MBTAAnalysis: A look inside the MBTA

0 Comments

/

The MBTA shuttles over a million passengers a day around Greater…

https://pioneerinstitute.org/wp-content/uploads/CloseupClock-1.jpg

739

1244

Mary Connaughton

https://pioneerinstitute.org/wp-content/uploads/logo_440x96.png

Mary Connaughton2017-02-20 12:34:192017-02-21 09:47:58The Clock is Ticking…….

https://pioneerinstitute.org/wp-content/uploads/CloseupClock-1.jpg

739

1244

Mary Connaughton

https://pioneerinstitute.org/wp-content/uploads/logo_440x96.png

Mary Connaughton2017-02-20 12:34:192017-02-21 09:47:58The Clock is Ticking…….

Hilda Torres Makes the Grade

This week on JobMakers, host Denzil Mohammed talks with Hilda Torres, an immigrant from Mexico who runs My Little Best Friends Early Learning Center in Malden, Massachusetts. One of the most successful businesses in the city, the center enrolls over 100 students whose parents come from more than 25 different countries. In this episode, Hilda shares how she used the tools of education, and her own grit and determination, to make her mark in the land of opportunity.

Study Shows the Adverse Effects of Graduated Income Tax Proposal on Small Businesses

The state constitutional amendment promoted by the Massachusetts Teachers Association and the Service Employees International Union to add a 4 percent surtax to all annual income above $1 million will adversely impact a significant number of pass-through businesses, ultimately slowing the Commonwealth’s economic recovery from COVID-19, according to a new study published by Pioneer Institute.

Hong Tran Goes from Refugee to Realtor

This week on JobMakers, host Denzil Mohammed talks with Hong Tran, a Worcester, Massachusetts-based realtor and small business owner who emigrated to America as an orphaned refugee from Vietnam.

Sandro Catanzaro Takes His American Dream to Mars and Back

This week on JobMakers, host Denzil Mohammed talks with Sandro Catanzaro, who started several businesses in his native Peru but had no idea he’d end up helping NASA go to Mars, or that he’d use that same technology to plan and buy video ad campaigns. Now Head of Publisher Services Strategy for Roku, which acquired the company he founded, dataxu, in 2019, Mr. Catanzaro is an emblem of ingenuity and inventiveness. His demand-side platform, device graph technology and analytics platform help accelerate Roku’s ad tech roadmap and ability to serve a wide array of advertisers. But he’s not done yet!

Study: Graduated Income Tax Proposal Fails to Protect Taxpayers from Bracket Creep

The state constitutional amendment proposed by the Service Employees International Union and the Massachusetts Teachers Association to add a 4 percent surtax to all annual income above $1 million purports to use cost-of-living-based bracket adjustments as a safeguard that will ensure only millionaires will pay. But historic income growth trends suggest that bracket creep will cause many non-millionaires to be subject to the surtax over time, according to a new study published by Pioneer Institute.

Christina Qi Goes From Welfare to Wall Street

This week on JobMakers, Host Denzil Mohammed talks with Christina (Chi) Qi, who started a hedge fund at just 22. They discuss her background and journey, moving with her family from China to Utah, being on welfare, and then attending MIT. She went on to co-found Domeyard, a quantitative trading firm, in 2013, among the longest running high-frequency trading hedge funds in the world, and was trading up to $7 billion dollars a day. In 2019, she founded Databento, an on-demand data platform for asset managers and quantitative analysts. They discuss how being an immigrant, Asian, and a woman in the cutthroat, male-dominated world of Wall Street didn’t deter her from success.

New Study Warns Graduated Income Tax Will Harm Many Massachusetts Retirees

If passed, a constitutional amendment to impose a graduated income tax would raid the retirement plans of Massachusetts residents by pushing their owners into higher tax brackets on the sales of homes and businesses, according to a new study published by Pioneer Institute. The study, entitled “The Graduated Income Tax Trap: A retirement tax on small business owners,” aims to help the public fully understand the impact of the proposed new tax.

Herby Duverné Keeps Americans Safe & Gives Back

Welcome to JobMakers, a new, weekly podcast, produced by Pioneer Institute and The Immigrant Learning Center. Host Denzil Mohammed explores the world of risk-taking immigrants, who create new products, services and jobs in New England and across the United States. In the debut episode, Denzil talks with Herby Duverné, CEO at Windwalker Group, an award-winning small business with more than 25 years of experience in physical and cybersecurity solutions that protect and prepare companies through custom learning and training solutions.

Study: Graduated Income Tax Proponents Rely on Analyses That Exclude the Vast Majority Of “Millionaires” to Argue Their Case

Advocates for a state constitutional amendment that would apply a 4 percent surtax to households with annual earnings of more than $1 million rely heavily on the assumption that these proposed taxes will have little impact on the mobility of high earners. They cite analyses by Cornell University Associate Professor Cristobal Young, which exclude the vast majority of millionaires, according to a new study published by Pioneer Institute.

