012 income and sales tax increase in California, named “Proposition 30,” stifled business activity, accelerated out-migration among the wealthy, and ultimately reduced the state’s tax base. It also aims to share empirical data about the impact of tax policy decisions.

California Tax Experiment: Policy Makers Receive Valuable Economics Lesson

Host Joe Selvaggi talks with Stanford University Economics Professor Joshua Rauh about his research on the reaction of Californians to a tax increase, from his report, “The Behavioral Response to State Income Taxation of High Earners, Evidence from California.” Prof. Rauh shares how his research offers tax policy makers insight into the likely effects of similar increases in their own states, including here in Massachusetts.

California’s Common Core Apologia

In a recent blog, Dr. Michael Kirst, past president of the California State Board of Education, attempts to defend his record of Common Core implementation during that period. But policy experts Ze’ev Wurman & Williamson Evers set the Golden State's record during Common Core straight.

National Standards Still Don’t Make the Grade

National Standards Still Don’t Make the Grade Academic Standards…