Sunshine Week 2024

Partly Sunny with a Chance of Transparency

As Pioneer Institute…

Rolling the Retirement Dice: Why the MBTA Should Steer Clear of Pension Bonds

This study illustrates why issuing pension obligation bonds (POBs) to refinance $360 million of the MBTA Retirement Fund’s (MBTARF’s) $1.3 billion unfunded pension liability would only compound the T’s already serious financial risks.

The Massachusetts Retirement Credit Bonus Legislation: Missing the Mark While Costing Billions

Two identical bills to reward public employees with a retirement credit bonus for working during the COVID-19 emergency are currently pending in each chamber of the Massachusetts Legislature. The bills would add billions of dollars in liabilities to public pension funds and reward workers based on their compensation, years of service and age rather than the type or duration of the work performed during the emergency, according to a new study published by Pioneer Institute.

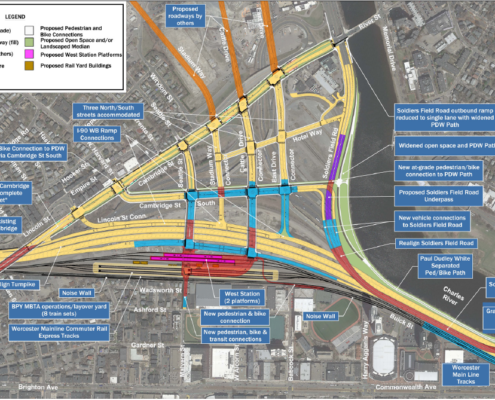

Public Testimony to the Joint Meeting of the MassDOT Board of Directors and Fiscal Management Control Board

0 Comments

/

Public Testimony to the Joint Meeting of the MassDOT Board of Directors and Fiscal Management Control Board regarding the Allston Multimodal Project, on Oct. 19th, 2020 by Mary Z. Connaughton, Pioneer Institute.

As the COVID-19 Pandemic Spurs Consumer Shift to E-Commerce, the Massachusetts Sales Tax Collection System Deserves Renewed Scrutiny

At a time when state tax revenues are plummeting, a plan to modernize sales tax collection could get money into state coffers more quickly. This report analyzes the merits of a two-part proposal Governor Baker included in his January state budget submission to streamline state sales tax collections. Sullivan and Mikula find that the first part of Baker’s plan makes sense and is entirely feasible because advances in electronic data processing and electronic funds transfer have eliminated the need for protracted remittance timetables.

The Merit Rating Board: Review and Recommendations

Significant administrative failings involving the Registry of Motor Vehicles have drawn attention to an entity called the Merit Rating Board (MRB or the Board). MRB’s administrative personnel and processes have been the subject of sharp criticism, and also extensive ongoing reform efforts. This policy brief reviews the relevant circumstances, and makes recommendations for consideration by MRB and other government personnel as they move forward.

Outdated and Obfuscated: The State of Public Financial Disclosure in Massachusetts

Despite some recent progress, there is more to do if the Commonwealth is to make the Statements of Financial Interest (SFIs) that public officials file annually truly accessible to Massachusetts citizens.

Williams and Markopolos Were Proven Right: MBTARF Was Underreporting Its Unfunded Pension Liabilities Just as the Whistleblowers Said in Their 2015 Report

In a new brief, Pioneer shows that whistleblowers’ 2015 claims that the MBTA Retirement Fund (MBTARF) has been underreporting its unfunded pension liabilities was correct. In their study, Boston University Professor Mark T. Williams and Bernie Madoff whistleblower Harry Markopolos outlined three specific ways in which the T pension fund was misrepresenting its liability, by a total of $280 million. At the time, MBTARF vigorously refuted the validity of the findings, but a new Pioneer brief presents in-depth analysis vindicating Williams and Markopolos.

Unions Are Not Progressive When It Comes to Their Members

This study finds that despite backing progressive taxation initiatives, Massachusetts teacher unions use regressive methods to collect revenue from their own members.

After Janus, Public Employers Must Obtain Informed Consent Before Collecting Union Dues or Agency Fees

This reports explains that in most cases a written waiver is sufficient for employees to have union dues or agency fees deducted from their paychecks. The employee must be made aware of his or her right not to pay, and must not feel coerced or pressured to sign the waiver.

Massachusetts’ Skyrocketing Unfunded Pension Liability

Despite several reform bills targeted at the Commonwealth of Massachusetts’s public pension system in recent years, the unfunded actuarial accrued liability (UAAL) has continued to rise and is drawing closer to a crisis level.

Where Do Teacher Union Dues Go? Public Higher Education in Massachusetts

Only a small share of annual union dues paid by faculty at the University of Massachusetts, state colleges and universities and community college campuses that make dues data publicly available remain with local union affiliates to cover the costs of collective bargaining and grievance procedures.

What Ever Happened to Flagger Reform?

The unusual way in which Massachusetts determines prevailing wages and the fact that civilian flaggers are subject to state prevailing wage law explain why a 2008 law that ended the Commonwealth’s status as the only state to require police at road construction projects has failed to generate substantial savings.

Where Do Teacher Union Dues Go?

Just 16 percent of dues paid by the average member of a union affiliated with the Massachusetts Teachers Association (MTA) actually goes to their local association, while the remaining 84 percent flows to the state (MTA) and national (National Education Association) organizations.

