WSJ op-ed: Don’t Make Massachusetts ‘Taxachusetts’ Again

Read this op-ed in The Wall Street Journal.

By Jim Stergios, Boston

Unlike many blue states, Massachusetts has resisted the temptation to raise taxes on high earners. That antitax fortitude is about to be tested. In November, state legislators will ask voters to approve an amendment to the Massachusetts constitution adding a 4% surcharge to annual income over $1 million.

Massachusetts is home to arch-progressives like Sen. Elizabeth Warren and Rep. Ayanna Pressley, but many voters here remember the 1980s, when the state was derisively known around the country as “Taxachusetts.” A series of antitax popular initiatives in the 1980s and tax cuts enacted by Gov. William Weld in the 1990s reduced Massachusetts’ overall state and local tax burden considerably. Proposition 2½, which limits both the levels and growth of property taxes, was approved by voters in 1980 and remains sacrosanct. Among states with income taxes, Massachusetts’ flat 5% rate is on the low side. In neighboring Connecticut and New York, the highest earners pay 6.9% and 10.9% respectively.

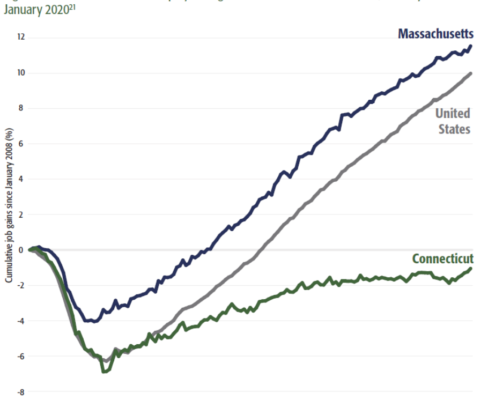

What was Taxachusetts has become New England’s economic dynamo. Since the 2007-09 recession, wage and job growth in Massachusetts has outpaced the nation. Sustained economic growth produced a budget surplus exceeding $5 billion in the past fiscal year, which makes it doubly odd to ask voters to approve a tax hike now.

Read more in The Wall Street Journal.

Get Updates on Our Economic Opportunity Research

Related: