Barnstable County: What Towns Tax the Most?

The housing market has been the center of American economic growth and decline for decades. Many potential home buyers consider residential property taxation and single-family tax bills in choosing a community. As such, property taxes can impact regional housing markets, as people consider whether those markets are affordable. One super-hot real estate market right now is Barnstable County, Massachusetts, which makes up most of Cape Cod.

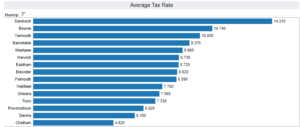

So what do tax rates look like on the Cape?

per $1,000 in assessed valued.

According to the graph above, the tax rates per $1,000 in assessed value for the majority of municipalities within Barnstable county are far below the statewide average of $14.92, with the town of Sandwich as the only exception. While the lowest tax rate was Chatham’s $4.82, the majority of towns have a rate between $7-$10. Overall the average tax rate for residential properties in Barnstable county for the fiscal year of 2020 was $8.548, 43% lower than the statewide average.

Additionally, Barnstable county is on the low end of the average tax rates among Massachusetts counties, At $8.548, it ranks 3rd lowest, behind only Dukes (primarily Martha Vineyard) and Nantucket counties, also seasonal communities dependent on tourism.

Tax rates are only one part of the equation since they have to be applied to the assessed value. Real estate buyers focus more on the bottom line – the tax bill.

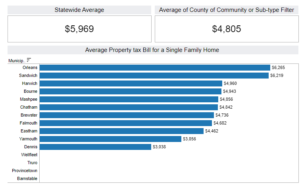

From MassAnalysis, Pioneer Institute’s municipal database – Average single Family tax bill – Barnstable, Massachusetts

As shown above, the municipalities of Provincetown, Orleans, and Sandwich reported the highest average single-family tax bills. Nearly 50% of the towns reported a single-family tax bill between $4,000 to $5,000, with the town of Dennis coming out as the lowest with an average of only $3,086, which was $1,719 less than the average for the overall county. Provincetown county had the highest, with an average of $7,303. Overall, with a reported average of $4,805, Barnstable county had one of the lowest Single Family Tax Bills in the state. Despite this, Barnstable’s average is far higher than the national average of $3,719 in 2020. It is important to note that Massachusetts has the 3rd highest single-family tax bill average, so the majority of towns within it are going to have a far higher rate than the national average. Consequently, if anyone is looking to enter the Cape Cod real estate market, be prepared to spend significantly higher on your tax bill than in other parts of the country, but significantly lower in comparison to other housing markets in the state of Massachusetts.

According to the Cape Cod Times, “the median sales price for a single-family home in Barnstable County during July was $559,500.” That’s an increase of 18.5% compared with July 2020, according to data from Realtor.com. Barnstable county, with its relatively low taxation rates and single-family tax bills, may be attractive to real estate buyers, but with limited single-family home inventory, those low taxes are out of reach for many.. Yet

About the Author:

Etelson Alcius is a roger perry transparency intern with the Pioneer Institute. He is a recent graduate of Cathedral High School and incoming freshmen at the College of the Holy Cross, where he intends to double major in economics and computer science on a prelaw track. Feel free to reach out via email, linkedin, or write a letter to Pioneer’s Office in Boston.