Globe columnist Shirley Leung makes our argument on the tax hike amendment

In today’s Boston Globe, business columnist Shirley Leung raises important questions about who exactly will be impacted by the tax hike amendment that will appear on the Massachusetts ballot in November. Shirley notes:

Yet the first ad from the opposition, which debuted last week, paints a different picture of who could get hit with the proposed hike: farmers, lobstermen, small business owners, and even homeowners. That’s because “they” include so-called one-time millionaires.

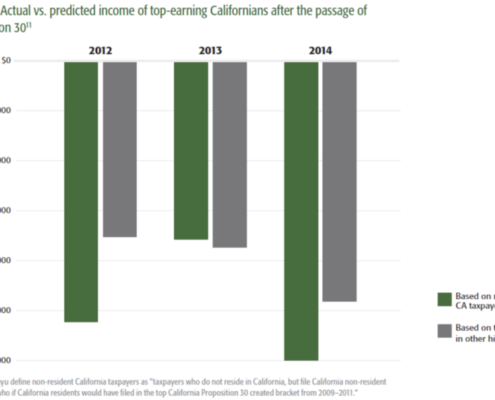

She cites a Tufts University analysis showing that “the pool of wealthy households in Massachusetts changes dramatically year to year with only about half consistently earning incomes of more than $1 million,” and describes some of the people who oppose it. Pioneer presented the actual numbers, from Massachusetts Department of Revenue data, in its The Graduated Tax Trap study (April 2021): The majority (60 percent) of the families that would be impacted by the tax proposal earned more than a million dollars once or twice in the 10-year period surveyed through 2017; these are retirees and small businesses selling assets to build a nest egg that will have to serve them over 20 or 30 years. Fewer than 25 percent of families regularly earned more than $1 million.

These people include Ann Sullivan, who owns Metro Equipment Corp. in Braintree. As Shirley describes,

Ann also does not consider herself a millionaire, but she will be classified as one when she sells her excavation business… Sullivan figures that if she sells her company and nets $2 million, the first million will be taxed at the rate everyone pays, which is 5 percent, and then the next million dollars would be taxed at 9 percent. Instead of paying $50,000 in taxes on the next million dollars, she would owe $90,000 if the ballot question passes. Although a $2 million payday may seem like a lot of money to most people, Sullivan, 61, said the sale proceeds would constitute her retirement. “This is my nest egg,” Sullivan said. “When I stop working, I stop working. So every dollar is going to count.”

Pioneer’s research going back several years has shown that 46 percent of Massachusetts taxpayers who earn more than $1 million in a year do so just once over a decade, and it is derived from profits from the one-time sale of a business or home, usually – as with Ann Sullivan – to fund retirement.

Pioneer’s Jim Stergios and Mary Connaughton explain that very same point in this June video:

Pioneer’s book, Back to Taxachusetts?, devotes a whole chapter to this topic. As the book’s fact sheet summary notes,

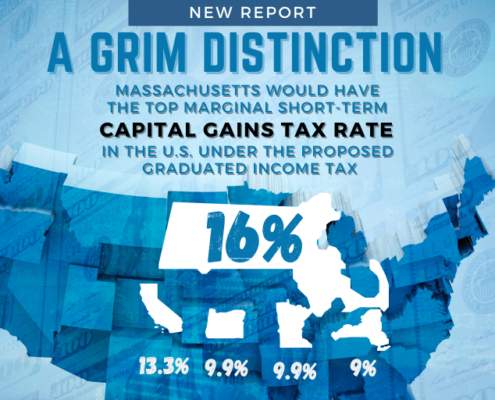

The tax mainly impacts retirees and small business owners—not “millionaires” The majority of households ensnared by the tax hike are not “millionaires”—they do not regularly have incomes exceeding $1 million. They are households selling a business or seniors selling their home and assets to fund retirement. Pass-through businesses—partnerships, sole proprietorships, S or limited liability corporations that are taxed via individual returns—account for 70% of all for-profit entities and employ half of Massachusetts’ workforce. When added to other taxes that only apply to such entities, these small businesses would pay taxes at a higher rate than large corporations.

More recently, Pioneer’s Jim Stergios has noted this in The Wall Street Journal:

That tax revenue would come at a steep cost. Because the amendment’s definition of income includes capital gains and “pass-through” income from entities taxed via individual returns, such as partnerships, sole proprietorships and S corporations, the proposed tax would primarily affect retirees and small businesses.

And in a debate on Keller @ Large.

As Shirley notes at the conclusion of her column, how Massachusetts voters come down on this issue will be related to whether they themselves or someone they know expect to earn $1 million in a single year, and she argues, importantly, that “in an entrepreneurial economy and a housing market like ours, the answer is perhaps not that clear.”

Suddenly, as we’ve been showing through our research, more people are seeing that the impact of this tax is much greater than they thought – it’s not just the super wealthy.

We look forward to a robust discussion about this important topic, as we believe that if the public understands the full implications of this proposal – the faces of the retirees and small business owners who will lose their nest eggs and hard-won earnings – they will reject it decisively.

Get Updates on Our Economic Opportunity Research

Additional Pioneer reports on this topic:

Related Posts