Special Legislative Commission On Public Records

Mary Z. Connaughton provides public testimony to a special legislative commission regarding public records.

Back to Taxachusetts? Lessons from Connecticut

This report urges proponents of a 2018 statewide ballot initiative that would add a surcharge on the state taxes of those earning over $1 million annually to look at the experience of Connecticut, where multiple rounds of tax hikes aimed at high earners triggered an exodus of large employers and high-earning individuals that resulted in declining tax revenue.

Increasing MBTA Ridership and Revenue with Company Commuter Benefit Programs

This report illustrates that increased use of employer-sponsored commuter benefit programs could boost MBTA revenue significantly, reduce employee commuting costs, provide employer savings, reduce traffic congestion and yield environmental benefits.

Is it time to expand water transportation in Greater Boston?

A comprehensive study of the MBTA ferry service’s performance as a transit mode and how it compares to other ferry operators nationwide offers useful insights for policy discussion on future water transportation in Massachusetts Bay, according to a new study published by Pioneer Institute.

The Bombshell Cheiron Report: The MBTA Just Got A $1.485 Billion Pension Bill That It Can’t Possibly Pay

This report asserts that with the current MBTA pension agreement set to expire in June 2018 and a new evaluation projecting a $1.485 billion increase in retirement costs over the next 18 years under terms of the current agreement, the T’s Fiscal and Management Control Board (FMCB) should take immediate action to protect the authority’s precarious finances.

Forensic Mysteries from the MBTA Retirement Fund’s Actuarial Reports

This report documents significant deficiencies in the actuarial valuations produced by the Massachusetts Bay Transportation Authority Retirement Fund (MBTARF) since 1990. Analysis of about a quarter-century of data suggests that the MBTARF's actuarial reports may have deviated considerably from the true cost of pension benefits. As of yearend 2015, the fund had an estimated unfunded liability of about $944 million.

2015 MBTA Bus Maintenance Costs Were Nation’s Highest

This report compares MBTA bus maintenance costs with those of five transit agencies identified as peers by the Integrated National Transit Database Analysis System. In 2015, the MBTA had the highest vehicle maintenance cost per hour of bus operation of the six transit agencies identified as peers by INTDAS.

Recommendation to the FMCB: Retain an Independent Auditor and Actuary to Review the MBTARF

The present policy paper argues that FMCB must conduct an independent audit and actuarial valuation of the fund, because of specific failures and omissions even in the limited work that FTI did. In doing so, we find that in opposition to the claims of FTI, the claims of potential malfeasance and poor management by the MBTARF Board, which came from noted whistleblower Harry Markopolos and Boston University Professor Mark Williams, were likely accurate.

Aim High on MBTA Ridership: A big-picture take on the T’s strategic plan

This report focuses on setting a strategic target for substantial increases in MBTA ridership. The author examines ridership trends from 2002 through the most recent available data for 20162, tracking annual growth in ridership from September through August for each year on the following six transit modes: heavy rail (the Blue, Orange and Red Lines), light rail (Green Line), commuter rail, bus, trolley bus and ferry service. The report offers projections of potential revenue the MBTA could generate in a range of scenarios.

Public Comment for the Stakeholder Input Meeting

Jim Stergios shares Pioneer Institute's perspective on the Strategic Plan being developed by the Fiscal and Management Control Board. Please allow me to make a few observations on “Strategic Planning Update, September 26, 2016,” the 23-page slide deck that has been made publicly available.

Driving Innovation: Tolling and Transponders in Massachusetts

Driving Innovation: Tolling and Transponders in Massachusetts explores transponder use in other states and encourages cooperation between public agencies and private industry to simplify and rethink customers’ transportation experience.

The Reckless Cost of Investment Mismanagement at the MBTA Retirement Fund

This report illustrates that had MBTA Retirement Fund (MBTARF) assets been placed in the Massachusetts state pension fund at the end of 2000, their value would have been an estimated $902 million greater by 2014 and T pensions would have been about fully funded.

The Abandoned Legacy of Dorothea Dix

Reforming the commonwealth’s solitary confinement policies and the troubled Bridgewater State Hospital would be important steps to halt the trend in recent decades toward housing more mentally ill individuals in Massachusetts prisons and jails.

Combating Opioid Addiction in Massachusetts: A Hospital-Based Solution Shows Promise in Reducing Relapses and ER Costs

Preliminary results suggest that a new program that gives opioid overdose patients at Beth Israel Deaconess Hospital-Plymouth (BID-Plymouth) multiple opportunities to access detox programs, psychological counseling, anti-abuse drugs and other services is proving effective at reducing recidivism and returning opioid users to more productive lives.

UMass At A Crossroads

This paper is the first in Pioneer Institute’s UMass at a Crossroads series. In this study, Pioneer focuses on UMass’ significant growth in two areas, academic competitiveness and student enrollment, compared to other New England state universities, MA private universities, national private universities and national public universities. Pioneer raises the question of whether the continued expansion of UMass, based largely on increased enrollment of out-of-state students, is in the best interest of the commonwealth.

The Reckless Cost of MBTA Financial Derivatives

This study reveals that the MBTA built up a large exposure to financial derivatives and had to pay an estimated $236 million in interest on synthetic swaps for fiscal years 2001 to 2015.