ACA Spiking Premiums in Massachusetts, More Than 300 Cancellations of Plans

The Patrick Administration has been publicly touting that health care premiums are only going to go up 2% this year in the Commonwealth. However the anecdotal evidence fails to back up that assessment, and in a future post I will explain the intentionally misleading nature of that number. In short, the Division of Insurance asked the insurance companies to restate 2013 rates as if the ACA was in effect, to make the premium difference seem lower for 2014 under the ACA.

I have written numerous times on this blog about the changes come to the Bay State under the ACA, and the roller coaster effect we can expect small companies to experience, and now we have some evidence.

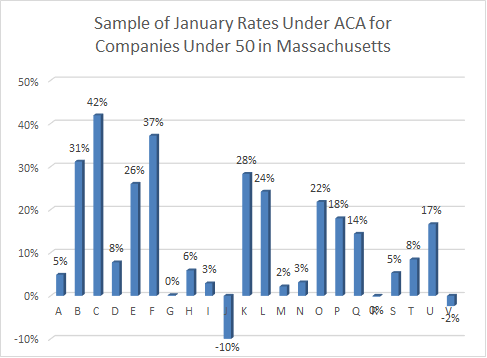

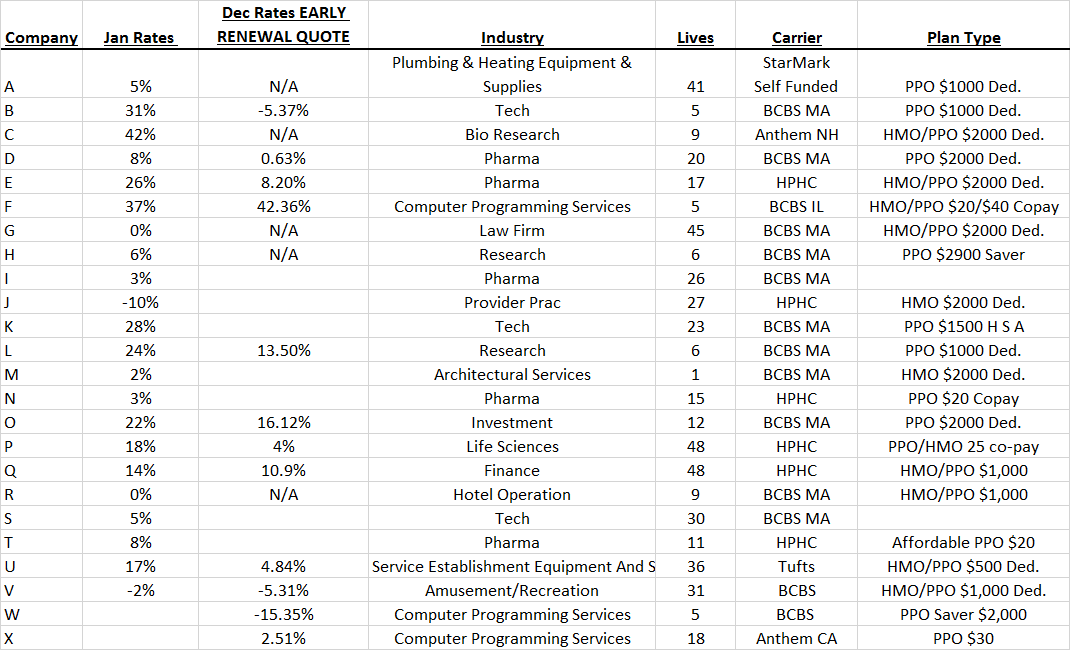

I asked the kind folks over at William Gallagher Associates to send me over a sample of the premium renewals they had for January 1, 2014.

The takeaways include:

1) Premium rates are all over the map, but generally going up. For this sample, the average rate increase was 13%, and the weighted average when considering the size of each company is 10%.

It should be noted that Massachusetts small companies pay the highest premiums in the world on average, so 10-13% increases can translate into a multi-thousand dollar increase per policy this year.

2) Most would have experienced lower rates if they renewed in December of 2013, just before the ACA went into effect. This should tell us something about the impact of the ACA. The downside of renewing then was that deductibles reset early, so employees would be facing a whole new deductible at least a month early.

3) Multiple aspects of the ACA phase-in over time, so we can expect to see rates continue to increase incrementally for at least the next 3 years. And given the uncertainty around the Connector locally, and delays at the national level, insurers are sure to build in a little extra.

Since small businesses renew at different times of the year, we will get multiple chances to see how premiums are being impacted.

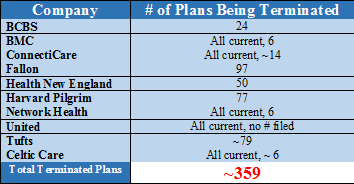

We can also expect to start to hear about cancellations again going forward, as I counted at least 379 plans that will be terminated this year.