Hoover Institution’s Dr. Eric Hanushek on COVID-19, K-12 Learning Loss, & Economic Impact

This week on “The Learning Curve," Gerard and Cara talk with Dr. Eric Hanushek, the Paul and Jean Hanna Senior Fellow at Stanford University’s Hoover Institution. They discuss his research, cited by The Wall Street Journal, on learning loss due to the pandemic, especially among poor, minority, and rural students, and its impact on skills and earnings.

Report Contrasts State Government and Private Sector Employment Changes During Pandemic

Massachusetts state government employment has been virtually flat during COVID-19 even as employment in the state’s private sector workforce remains nearly 10 percent below pre-pandemic levels, according to a new study published by Pioneer Institute. The study, “Public vs. Private Employment in Massachusetts: A Tale of Two Pandemics,” questions whether it makes sense to shield public agencies from last year’s recession at the expense of taxpayers.

A wealth tax, a SCOTUS case, and a likely Mass. exodus

Op-ed in The Boston Globe: A case New Hampshire filed with the US Supreme Court last October against the Commonwealth of Massachusetts could have a huge impact on state finances nationwide. It also raises the stakes as the Massachusetts Legislature considers amending the state constitution to eliminate the state’s prohibition against a graduated income tax and to hike taxes on high earners.

Study Finds Massachusetts Graduated Income Tax May Be a “Blank Check” and Not Increase Funding for Designated Priorities

Advocates claim a proposed 4 percent surtax on high earners will raise nearly $2 billion per year for education and transportation, but similar tax hikes in other states resulted in highly discretionary rather than targeted spending, according to a new policy brief published by Pioneer Institute. That same result or worse is possible in Massachusetts because during the 2019 constitutional convention state legislators rejected — not just one, but two — proposed amendments requiring that the new revenues be directed to these purposes.

Post-Pandemic Prospects: Tech Leaders’ Prescription for Preserving a Healthy Economy

Host Joe Selvaggi talks with Chris Anderson, President of the Massachusetts High Technology Council, about the reasons why Massachusetts has a thriving tech sector, what challenges his members have faced in the pandemic, and what he sees as the most prudent path toward future prosperity in the commonwealth.

Report: Proposed Graduated Income Tax Might Not Increase State Education and Transportation Spending

While supporters of a state constitutional amendment that would impose a 4 percent tax rate hike on annual income over $1 million claim additional revenue from the surtax will fund public education and transportation needs, the amendment in no way assures that there will be new spending on these priorities. In fact, without violating the amendment, total state education and transportation funding could stay the same or even fall, according to a new review published by Pioneer Institute.

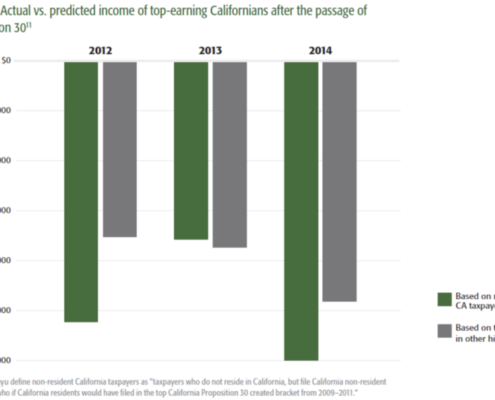

New Study Highlights Economic Fallout from California’s 2012 Tax Hike

A 2012 income and sales tax increase in California, named “Proposition 30,” stifled business activity, accelerated out-migration among the wealthy, and ultimately reduced the state’s tax base, according to a new study published by Pioneer Institute that aims to share empirical data about the impact of tax policy decisions.

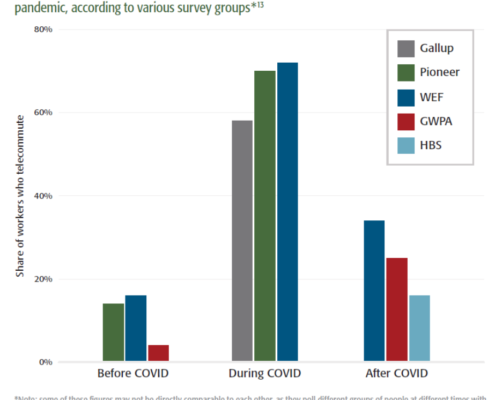

Wealth Migration Trends: Remote Work Technology Empowers Workers to Live Anywhere

Host Joe Selvaggi talks with Pioneer Institute’s Andrew Mikula about his recent research into migration trends of high-income individuals, how pandemic-related technologies may accelerate that movement, and what challenges these changes present for policy makers.

New Study Finds Pandemic-Spurred Technologies Lowered Barriers to Exit in High-Cost States

Both employers and households will find it easier to leave major job centers as technologies made commonplace by the COVID-19 pandemic have led to a rethinking of the geography of work, according to a new study published by Pioneer Institute.

Interstate Legal Skirmish: New Hampshire Takes Massachusetts Telecommuter Tax to the Supreme Court

Host Joe Selvaggi talks with legal scholar and George Mason University Law Professor Ilya Somin about the details, the merits, and the likely implications of the Supreme Court case, New Hampshire v. Massachusetts, on state taxation power, federalism, and the power to vote with one’s feet.

