Data, Attitudes, and Ecommerce: Noteworthy trends in retail for the present and future

Following the July 16th release of the June Retail Sales Report that detailed a more than 17% jump in total retail sales in the U.S. from April to May and an additional 6.4% jump in June, many Americans may assume that brighter economic days are ahead. While it may be indicative of some degree of economic resilience during the pandemic, this surge holds a bit more complexity and highlights retail trends of note for both the near future and the months ahead.

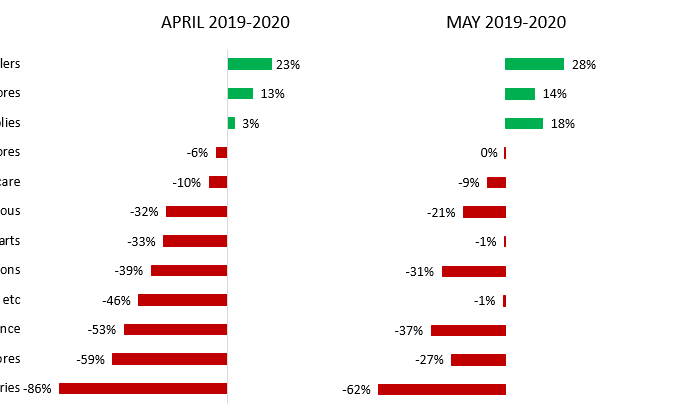

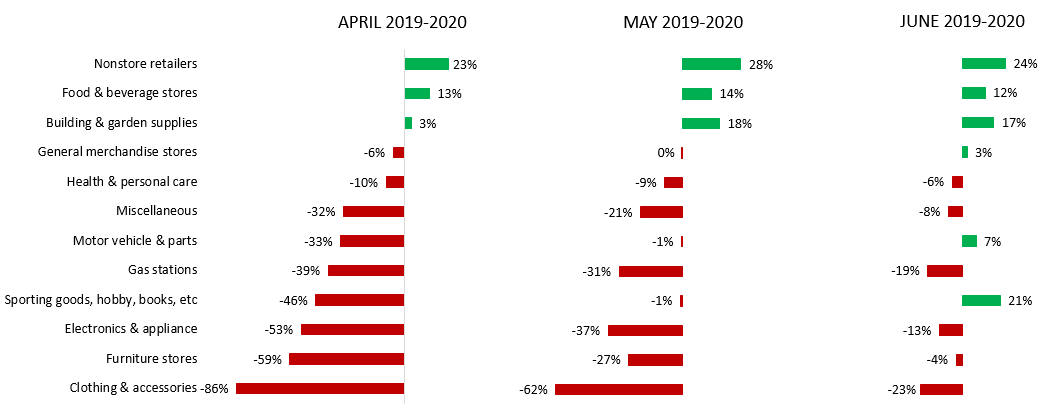

Figure 1. Estimated Monthly Sales for Retail and Food Services, by Kind of Business, Percentage +/-, June 2020 v June 2019, May 2020 v May 2019, April 2020 v April 2019 (millions)

Source: U.S. Census Bureau Advance Monthly Retail Trade Report, July 16 2020. Analysis by Pioneer Institute.

To put this growth in perspective, as shown in Figure 1, the month of April, when compared to April 2019, showed a near -20% decline in total retail & food service sales, equally as unprecedented as the month-to-month spike in retail sales in May. Further, when the monthly totals from May 2020 were compared to data from May of last year, there was still a substantial -5.7% decrease in total revenue. In the latest June data, total sales are up just over 1 percent higher than sales this time last year.

As also shown in the graph, electronics, furniture, and clothing stores have been especially hard hit by the pandemic in terms of year-over-year sales losses. However, sales in these categories have increased as restrictions have been loosened. Electronics, furniture, and clothing stores are down -12.7%, -3.5%, and -23.2% for June 2020 in relation to June 2019, respectively. These numbers are significant improvements from April 2020, which saw -53.3%, -59.1%, and -86.5% decreases in comparison to April 2019. But, seeing that many brick and mortar enterprises closed during the month of April, at least some part of May’s retail sales rebound is likely due to the reopening of more physical stores as states loosened stay-at-home restrictions. Going forward, it is unclear whether a loosening of restrictions will immediately hasten recovery for all of the retail sector, one of the industries hardest hit by this pandemic.

