Newburyport, Abington and Beyond: How Should Massachusetts Towns Prepare for Legalized Recreational Marijuana?

Recreational marijuana businesses are legal in Massachusetts as of July 1, but many of the Commonwealth’s towns are still unsure about how to proceed.

Even though voters enthusiastically approved Question 4 in 2016, the enthusiasm has not carried over to town governments. For example, in Milford, 52 percent of voters supported the statewide legalization initiative. Yet less than a year later, 56 percent of Milford voters supported a referendum banning all recreational marijuana sales in the town. Despite this referendum, the first-ever recreational marijuana license in Massachusetts was recently granted to a Milford cultivation facility.

While several similar towns have opted for an indefinite ban on recreational marijuana sales, over one third of Massachusetts towns have imposed moratoriums, temporarily banning the sale until local governments feel better equipped to regulate the industry. A recent ruling by state Attorney General Maura Healey further strengthened the power of moratoriums and decertified the likelihood of widespread recreational marijuana sales starting on July 1st. Healey’s decision gives municipalities that have already enacted moratoriums the ability to extend them through June 2019 without having to poll town residents.

One town currently using a moratorium is Newburyport, where a town forum was held on June 19th to discuss the potential future of recreational marijuana in their community.

In Newburyport, an ordinance was recently approved by a 10-1 city council vote allowing no more than two marijuana cultivators to operate in the city business park while keeping the moratorium on recreational sales in place. This decision has mounted opposition among residents and city officials; however, those seeking to cultivate in Newburyport argue it will bring jobs and tax revenue to the city.

In July 2017, a joint House-Senate committee forged a compromise, establishing a 20 percent tax on recreational marijuana sales with a local sales tax of up to 3 percent. According to a 2016 report, recreational cannabis in Massachusetts could grow to be a $1.1 billion industry by 2020.

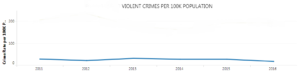

Information available on MassAnalysis, a website offered by Pioneer Institute that is chock-full of municipal information, reveals that Newburyport has a commercial tax levy of $3.7 million, which ranks 108th out of 351 Massachusetts municipalities. The city’s total tax levy of $50.4 million is predominantly fueled by a residential tax levy of $43.8 million. Therefore, well-regulated sales of recreational marijuana could boost non-residential revenue, potentially allowing a break for homeowners. Newburyport already has a low crime rate so legal recreational marijuana sales might allow the community to maintain or even further improve its crime statistics by eliminating the prevalence of illegal drug dealers in communities.

The Town of Abington has the closest proximity score in MassAnalysis to Newburyport based on commercial tax levy, population, and violent crime totals, making it another city that could benefit economically from recreational marijuana sales. Additionally, Abington residents recently voted to end a moratorium on recreational marijuana sales, showing that there is support within the community.

With the start of legal recreational marijuana sales rapidly approaching, towns and cities such as Abington and Newburyport can boost their non-residential revenue from recreational marijuana sales. As Massachusetts towns begin to reap in the financial rewards of recreational marijuana sales, no doubt other towns will follow; especially those looking to boost non-residential tax revenue and towns with tight budgets.

Jay Anderson is a Northeastern University Co-Op at the Pioneer Institute; he is a Political Science major.