Why Landlords are Suing Massachusetts

In late July, Governor Charlie Baker extended the moratorium on evictions and foreclosures by two months after citing the need for additional housing security amid economic hardship and COVID-19. The moratorium will now end on October 17th instead of August 18th, which gives struggling tenants more time to adjust to the pandemic.

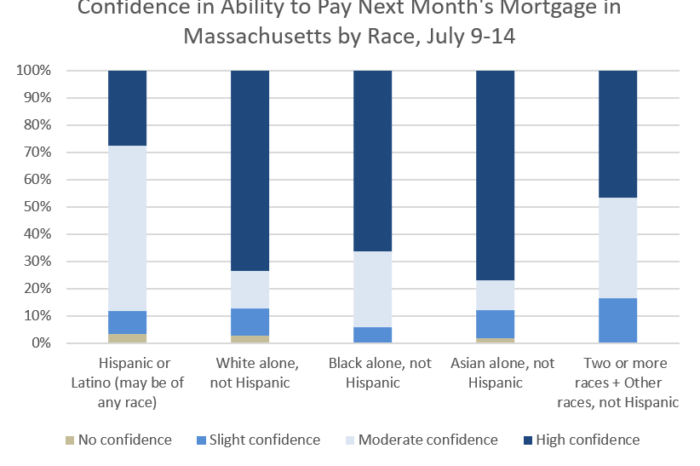

The Census Bureau’s Week 11 Household Pulse Survey showed that many Massachusetts residents, especially the Hispanic or Latino population, express less than high confidence in their ability to pay their next month’s mortgage. For them, an extended eviction moratorium will provide relief while they catch-up on lost income from COVID-19.

Source: U.S. Census Bureau

Tenants and tenant advocates have consequently expressed widespread support. According to new regulations from the Department of Housing and Community Development, landlords “in most cases” are not allowed to file for evictions in court or send tenants notices of terminated leases. Additionally, courts are not allowed to accept summary process filings for evictions, schedule hearings on evictions, or enter a judgement in an eviction case, among other restrictions. Only once the federal and state eviction moratoriums expire will millions of renters nationwide once again become subject to summary processing for evictions.

This extension of the moratorium, however, further compounds the difficulties that many landlords are facing, and they are now suing the state of Massachusetts. Several local landlords, including a nurse who owns property in Randolph and is behind $20,000 in rent receipts, are arguing that the moratorium tramples on their constitutional rights.

Landlords argue that the eviction ban represents an unlawful government mandate that forces landlords to bear the financial burden of subsidizing tenants who violate their leases, without compensation. The lawsuit brought by the landlords seeks to address certain violations of their rights, including: the right to petition the judiciary, the right to free speech, the right to just compensation from an unlawful taking of property, and the right to be protected by the Contracts Clause of the U.S. Constitution.

Governor Baker has acknowledged the impact of the moratorium extension on rent collectors and is encouraging tenants to continue paying rent when they can afford it. But the key takeaway here is the following…

Less than 20 percent of unpaid rent is ever collected.

That being the case, landlords are being forced by law to pay out of pocket to provide COVID-19 financial assistance, whereas the federal government i.e. the taxpayers have paid $3 trillion so far to pay for virtually all other pandemic financial relief to citizens and businesses.

Other businesses are not being forced by law to provide goods or services for free, involuntarily, and then try to collect payment through expensive time consuming and ultimately ineffective collection agencies and court proceedings. The government is not forcing grocery stores, take-out restaurants, pharmacies, cab companies, or clothing stores to give their goods and services without payment to people who’ve lost jobs due to Covid-19 and then try to collect later through collection agencies and court proceedings.

Do many of the country’s unemployed workers need help to pay the rent? The answer is a resounding yes. Should Congress provide targeted relief to those people? Yes, and that is what Congress has spent $3 trillion so far trying to do, albeit in a very non-targeted way through $2,800 payments to more than 90 percent of taxpayers, $600 per week in extra unemployment payments, and payroll protection plan for employers. But forcing business owners, i.e. landlords, to provide services with limited hope of compensation is a completely different story.

It is possible, if not probable, that the courts will ultimately rule that state governments like Massachusetts’ will have to compensate landlords for losses, and that would exacerbate the ongoing state budget crisis created by the pandemic.

Max von Schroeter is the Roger Perry Government Transparency intern at the Pioneer Institute. Research areas of particular interest to Mr. von Schroeter include healthcare costs and public education. He is currently a student at the University of Virginia studying business and history.