Consumer attitudes towards shopping, especially for non-essential goods and services, have drastically changed in light of the ongoing pandemic. Survey results indicate that a sizable contingency of consumers present a far lower degree of willingness to engage in non-essential economic activity. According to a study from McKinsey & Company,

“70 percent of consumers are not comfortable going back to ‘regular’ out-of-home activities. Most consumers are waiting for milestones beyond governments lifting restrictions—they are waiting for medical authorities to voice their approval, safety measures to be put in place, and a vaccine and/or treatments to be developed.”

These findings are corroborated by an international McKinsey study, finding that “when deciding where to shop, [consumers] look for retailers with visible safety measures such as enhanced cleaning and physical barriers. In addition, they buy more from companies and brands that have healthy and hygienic packaging and demonstrate care and concern for employees.” Moreover, consumer confidence about the overall state of the economy has also been deteriorating. This oft-cited economic indicator has seen marginal improvement since the beginning of the pandemic, but it still remains -25.6% lower than it was a year ago. This is not to say that all Americans hold a pessimistic view of the economy. In fact, analyses of different demographics reflect wide discrepancies in individuals’ economic outlooks. For example, the index of consumer sentiment in the South was 14.2 points higher than the Northeast in the month of May, findings buttressed by state-specific research. Although the precise relationship between consumer confidence and real consumption is a topic of contention in economic research, the data is at least demonstrative of widely varying attitudes towards the economy among American consumers.

Consumer hesitancy to return to physical stores may be a contributing cause to the recent success of nonstore retailers. Nonstore retailers posted May 2020 sales numbers 28% greater than in May 2019, and June sales numbers were 23.5% greater than June 2019 (Figure 1). Within this noticeable growth is a particularly fascinating trend of the rise of ecommerce in sectors that previously relied on brick and mortar sales. These sectors include grocery shopping–evidenced by the growth of Instacart–and telemedicine. Therefore, it seems that not only are consumers hesitant to return to non-essential economic activities in person, but also that consumers are trying to complete essential activities online.

In her analysis of this data, Diane Swonk, chief economist at Grant Thornton, suggests that the coronavirus has accelerated change in the retail sector “by two to four years.” This restructuring consists not only of ecommerce’s proliferation, but also the collapse of primarily brick and mortar enterprises, such as shopping malls. Other analysts concur, including CNBC Markets Editor Patti Domm, arguing that “the divide between online merchants and brick-and-mortar stores is growing,” ultimately claiming that the pandemic has expedited the inevitable move away from big-box retailers towards online shopping.

The COVID-19 pandemic has resulted in unique outcomes both within the retail industry and among consumers. May and June numbers suggest positive signs that consumers are returning to stores. But, consumers, likely as a consequence of more time being spent at home and growing fear of infection, appear to be engaging in online shopping more than ever before. These trends clearly differ with respect to key demographics, such as age, location, income level, and local COVID-19 infection rates. Looking towards the rest of 2020, trends in the retail sector, including the role of ecommerce in retail, are phenomena to keep one’s eyes on.

For more insight and recommendations for spurring recovery of the Retail Trade sector, view Pioneer’s latest report “A Public Policy Guide for Economic Recovery from COVID-19 for Hospitality and Retail Businesses.”

Nina Weiss is a Roger Perry Research Intern at the Pioneer Institute. Research areas of particular interest to Ms. Weiss include education and transportation. She is currently a student at Johns Hopkins University studying Sociology and International Relations.

Thomas O’Rourke is a Roger Perry Government Transparency Intern at the Pioneer Institute. Mr. O’Rourke holds a wide array of policy interests ranging from advancing economic opportunity to government accountability. He is currently a junior at Emory University studying PPL (Philosophy, Politics, and Law) as well as Economics.