FY2026 Consensus Revenue Hearing – Forecasting of Revenues is Tricky Business

The next major event on the legislative calendar is the FY2026 Consensus Revenue Hearing on December 2. At this forum, several experts make projections about how much money will be available for the fiscal year that begins on July 1, 2025.

Making projections several months in advance for a budget that extends 18 months out (fiscal year ends on June 30, 2026) is difficult. Who can say what the economy will look like then with a new president, a tense global environment and an economy that has defied recession? At the hearing, experts use data from credit agencies, the U.S. census and economic literature to make their best guesses.

This is a useful, if imprecise, exercise because it gets the executive and legislative branches to agree by January 15, 2025 on the aggregate amount of money available to build the state’s operating budget. Branches may propose to spend the money differently, but the bottom line should be common to the Governor, House and Senate versions of their respective FY2026 budget plans. It also signals directionally where the state’s finances are heading.

If I were testifying at this year’s hearing, which I am not, but have done several times in the past, I would err on the side of caution. Several data points signal that tax revenue may grow at a slower rate than in recent years.

- Growing unemployment. The Massachusetts unemployment rate has steadily crept up over the past year to 3.9 percent from 2.8 percent a year ago and layoff announcements continue. This means lower aggregate wages, so less tax withheld on income.

- Outmigration. Massachusetts continues to see outmigration of high-income, college educated 25–34-year-olds, which could lead to income tax liability leakage.

- Below Benchmark Revenue Collections. Aggregate tax collections are shy of the benchmark by 1 percent through the end of October. While collections only reflect four months of the 2025 fiscal year, they are not where they need to be.

- Through October, the only tax category that has performed better than the FY2025 benchmark is estimated income tax payments, which capture taxes on interest, dividends and capital gains. As the income surtax takes hold and more people take steps to reduce their tax liability, we could see a decline in this category.

- Major categories of taxes – meals tax, general sales, motor vehicle excise, corporate & business – are all down.

- Policy Headwinds. Three important sectors of the Massachusetts economy — Healthcare, life sciences and education — could undergo a sea change under the incoming Trump administration.

- This could stymy investment in research and innovation in the life sciences and pharmaceutical industries.

- For the healthcare sector as a whole, it could mean less federal money for Medicaid and Medicare, which pay for about half of all care at a time when hospitals are demanding reimbursement rate increases of as much as 50 percent over three years. Fewer resources could prompt much-needed transformational changes in how we deliver and pay for care, but more likely it will mean additional state subsidies to keep the current healthcare system afloat.

- For higher education, at a time of changing demographics and public concern about the sector’s ability to deliver return on investment, the new administration is publicly discussing cuts in federal funding, the use of accreditation to drive its policy agenda and even taxing especially large endowments.

- New tariffs could raise the cost of goods. This could either bolster sales tax revenue or soften demand for imports, which could reduce them.

- Federal tax reform could alter the tax base.

Although the consensus revenue hearing focuses only on tax revenues, there are other important revenue sources used to cover the state’s operating expenses. These include assessments, federal grants and reimbursements, departmental fees, lottery reimbursements and distributions, Stabilization Fund transfers and court settlements, among other things.

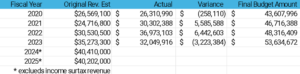

Projecting there will be less money to spend serves the important purpose of curtailing spending. And we know, balancing a budget is about both sides of the ledger. The spending side has been growing at an unsustainable pace. The budget has gone from $46.716 billion in FY2021 to $57.8 billion in FY2025, an $11 billion or almost 20 percent increase in five years.

The current state budget demonstrates that these spending increases are unsustainable. It uses $1.2 billion in one-time revenue to cover a $1.7 billion jump in spending. Thus, lawmakers will be searching under the proverbial couch cushions in FY2026 or eyeing new taxes to pay for the spending growth. Unforeseen new expenses, such as the recent migrant crisis, could make it even harder to balance next fiscal year’s budget.

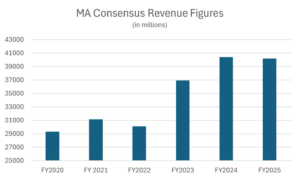

We will learn on December 2nd if my recommendations align with the experts’ testimony. What we can say for sure is that state finances have been volatile over the past five years, as reflected in Figure 1. The lack of a clear-cut revenue trend makes it harder to make projections.

Figure 1

If my predictions are far off, I will be in good company. For those of you wondering about how close actual tax revenue collections track to the consensus revenue figure, the table below outlines the variances in recent years. This period was particularly challenging with the pandemic and its aftermath wreaking havoc on both revenues and spending. I added a column that shows the final budget figure to give you a sense of the portion of the budget funded by state tax revenues. Let’s just say I am aiming to be in the ballpark.

Table 1 (in 000s)

Source: Office of the Comptroller