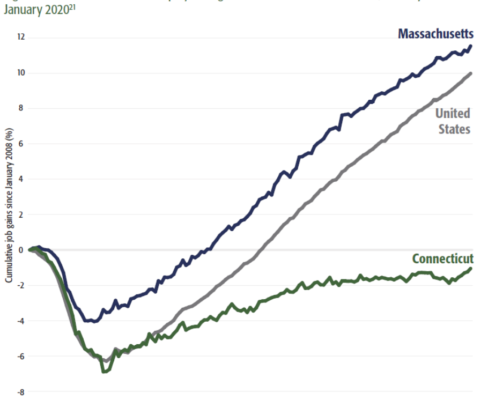

Connecticut’s Painful Journey: Wealth Squandered, Lessons Learned, Promise Explored

Host Joe Selvaggi talks with Connecticut Business and Industry Association’s President and CEO, Chris DiPentima, about what policy makers can learn from Connecticut’s journey from the wealthiest state in the nation, to one with more than a decade of negative job growth.

New Study Shows Significant Wealth Migration from Massachusetts to Florida, New Hampshire

Over the last 25 years, Massachusetts has consistently lost taxable income, especially to Florida and New Hampshire, via out-migration of the wealthy, according to a new Pioneer Institute study.

In “Do The Wealthy Migrate Away From High-Tax States? A Comparison of Adjusted Gross Income Changes in Massachusetts and Florida,” Pioneer Institute Research Director Greg Sullivan and Research Assistant Andrew Mikula draw on IRS data showing aggregate migration flows by amount of adjusted gross income (AGI). The data show a persistent trend of wealth leaving high-tax states for low-tax ones, especially in the Sun Belt.

Intrepid Restauranteurs Endure: Passion for Community, Patrons, and Staff Mean Failure is Not on the Menu

Host Joe Selvaggi talks with Massachusetts Restaurant Association President and CEO Bob Luz about the devastating effects of the pandemic and lockdowns on restaurants. They discuss the industry's creative strategy for survival, plans for reaching beyond the crisis, and the many positive improvements for this vital sector that employs 10% of the workforce in the commonwealth.

California Tax Experiment: Policy Makers Receive Valuable Economics Lesson

Host Joe Selvaggi talks with Stanford University Economics Professor Joshua Rauh about his research on the reaction of Californians to a tax increase, from his report, “The Behavioral Response to State Income Taxation of High Earners, Evidence from California.” Prof. Rauh shares how his research offers tax policy makers insight into the likely effects of similar increases in their own states, including here in Massachusetts.

New Study Finds Tax Policy Drives Connecticut’s Ongoing Fiscal & Economic Crisis

Multiple rounds of tax increases aimed at high earners and corporations triggered an exodus from Connecticut of large employers and wealthy individuals, according to a new study published by Pioneer Institute.

Unemployment Insurance Rescue: Employer Advocate Seeks Relief to Catalyze Pandemic Recovery

Joe Selvaggi talks with John Regan, President and CEO of Associated Industries of Massachusetts, about the impact of higher UI rates on employers and what legislators can do to help mitigate the pain.

MBTA Cuts Ahead: COVID Causes Commuters To Consider Comprehensive Changes

Host Joe Selvaggi and Pioneer Institute Senior Fellow Charlie Chieppo discuss the reasons for the recently proposed cuts to MBTA service, and offer suggestions as to how the agency’s leadership could use this crisis to improve the service’s long-term health.

Pioneer Report Spotlights Decade-long Building Boom in Massachusetts Construction Industry

In the lead-up to the COVID-19 crisis, the Massachusetts construction industry enjoyed a boom in select subsectors, though employment numbers had yet to recover from the setbacks of the Great Recession, according to a new report from Pioneer Institute that draws data from the MassEconomix web tool.

Pioneer Checklist Includes Steps for Policy Makers, Business Owners to Revitalize Hardest-Hit Industries

Combining the recommendations of studies published earlier this year, Pioneer Institute has released “A Checklist for How to Revitalize the Industries Hit Hardest by COVID-19.” The recommendations for policy makers are organized in three sections: Immediate Relief, Tax Policy Changes and Permanent Reforms. Business owner recommendations are split into COVID-19 Health and Safety Protocols, Expanded Services and Steps to Improve Cash Flow.

Pioneer Report Highlights Pre-Pandemic Employment Growth in Massachusetts’ Hospitality & Food Industry

In the lead-up to the COVID-19 crisis, the Massachusetts Hospitality and Food Industry enjoyed generally positive employment growth, according to a new report from Pioneer Institute that draws data from the MassEconomix web tool. Most of the Hospitality and Food Industry employment across the state is concentrated in full-service restaurants and hotels.

Pioneer Report Highlights Employment Growth in Lowell, Massachusetts

In 2018, employment in Lowell, Massachusetts finally surpassed its pre-Great Recession peak, according to a new report from Pioneer Institute that draws data from the MassEconomix web tool. Before COVID-19, job growth in the city was driven largely by a resurgence in manufacturing and a continued high concentration of healthcare firms.